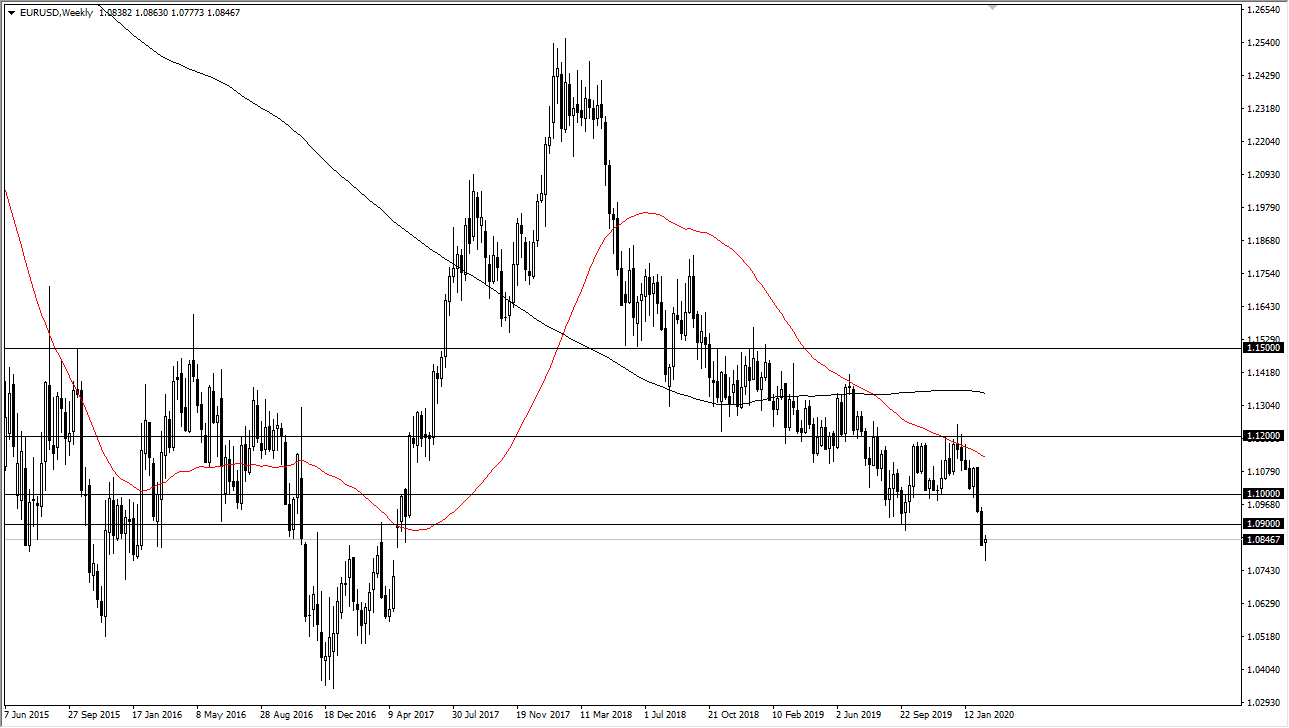

EUR/USD

The Euro has spent most of the week following, but Friday had an explosive move to the upside. Ultimately, the market looks very likely to reach towards higher levels, but I think there is a significant amount of resistance in order to turn this thing right back around. After all, the fundamentals don’t favor the Euro, but we are a bit oversold. I think the 1.09 level and most certainly the 1.10 level will both offer a potential selling opportunity at the first signs of exhaustion.

