Singapore faces disruptions related to Covid-19 but remains at the forefront of fighting the spread of the disease, as well as the economic damages from it. The city-state predicts a 30% drop in tourist arrivals, leading to a sharp decline in retail sales. Reports surfaced that the government is preparing a massive spending bill to counter the negative impact, which is expected to exceed the SG$230 million package during the 2003 SARS epidemic. The USD/SGD shows signs of exhaustion inside of its resistance zone, and a breakdown in price action is anticipated.

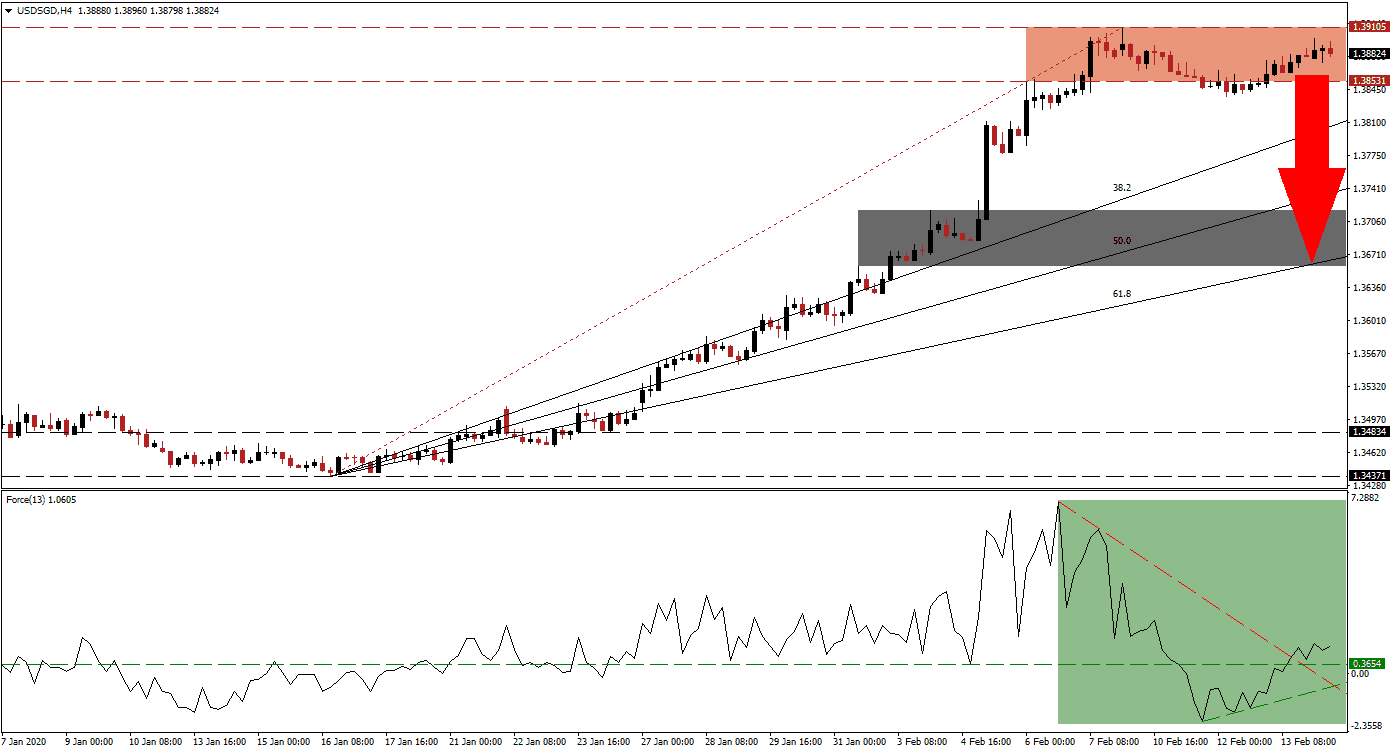

The Force Index, a next-generation technical indicator, recovered from its 2020 low as price action entered a sideways trend inside of its resistance zone. An ascending support level formed, initiating the conversion of its horizontal resistance level into support. It also resulted in a breakout above its descending resistance level, as marked by the green rectangle. Despite the triple bullish development, the USD/SGD failed to extend its advance, suggesting a pending collapse of the uptrend. This technical indicator is favored to contract into negative territory, placing bears in control of price action.

After this currency pair entered its resistance zone located between 1.38531 and 1.39105, as marked by the red rectangle, fears over the severity of Covid-19 eased. US economic data remains mixed with signs of stress evident. A breakdown in the USD/SGD is likely to trigger a profit-taking sell-off, leading to a push below its ascending 38.2 Fibonacci Retracement Fan Support Level, which is closing in on the bottom range of its resistance zone. This will increase downside momentum, allowing for a more massive corrective phase. You can learn more about the Fibonacci Retracement Fan here.

Forex traders are advised to monitor the intra-day low of 1.37773, the low of a minor pause in the advance pushing this currency pair to a fresh 2020 high. A breakdown below this level should inspire the next wave of net sell positions in the USD/SGD, leading it into its short-term support zone. This zone is located between 1.36579 and 1.37172, as marked by the grey rectangle, enforced by its ascending 61.8 Fibonacci Retracement Fan Support Level. More downside is likely to follow, but a short-term fundamental catalyst will be necessary.

USD/SGD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.38850

Take Profit @ 1.36700

Stop Loss @ 1.39300

Downside Potential: 215 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 4.78

In case of more upside in the Force Index, initiated by its ascending support level, the USD/SGD could attempt a breakout. Given the developing fundamental conditions, any spike from current levels will be a limited event, granting Forex traders a great opportunity to place short positions. The next resistance zone awaits price action between 1.40420 and 1.40700, dating back to June 2010.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.39500

Take Profit @ 1.40500

Stop Loss @ 1.39000

Upside Potential: 100 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.00