For the second consecutive day, the USD/JPY pair was exposed to profit-taking sales after the pair moved towards the 112.22 resistance at the end of last week’s trading, recording its highest level in 10 months. The bearish correction pushed the pair towards the 110.33 support in the beginning of this week’s trading, and after the recent Japanese yen losses, we confirmed that these losses will not last long. The Japanese yen is still one of the most important safe havens for investors after gold since the beginning of the deadly Coruna epidemic. Especially amid expectations that global output may decline for the first time since the global financial crisis, and all global stock markets fell yesterday. In a sign of confirmation of how sentiment was negatively affected, gold rose 1.8% to $1689 an ounce, its highest level in seven years, as traders sought financial assets that some consider safer in times of tension as is now.

Coronavirus negative impact expectations are constantly increasin. Bin Mai, director of global macroeconomics research at Oxford University of Economics, believes that now the global economy may see its first seasonal drop in seasonally adjusted production since the global financial crisis more than a decade ago. The comparisons of the 2003 SARS epidemic, another deadly epidemic that originated in China, is not reassuring, because China’s share of the global economy is much greater than it was at the time, and the supply chains transporting raw materials, spare parts and products across the global economy, are more than ever.

In the same context. Kristalina Georgieva, head of the International Monetary Fund, said the fund's basic scenario is that the Chinese economy is slowing down but it may return to normal in the second quarter. "But we are looking at more terrifying scenarios, as the virus continues to spread longer and more globally, and the consequences of growth are more prolonged," she said.

The US economy, unlike the rest of the world’s economies, has not been greatly affected by the paralysis in economic performance in China, even with the outbreak in many countries of the world. Economists attributed the matter to the lack of close linkage between the US and Chinese economies, as is the case with many global economies, such as the European Union, Japan, South Korea and Australia, for example. But at the same time, the US Federal Reserve announced that it would monitor the situation to determine what would be appropriate if the economy was affected by the epidemic and its consequences.

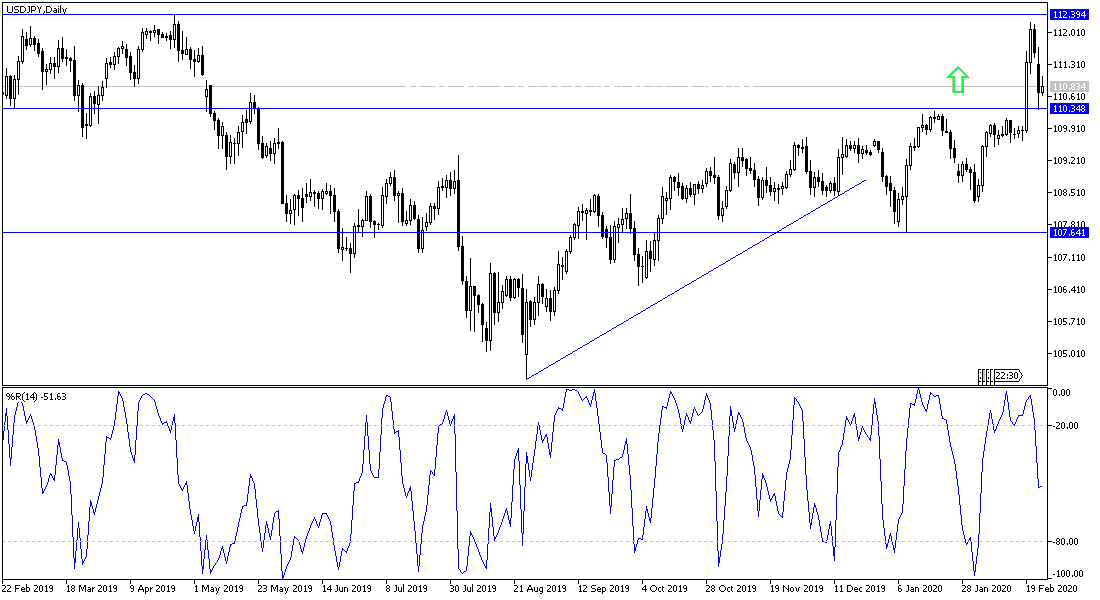

According to the technical analysis of the pair: Despite the USD/JPY bearish correction, the general trend of the pair is still bullish as long as it is stable above the 110.00 psychological resistance, and this appears clear from the performance on the daily chart below. We still prefer to buy the pair from each lower level, especially if it went to the 109 support or below. The closest support levels for the pair are currently 110.20, 109.55 and 108.80, respectively.

As for the economic calendar data today: The focus will be on the U.S data, Consumer Confidence and Richmond Industrial Index.