The USD/JPY price got an upward momentum that pushed it towards the 109.85 resistance, the highest level in two weeks, and the support of the pair came from the growing optimism that China can reach a treatment for the deadly Corona virus, which may contribute to the weakness of the second largest economy in the world, unless it is controlled soon. This is in addition to the positive US economic data, which still confirms the strength of the US economy even before the implementation of the terms of the Phase 1 trade deal with China.

The ADP report showed an increase in the number of US jobs in the non-agricultural sector to 291,000 new jobs, with expectations were for an increase of 157,000 jobs from 202,000 jobs recorded in December 2019. The survey referred to an increase of 47,000 jobs in the construction sector and an increase of 96,000 jobs in hospitality supported by warmer weather. The manufacturing sector added 10,000 jobs in January, while education increased by 24,000, and health care jobs increased by 47,000.

And in a separate report, the U.S. trade deficit fell for the first time in six years in 2019 after the US administration imposed more tariffs on Chinese products imported into the country. The gap between what the United States sold and what it bought abroad fell 1.7% last year to $616.8 billion. U.S. exports fell 0.1% to $2.5 trillion, but imports fell further, falling 0.4% to $3.1 trillion. Crude oil imports fell 19.3% to $126.6 billion.

The deficit in commodity trade with China last year narrowed by 17.6% to $345.6 billion. Trump imposed a tariff on Chinese imports worth $360 billion to counter Beijing's efforts to challenge US technological domination. They reached a temporary trade agreement last month, and Trump backed away from plans to extend the tariff on another $160 billion worth of Chinese goods.

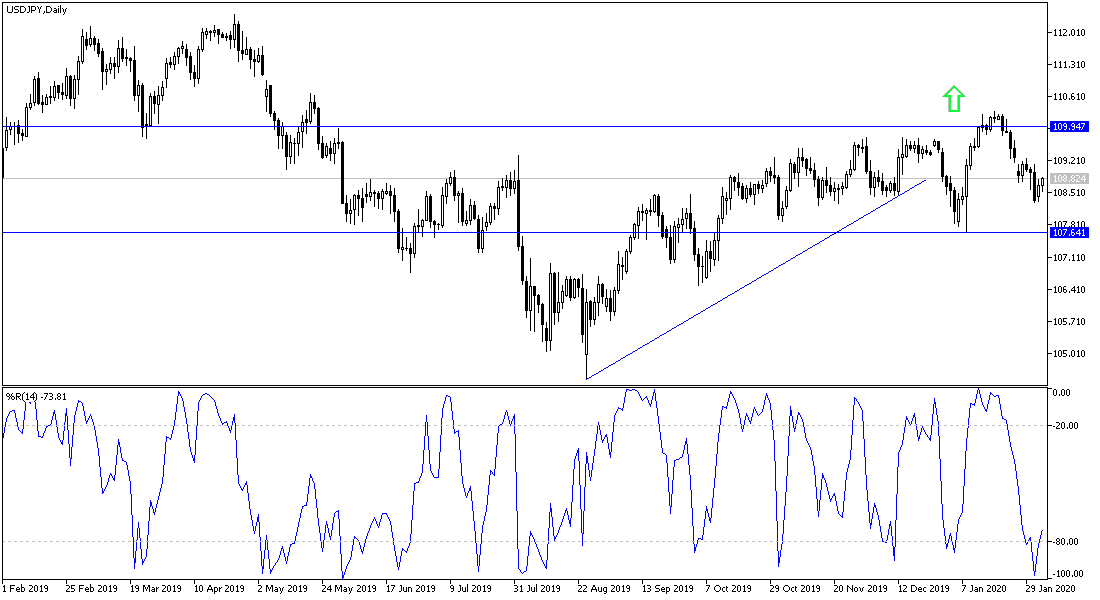

According to the technical analysis of the pair: On the daily chart, a break of the downtrend of the USD/JPY pair will culminate by testing the 110.00 psychological resistance and the stability above it. Considering that the renewed financial markets worries from the spread of the Corona virus and expanding its losses globally will support the return of the Japanese yen gains again, as it is the preferred safe haven for investors in times of uncertainty. On the downside, the closest support levels will currently be 109.25, 108.80 and 108.00, respectively.

As for the economic agenda data: The focus will be on US non-farm productivity data, labor unit costs, and claims for the unemployed.