The USD/JPY price losses stopped at the limits of the 108.30 support and failed to complete the downward correction for two trading sessions, and the pair returned to rise with limited gains that did not exceed the 108.80 level after the recent Chinese measures to allay the fears of the global financial markets, especially with the return of the Chinese markets after a long holiday for the celebration of the Lunar New Year, which was extended for additional days, with the rapid spread in the country of the deadly Corona virus, which has killed more than 360 people and infected thousands and spread the infection in many countries around the world.

For economic news. The US ISM Manufacturing PMI rose to a reading of 50.9 in January from 47.8 in December. As is well known, any reading of the index above the 50 level indicates growth. The index showed manufacturing shrinking in the United States from August to December, due to the fact that U.S. President Donald Trump's trade war with China had led to increased costs and uncertainty. Economists had expected another bad month in January.

But new orders, production and export orders all grew in the past month. Factory rental fell for the sixth month in a row, but at a slower pace than in December. ISM said factories are struggling to find workers at a time when the unemployment rate was at its lowest level in 50 years, at 3.5%. A new virus outbreak in China is threatening supply chains on which manufacturers depend. Timothy Fury, chair of the ISM's Industrial Survey Committee, said: "The Corona virus will have worrying negative impacts."

The United States and China reached a truce last month in their battle over Beijing's economic policies. But the United States continues to impose customs duties on Chinese imports worth 360 billion dollars.

Going back to China. The People's Bank of China also injected a total of 1.2 trillion yuan in financial markets on Monday through reverse repurchase deals to prevent the economy from collapsing. The bank's procedures came at a time when the death toll from the Corona virus, which originated in Wuhan, exceeded 350, and there are more than 17,000 confirmed cases in China. And the disease spread outside China. The World Health Organization has announced the Coronavirus as a public health emergency of international concern. As fears increased about the Corona virus, Chinese stock markets slid on Monday after it reopened after the Lunar New Year holiday.

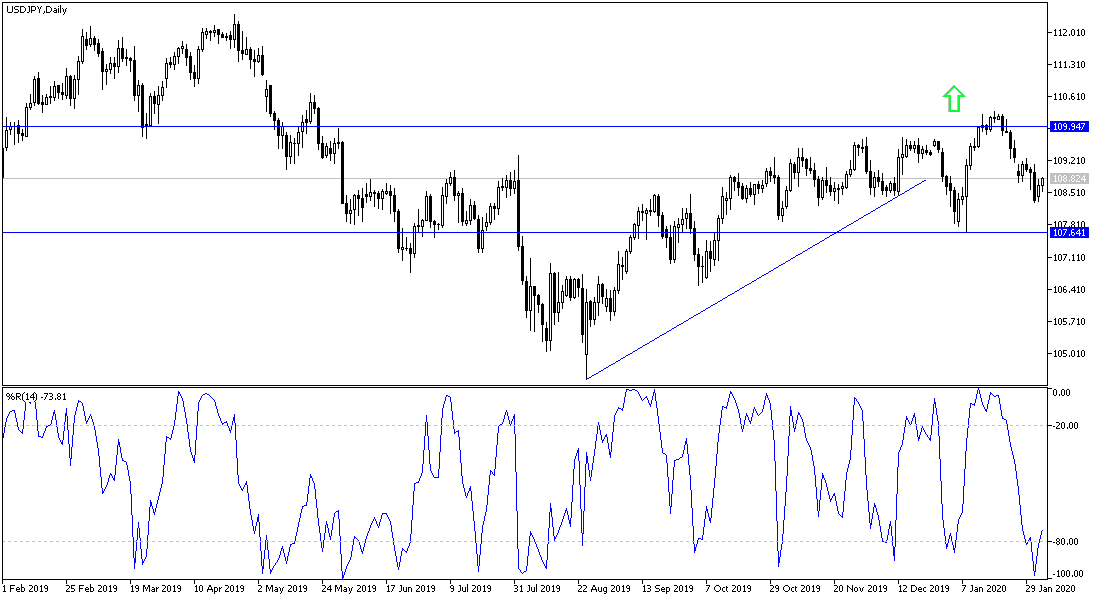

As for the technical analysis of the pair: On the daily chart, the price of the USD/JPY is still moving inside a descending channel, its strength will be supported by the move around and below the psychological support level of 108.00, and the persistence of fears of the Corona virus will increase investor appetite for safe havens and the Japanese yen is one of the most important ones.There will be no real opportunity for the pair to correct higher and reverse trend without breaking the 110.00 psychological resistance. I still prefer to sell the pair from every upside level. The pair awaits no data aside the announcement of US factory orders.