Moody’s Investors Service lowered its GDP forecast for South Africa, sparking fears that the March credit review will see the country’s credit rating downgraded to junk. A loss of investment-grade status will force funds to exit South African equity and bond markets to remain in compliance with respective prospectuses. The next budget will play a critical role and may delay a downgrade. Credit rating agencies are notorious to be late or wrong in their assessments, making the reaction in the USD/ZAR prone to a reversal, after reaching its resistance zone.

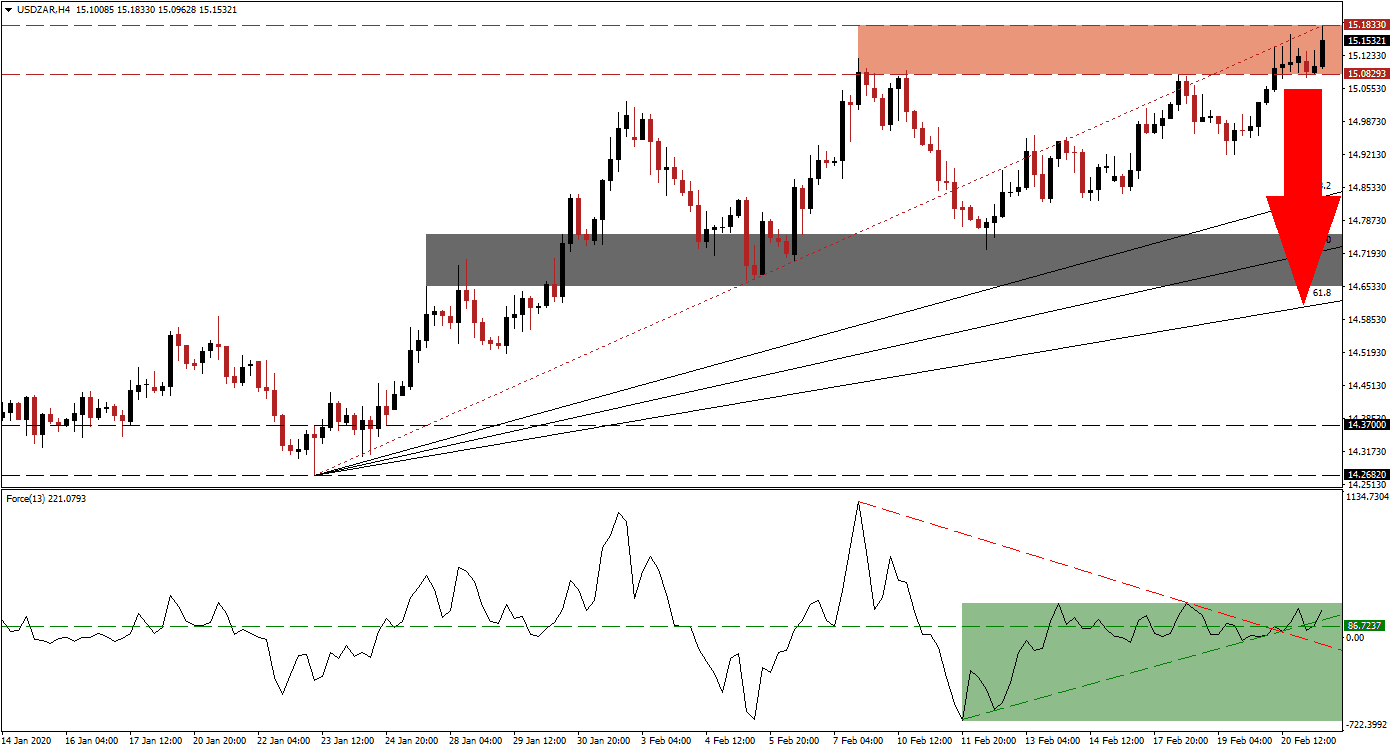

The Force Index, a next-generation technical indicator, failed to confirm the most recent advance in this currency pair. After price action bounced off of its short-term support zone, momentum failed to expand. The Force Index entered a sideways trend above its horizontal support level, as marked by the green rectangle. This technical indicator was unable to extend to the upside following the breakout above its descending resistance level or with the assistance of its ascending support level. Bulls are in control of the USD/ZAR, but the emergence of a negative divergence points towards the end-phase of the rally.

This currency pair is well-positioned for a profit-taking sell-off, sparked by a breakdown below its resistance zone located between 15.08293 and 15.18330, as marked by the red rectangle. The entire advance following the reversal off of its short-term support zone materialized below the Fibonacci Retracement Fan trendline, adding to bearish developments in the USD/ZAR. While the South African economy suffers from a lack of reforms, leading to structural issues, the US Dollar is under threat from a slowing economy mixed with political uncertainty. You can learn more about a profit-taking sell-off here.

Price action is favored to experience a rise in volatility, but this currency pair is in the process of establishing a long-term bearish bias. The pending breakdown is anticipated to close the gap between the USD/ZAR and its ascending 38.2 Fibonacci Retracement Fan Support Level. This will clear the path into its short-term support zone located between 14.65243 and 14.75775, as marked by the grey rectangle. A contraction into its 61.8 Fibonacci Retracement Fan Support Level is likely, but a further breakdown will require a fresh fundamental catalyst.

USD/ZAR Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 15.15250

Take Profit @ 14.60000

Stop Loss @ 15.29000

Downside Potential: 5,525 pips

Upside Risk: 1,375 pips

Risk/Reward Ratio: 4.02

In case of more upside in the Force Index, sparked by its ascending support level, the USD/ZAR may attempt a breakout. Due to the fundamental outlook for both economies, the long-term outlook remains increasingly bearish. Where South Africa is working to exit issues, the US is entering them. The upside potential appears limited to the next resistance zone located between 15.41346 and 15.49312. Forex traders should view this as an excellent short-selling opportunity.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 15.31250

Take Profit @ 15.49000

Stop Loss @ 15.22500

Upside Potential: 1,775 pips

Downside Risk: 875 pips

Risk/Reward Ratio: 2.03