Singapore has been at the forefront of Covid-19 responses and containment measures. The government announced a financial aid package to assists businesses and employees alike, placing the country on a potential fast-track to recover from economic disruptions related to the virus. The latest industrial production figures surprised to the upside, but more data is required to assess if this was an anomaly or the start of an ongoing resilience. Breakdown pressures for the USD/SGD are on the rise after the rejection by its resistance zone.

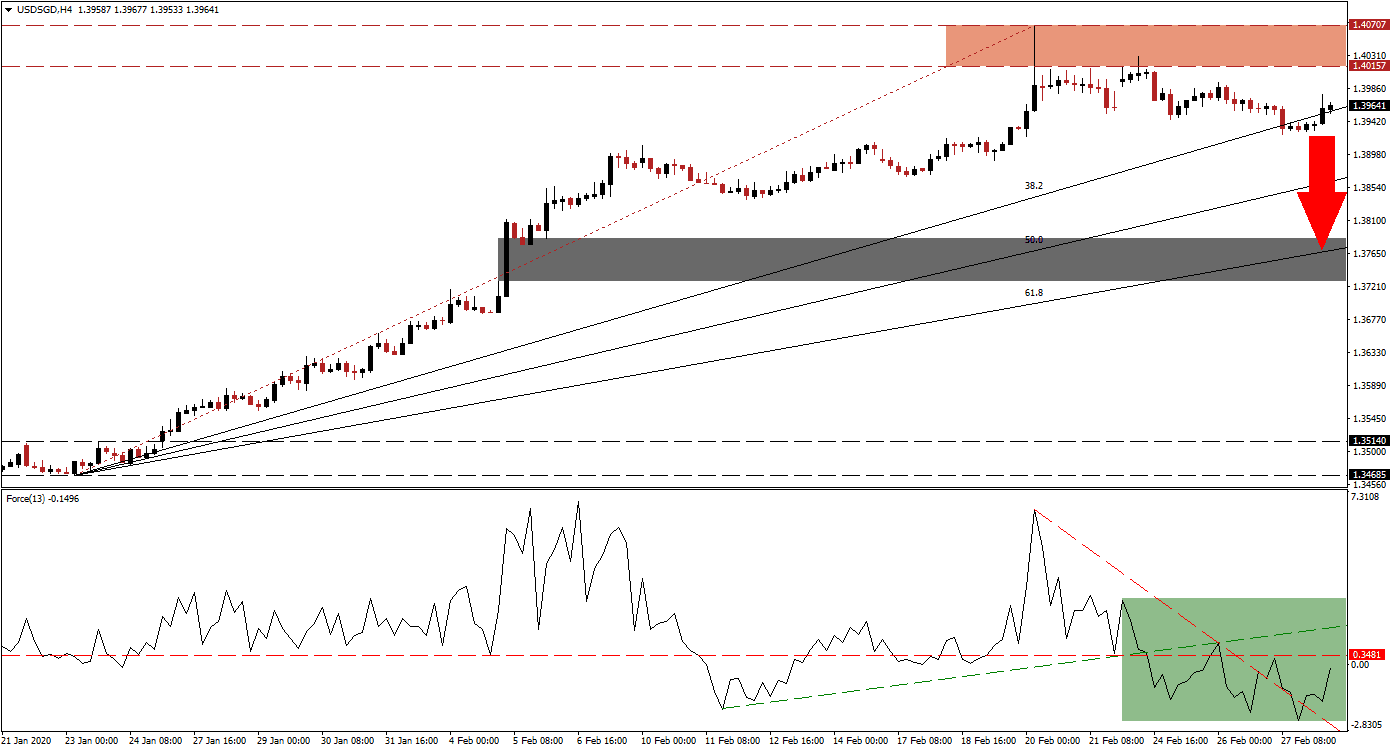

The Force Index, a next-generation technical indicator, quietly contracted to a new 2020 low following the reversal in this currency pair. While the Force Index pushed above its descending resistance level, which now acts as temporary support, it remains in negative territory below its horizontal resistance level. Bears took control of the USD/SGD following the breakdown below its ascending support level, as marked by the green rectangle. You can learn more about the Force Index here.

After being rejected by its resistance zone located between 1.40157 and 1.40707, as marked by the red rectangle, the USD/SGD drifted below its ascending 38.2 Fibonacci Retracement Fan Support Level. Price action recovered from a lower low back above it, accompanied by an increase in breakdown pressures. Forex traders are advised to monitor the intra-day low of 1.39246, the low of the current correction. A breakdown is anticipated to result in the addition of new net sell orders, triggering the next phase to the downside.

Following the first US community-transmitted Covid-19 case, the state of California confirmed that it is monitoring 8,400 individuals. The numbers are likely to spike, causing temporary disruptions across the country. The USD/SGD is well-positioned to correct into its next short-term support zone located between 1.37281 and 1.37859, as marked by the grey rectangle. It is enforced by its 61.8 Fibonacci Retracement Fan Support Level, which maintains the long-term uptrend in this currency pair.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.39600

Take Profit @ 1.37800

Stop Loss @ 1.40100

Downside Potential: 180 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 3.60

In the event of a breakout in the Force Index above its ascending support level, more upside pressure in the USD/SGD is favored. Forex traders are recommended to consider any breakout in this currency pair as a great short-selling opportunity. The outlook for the US economy in 2020 remains bearish and is not accurately priced into its currency, with the Federal Reserve poised to lower interest rates. Price action will face its next resistance zone between 1.42129 and 1.42647.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.40900

Take Profit @ 1.42150

Stop Loss @ 1.40400

Upside Potential: 125 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.50