2020 is well-positioned to allow a market-beating economic recovery in Turkey, allowing its currency to strengthen. Major investment advisory companies across the nation forecast a contraction in the inflation rate into single digits, while the central bank may lower interest rates further. GDP growth for 2020 is predicted at 3.5% annualized, below the government’s target of 5.0%, with inflation seen at 9.5%, and a current account deficit of 1.5% of GDP. The USD/TRY is expected to reflect the improvement in economic data and enter a more massive correction after reaching its resistance zone.

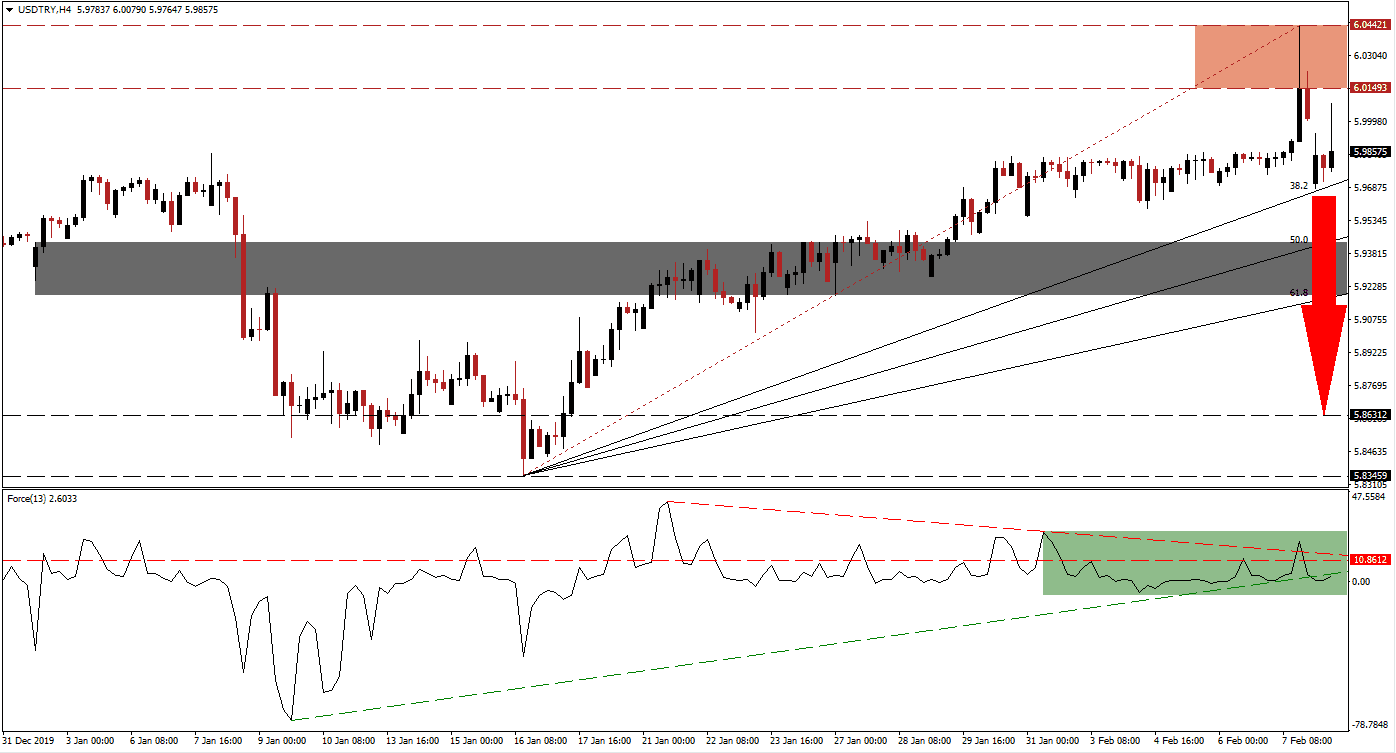

The Force Index, a next-generation technical indicator, indicates the loss of bullish momentum after a lower high resulted in the formation of a descending resistance level. It created a negative divergence following the breakout in the USD/TRY above its short-term resistance zone, converting it into support. The Force Index extended its slide below its ascending support level, as marked by the green rectangle. This technical indicator is now on the verge of moving into negative territory, placing bears in control of price action. You can learn more about the Force Index here.

Price action already completed a breakdown below its resistance zone located between 6.01493 and 6.04421, as marked by the red rectangle. The correction was temporarily halted as the USD/TRY approached its ascending 38.2 Fibonacci Retracement Fan Support Level. Volatility is anticipated to increase, supporting an accelerated move to the downside. One key level to monitor is the intra-day low of 5.95330, the low of the breakdown in this currency pair below its Fibonacci Retracement Fan trendline. A move below it is favored to inspire more net sell orders.

Once price action converts its 38.2 Fibonacci Retracement Fan Support Level into resistance, the USD/TRY will be on track to challenge its short-term support zone located between 5.91870 and 5.94340, as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level has entered the bottom range of this zone. With the improving conditions for the Turkish economy, a breakdown cannot be ruled out. This currency pair will face its next long-term resistance zone between 5.83459 and 5.86312. You can learn more about a breakdown here.

USD/TRY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 5.98500

Take Profit @ 5.86250

Stop Loss @ 6.02000

Downside Potential: 1,225 pips

Upside Risk: 350 pips

Risk/Reward Ratio: 3.50

In case of a breakout in the Force Index above its descending resistance level, the USD/TRY is likely to attempt one of its own. The upside potential remains limited to its next resistance zone located between 6.10780 and 6.14675. This will represent a sound short-selling opportunity to Forex traders, as more upside is unlikely unless a significant change in fundamental conditions emerges.

USD/TRY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 6.05000

Take Profit @ 6.13000

Stop Loss @ 6.01000

Upside Potential: 800 pips

Downside Risk: 400 pips

Risk/Reward Ratio: 2.00