In the best daily performance of the USD/JPY pair, the pair achieved its gains during yesterday's session, starting from the 109.83 support, reaching the 111.58 resistance, where it is also stable at the time of writing, and is the highest level in more than eight months. The surprisingly strong gains of the pair were supported by the strong momentum that the US dollar gained recently from investor demand for it as a safe haven amid the outbreak of the Corona epidemic in China and its threat to the global economy, along with the good and distinguished performance of the American economy compared to other global economies. With regard to the Japanese economy, it was subjected to deflation in the last quarter of 2019, before the outbreak of the Corona virus. Therefore, the upcoming figures will confirm further weakness of the Japanese economy. At the same time, Japan has become the largest hotspot for infection of coronavirus outside the Chinese borders.

Although the Japanese yen has benefited a lot and has long been favored by it as a safe haven with the outbreak of the Coronavirus, there have always been questions as to whether the Japanese yen is the best safe haven option. After all, the proximity of Japan and its trade with China, strongly increases the possibility of the pandemic spreading in Japan. This epidemic is still negatively affecting global financial markets because it is an explicit threat to global economic growth, and it is still illogical that the market has suddenly decided to punish the Yen.

On the other hand, and according to the content of the last Fed meeting, the monetary policy makers are willing to maintain the interest rate at its current low level in the coming months. They emphasized that the Phase 1 trade agreement between the United States and China recently removed some risks to the US economy and that it was ready to face the risks in the event of a Corona epidemic affecting the global economy. The bank sees the Coronavirus as a "new threat to global growth prospects."

Many Fed observers have interpreted this caution as an indication that the next step for the Federal Reserve, if this happens, is likely to be a cut of interest rates, not a hike. Traders are now betting that the odds of a year-end cut are 85%. The minutes of the Federal Reserve meeting showed that officials were willing to keep the key interest rate in the range of 1.5% to 1.75% in the future. Policymakers said rates at this level would help the US economy withstand the threats of slowing growth overseas.

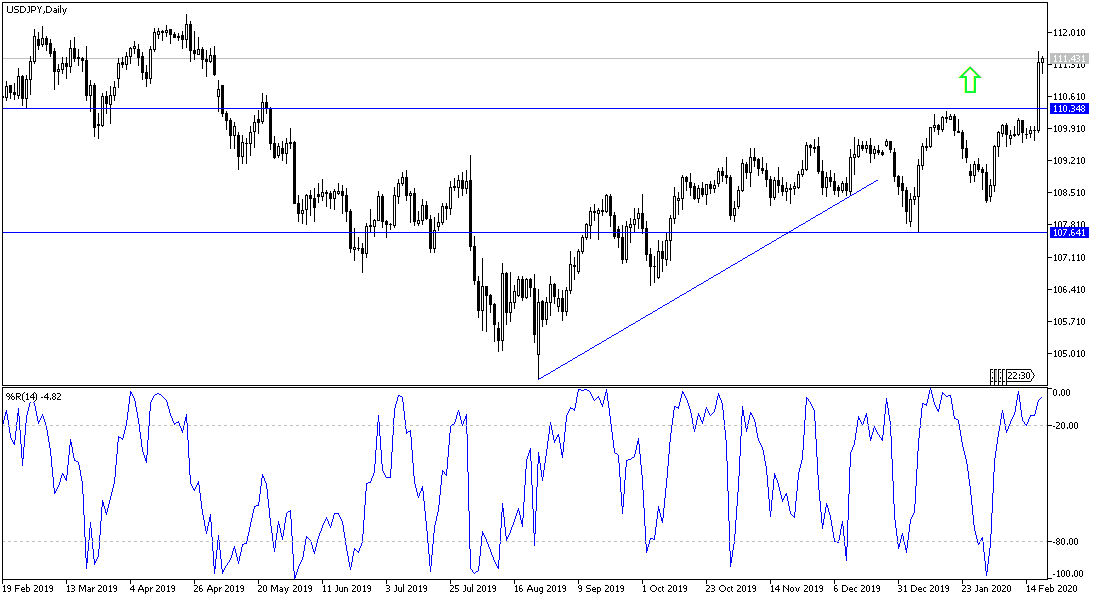

According to the technical analysis of the pair: The upward trend of the USD/JPY got stronger momentum. We have suggested before the launch of the pair that its movement in a limited range for several sessions foreshadows violent movement in one of the two directions. The bullish momentum will remain stronger as long as the pair remains stable above the 110.00 resistance and also the next psychological resistance at 111.00. On the downside, the closest support levels for the pair are currently 110.90 and 110.00, respectively. Despite the recent bounce, I still prefer to sell the pair from every bullish level.

As for the economic calendar data today: The focus will be on the US data which are unemployed claims and the Philadelphia Industrial Index.