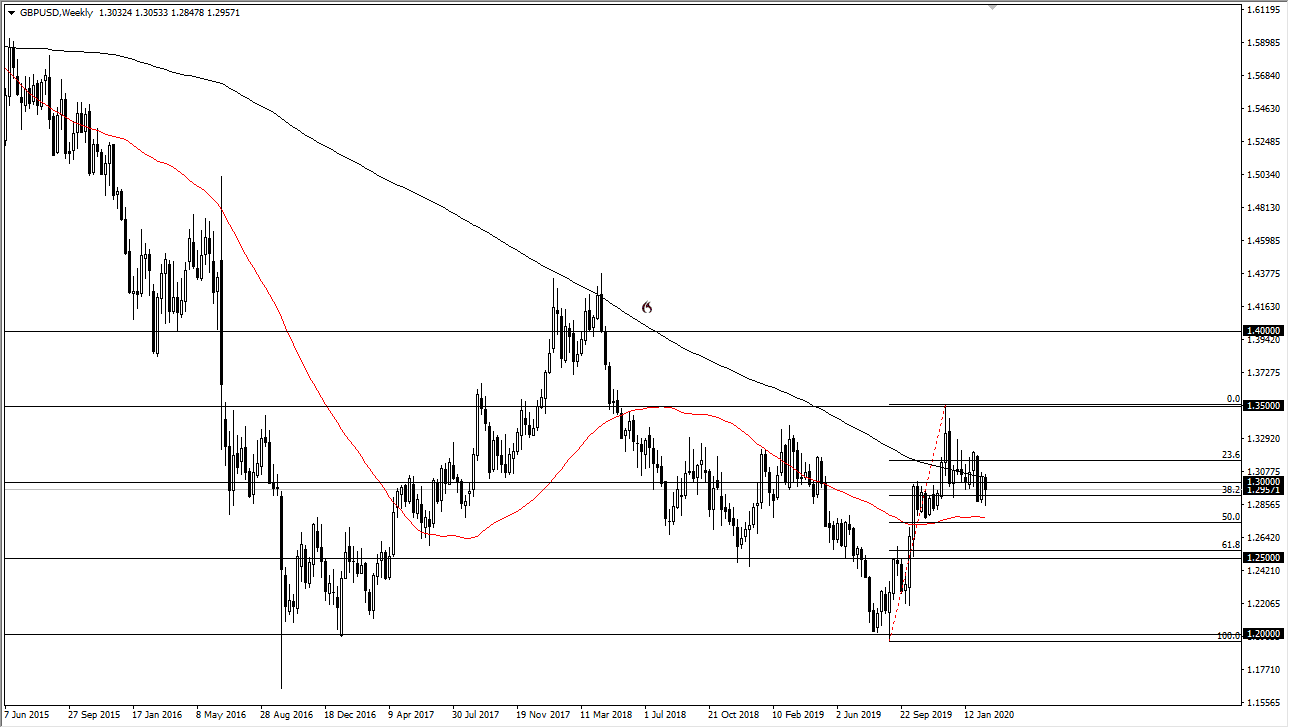

GBP/USD

The British pound fell during most of the week but did get a little bit of a reprieve on Friday as the US Manufacturing PMI figures came out lower than anticipated. Ultimately, that doesn’t change much though, as there are a lot of concerns. The British pound continues to struggle in general, and quite frankly I think that if the British pound rallies against the greenback, you should probably look to buy the British pound against other currencies as it will get more mileage.

