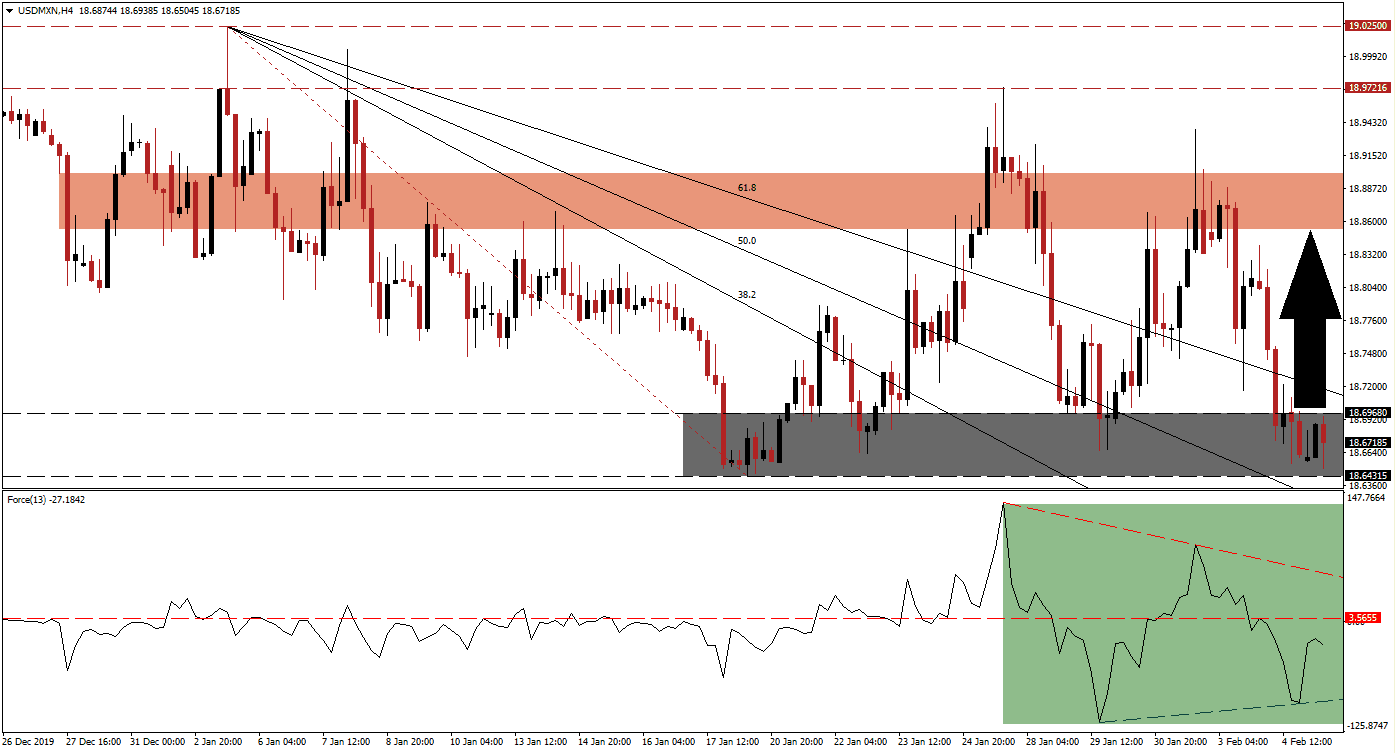

Selling pressure in the USD/MXN has eased after it reached its support zone. Despite several economic headwinds facing Mexico, like the tariffs imposed by the US on its steel and aluminum tariffs or changes from NAFTA to the USMCA trade deal, the Mexican Peso performed well against the US Dollar. This trend is expected to continue, but short-term developments favor a short-covering rally, which will keep the long-term downtrend intact. You can learn more about a support zone here.

The Force Index, a next-generation technical indicator, retreated from a higher low while converting its horizontal support level into resistance. Bearish momentum eased, allowing for an ascending support level to materialize due to a higher low, as marked by the green rectangle. The Force Index is now anticipated to advance into positive territory, placing bulls in charge of the USD/MXN. Breakout pressures remain dominant until this technical indicator reaches its descending resistance level.

With the bullish momentum recovery unfolding and price action inside of its support zone located between 18.64315 and 18.69680, as marked by the grey rectangle, a short-term bounce is likely to follow. The 38.2 Fibonacci Retracement Fan Support Level is the last one of the sequence above the support zone, soon to cross below the top range of it. A breakout in the USD/MXN above it is favored to spark a short-covering rally, while the long-term bearish chart formation retains its dominance.

Due to the established bearish patterns of lower highs, the pending counter-trend rally is expected to come to an end at the bottom range of its short-term resistance zone. This zone is located between 18.85300 and 18.90042, as marked by the red rectangle. A further breakout will require a significant change in fundamental conditions, which remains unlikely. Forex traders are advised to consider any price spike in the USD/MXN from current levels as a great short-selling opportunity. You can learn more about a breakout here.

USD/MXN Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 18.67000

Take Profit @ 18.85300

Stop Loss @ 18.62000

Upside Potential: 1,830 pips

Downside Risk: 500 pips

Risk/Reward Ratio: 3.66

In the event of a breakdown in the Force Index below its ascending support level, the USD/MXN is anticipated to evade a short-term bounce, extending its long-term corrective phase. A breakdown below its support zone is favored to accelerate selling pressure, taking price action into its next support zone located between 18.40210 and 18.45835. While more downside cannot be ruled out, a new fundamental catalyst will be required.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 18.57000

Take Profit @ 18.40300

Stop Loss @ 18.64300

Downside Potential: 1,730 pips

Upside Risk: 730 pips

Risk/Reward Ratio: 2.37