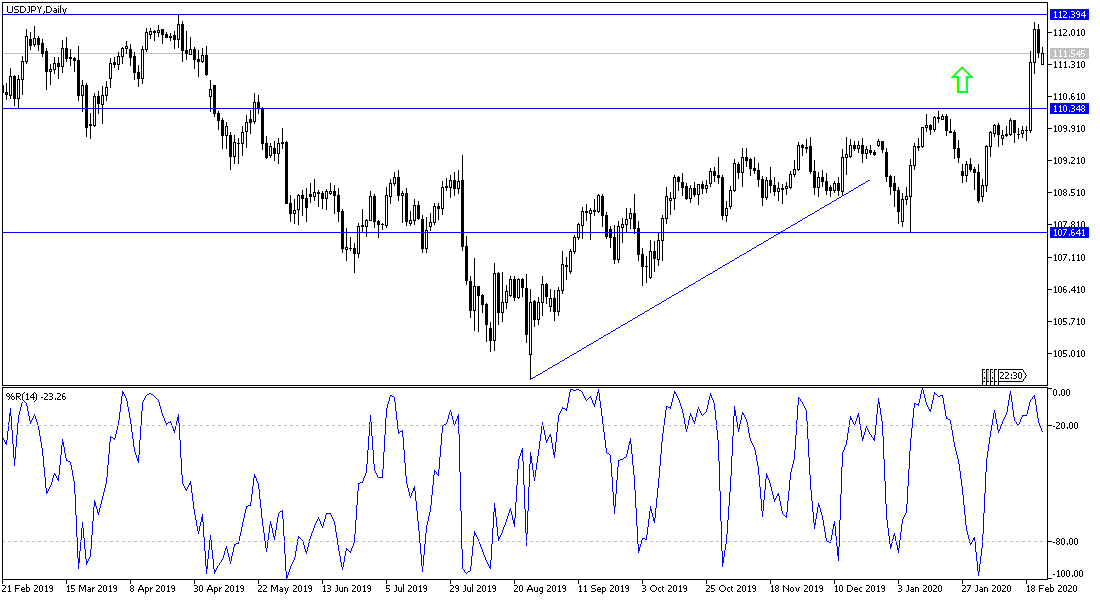

The US dollar remains the best performing currency compared to other major currencies. Since the beginning of trading in 2020, the price of the USD/JPY was the most prominent on the trading screens last week, as the pair succeeded in grabbing more than 300 points higher, reaching the 112.22 resistance, the highest level since April 2019. Before closing the week's trading around 111.56. Last week’s gains were the best weekly performance for this pair since September 2017. The results of the recent US economic data confirmed to the markets that the economy does not suffer much from the crisis in China in relation to the deadly corona virus (COVID-19), unlike other global economies, such as the European Union, Australia, Japan, and others. The latter recorded an economic downturn at the end of 2019 just before the outbreak, which confirms that it will suffer in the near future, supporting recent JPY strong losses.

Key US economic figures will be few and far between this week, although investors will take into account the Consumer Sentiment reading on Tuesday, Core Durable Goods Orders on Thursday and the Core PCE Price Index on Friday. Investors will try to assess the impact the Corona virus has had on household confidence and commercial investment, as both are important pillars of the US economy.

The US economy has experienced a steady growth of 2.1% in the last quarter of last year, while most other major economies have slowed to date since the beginning of 2020, and this trend seems to make such economic exceptions, with the possibility of interest rate cuts from the Federal Reserve, less likely than in the past, and increases the dollar’s gains against its competitors, thus increasing the value of the US currency.

The minutes of the Federal Reserve’s January meeting showed that the bank adheres to the principle that there is no “material change” in the outlook for the local economy. The performance is still good at an unemployment level which is the lowest in 50 years and inflation near the bank’s goal, and the coronavirus developments are monitored along with their effect on the economy to take appropriate measures.

Fed officials have recently said that they see no need to cut interest rates any time soon. Meanwhile, worries about the consequences of the Coronavirus rocked the stock and bond markets last Friday, especially after a survey by IHS Markit for purchasing managers, showed that US corporate production fell in February for the first time in more than six years. Accordingly, the Dow Jones Industrial Average fell 228 points, and the yield on 30-year Treasury bonds fell to a record low.

These fears also led to higher estimates in the futures markets for the Federal Reserve rate cut later this year. According to the CME Group, traders envision a roughly 58% possibility of cutting interest rates at least once by June - up from less than 20% in the previous month.

According to the technical analysis of the pair: the general trend of the USD/JPY will remain bullish as long as it remains stable above the 110.00 psychological resistance, and with the recent bounce, technical indicators have reached strong overbought areas. Resistance levels above 112.00 can be targeted to return to selling and win the correction gains to take profit. The nearest resistance levels are now 112.30, 113.00 and 113.55, respectively. On the downside, the closest support levels at 110.90 and 110.00, are currently considered the most important ones, and breaking below the last one provides new bears strength to control performance.

The pair is not looking for any important economic releases, whether from Japan or the United States of America today.