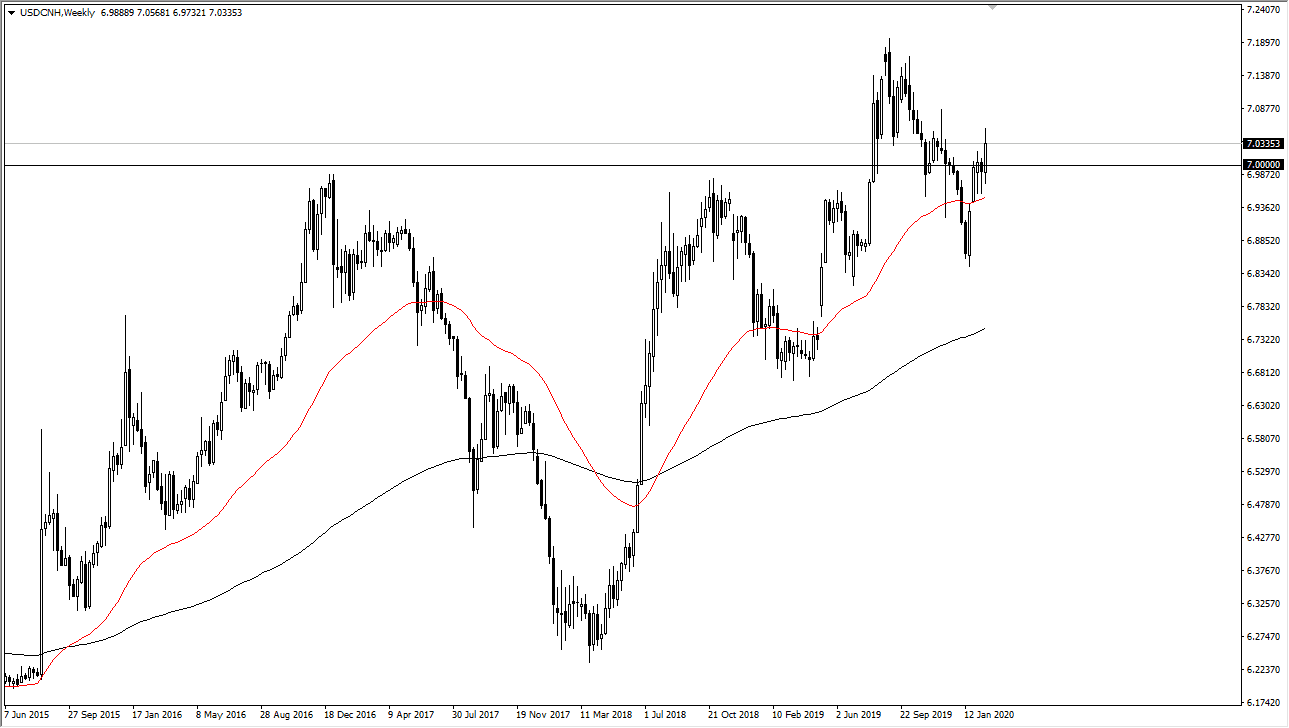

USD/CNH

The US dollar rallied against the Chinese Yuan during the week, breaking above the 7.0 level yet again. Ultimately, the market looks as if it is going to go back towards the highs which makes quite a bit of sense considering that the coronavirus is still raging for China, and of course the US dollar is a bit of a safety currency. Furthermore, the US economy continues to look relatively strong and although the PMI numbers were a bit soft during the trading session on Friday, the reality is that it’s not China, and that’s really all that matters. The Chinese Yuan will more than likely continue to lose strength, as the uptrend continues to show just how favored the US dollar is in general.

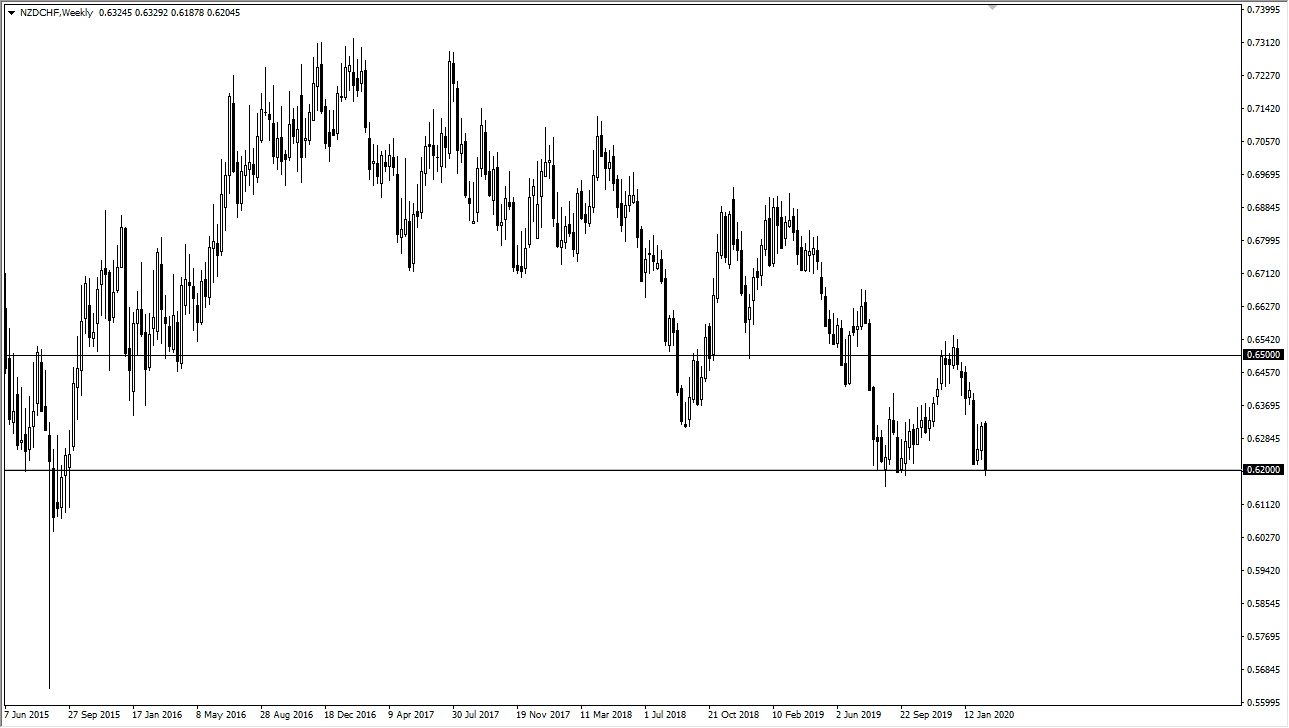

NZD/CHF

The New Zealand dollar had a rough week against the Swiss franc, showing a very “risk off” type of scenario. The 0.62 level has been very supportive, so I think it’s only a matter of time before we break down and reach towards the 0.60 level. At this point, the market will continue to sell rallies, as quite frankly there is a lot out there that people are concerned about. Looking to fade exhaustion after pops will probably continue to be the way people take advantage of this “risk on/risk off currency pair.” All things being equal, I don’t trust rallies.