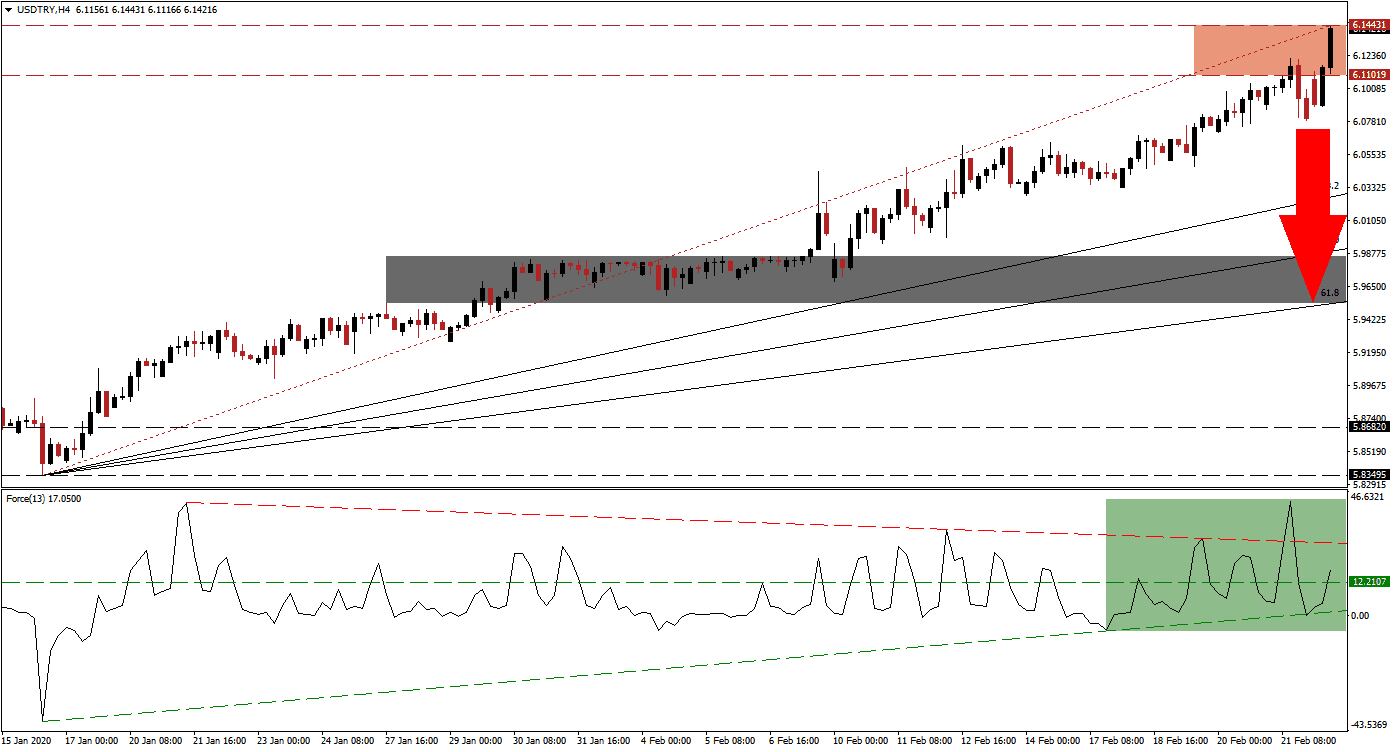

Turkey’s economy is in full recovery mode. The central bank lowered interest rates once again by 50 basis points to 10.75%. Since President Erdogan’s government took a more direct role in monetary policy, it slashed interest rates by 1,275 basis points and vowed single digits in the second half of 2020. Economic indicators confirm the recovery, but doubts over sustainability remain. The debt-driven expansion can be compared to the US, where economic indicators are contracting. With the USD/TRY attempting to extend its advance with a breakout above its resistance zone, the exhausted upside is ripe for a sell-off.

The Force Index, a next-generation technical indicator, initially spiked to a new 2020 high before correcting into its ascending support level. It was able to reverse and convert its horizontal resistance level into support, as marked by the green rectangle. While bulls have regained control of the USD/TRY after the push into positive conditions, the descending resistance level is favored to pressure the Force Index into a reversal. The collapse in this technical indicator will precede a corrective phase in price action.

Last week’s surprise contractionary reading for the US service sector shocked markets, but more data is awaited to assess if this is the start of a trend to monitor. The current resistance zone located between 6.11019 and 6.14431, as marked by the red rectangle, was initially established in August 2018. It has forced three massive corrections in the past, and given the developing economic conditions in the US and Turkey, a fourth one is anticipated to materialize, resulting in a breakdown in the USD/TRY.

Price action may face a potentially violent profit-taking sell-off, closing the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level. One key level to monitor is the intra-day low of 6.07910, the low of the previously reversed breakdown. A push below this level is likely to inspire the next wave of net sell orders in the USD/TRY. It will clear this currency pair to descend into its short-term resistance zone located between 5.95319 and 5.98526, as marked by the grey rectangle. You can read more about the Fibonacci Retracement Fan here.

USD/TRY Technical Trading Set-Up -Profit-Taking Scenario

Short Entry @ 6.14400

Take Profit @ 5.95400

Stop Loss @ 6.20000

Downside Potential: 1,900 pips

Upside Risk: 560 pips

Risk/Reward Ratio: 3.39

In the event of a breakout in the Force Index above its descending resistance level, the USD/TRY is expected to push above its resistance zone. With the US economy on the verge of a potential recession, the upside potential is limited to its next long-term resistance zone, located between 6.33730 and 6.41854. The top range represents the bottom of the candlestick that marked an all-time high in this currency pair. Forex traders are advised to consider this as an outstanding short-selling opportunity.

USD/TRY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 6.25000

Take Profit @ 6.41750

Stop Loss @ 6.18750

Upside Potential: 1,675 pips

Downside Risk: 625 pips

Risk/Reward Ratio: 2.68