The USD is on an important date today, with Federal Reserve Governor Jerome Powell testifying before the special Congressional committee clarifying the economic performance of the United States of America, the bank's plans according to its monetary policy to continue the strength of the economy and ways to confront the spread of the Coronavirus and its impact on the American economy. Prior to that important testimony, the US dollar is still stronger against other major currencies. The price of the USD/JPY pair is stable around 109.91 at the time of writing, and is in strong bullish momentum despite the Corona virus concerns, which supports the strength of safe heavens.

The US central bank under Jerome Powell trusts the country's economic performance, job numbers, wages, and consumer spending confirm this trust, and therefore the bank adheres to its monetary policy and promises to maintain it in the coming months and that the bank is ready to do what is needed in the face of any risks. After the tariff war with China subsides, a new danger has appeared in the form of the outbreak of the Coronavirus starting from China, bringing the infection cases to more than 20 countries, but the largest number is still in China the source, where the death toll reached 1000 cases and confirmed cases, according to official figures, are 40,000. Today, the US Congressional Committee may ask Powell about the bank's plans to counter such risks, as of now there is no vaccine to stop the outbreak.

And just before Powell's testimony, US President Donald Trump unveiled a $4.8 trillion budget plan and Trump's fiscal plan for 2021 promises that the government’s deficit will exceed $1 trillion for the current budget year only, before it steadily drops to more manageable levels, and Trump said in a message attached to the document that the budget “paves the way for a future that will ensure continued American hegemony and prosperity. There is optimism that did not exist before 63 million Americans asked me to work for them and get them out of the quagmire. And for decades, the Washington elite have told us that Americans have no choice but to accept stagnation, decline and decline. We have proven that all this is wrong. Our economy is strong again. ”

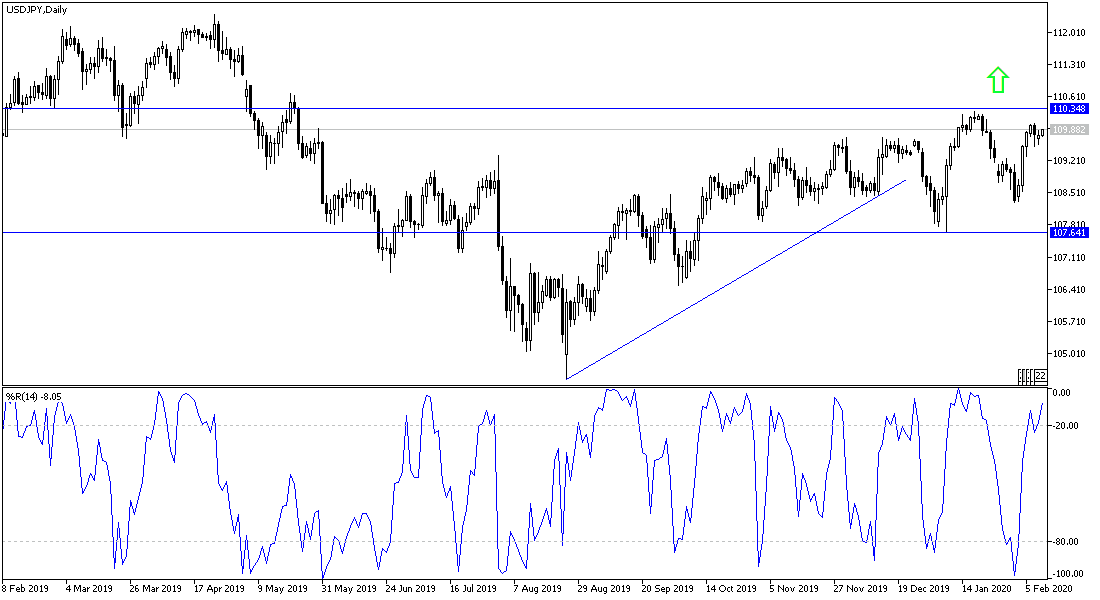

According to the technical analysis of the pair: The price of the USD/JPY is still in an upward path that will be supported strongly if it succeeds in breaking the highest psychological resistance of 110.00, and accordingly, the next bulls targets may be at 110.35 and 111.20, respectively. In the event that global fears increase due to the spread of the Coronavirus, which threatens global economic growth, the Japanese yen may return to achieve stronger gains because it is one of the most important safe heavens, and therefore the pair may return to the support levels at 109.60 and 108.80, respectively. I still prefer buying the pair from every lower level.