Despite growing fears again about the bleak future of the second largest economy in the world due to the recent global Corona virus, and the flight of investors from risk, despite China's steps to reassure the world, the price of the USD/JPY showed resilience, and its losses did not exceed the 109.65 resistance level, before stabilizing around the 109.90 level in the beginning of today’s trading. This cohesion may face the announcement of the content of the last US Fed meeting of later in the day. The dollar may be affected a lot if the minutes bring in new information, in contrast to the bank's confidence in the economic performance of the United States of America.

Global Fears of Corona “Covid-19”: With many Chinese returning to work after the longest holiday ever for the new lunar year, the economic effects of the outbreak in Wuhan may have just begun. As companies warn that their final results will get a huge hit, governments are stepping up stimulus measures for economies and hoping to see a recovery after months of uncertainty due to trade tensions and slowing global growth.

In this context, South Korean President Moon Jae-said that "emergency situations require emergency measures," and called for strict measures to support companies that depend on trade with China and encourage consumers to spend more.

Central banks across the region have already begun to cut interest rates to help ease credit, as the flow tourists has stopped and manufacturing and delivery networks have become embroiled in bottlenecks caused by closings within China aimed at helping contain the spread of the virus that has killed more than 1,870 people and infected more than 73,000 globally.

Asian economies have grown increasingly on trade with China and tourism that caters to the needs of an increasing number of Chinese travelers. Another regional power, Japan, and its economy, the world's third largest, saw a contraction - 6.3% in annual terms in the last quarter of 2019, even before the virus spread and turned into a crisis.

This tense situation is offset by a rosy view of the US economy, which remains strong, with an unemployment rate which is the lowest in 50 years and inflation near the goal of the US central bank, which in turn adheres to monetary policy, and an interest rate that is the highest among other global central banks.

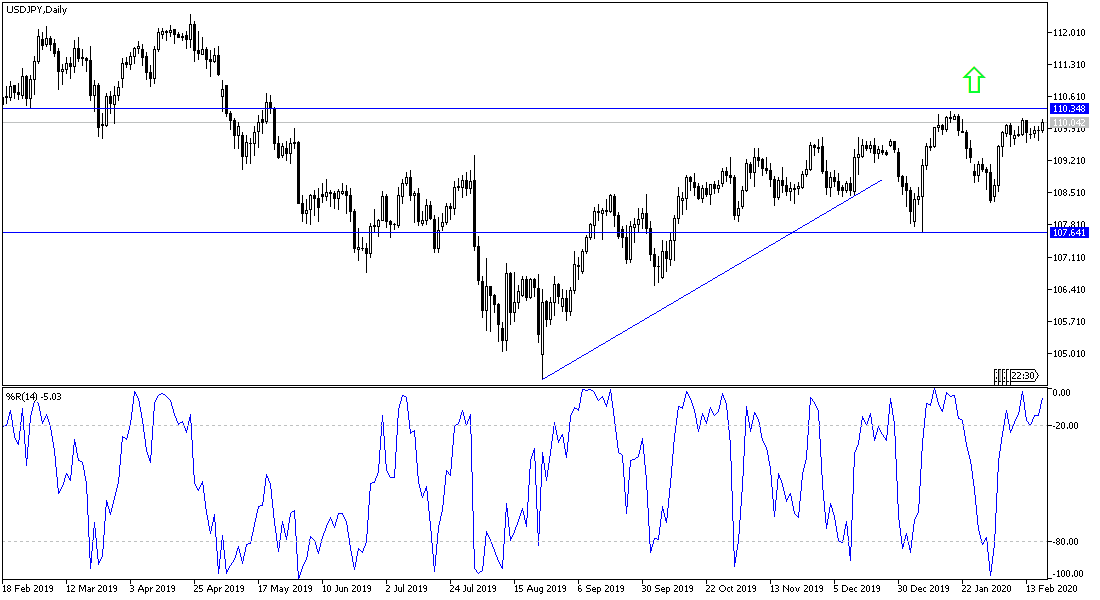

According to the technical analysis of the pair: Despite the pause in the pace of its gains, the USD/JPY is still moving inside a bullish channel supported by the 110.00 psychological resistance, which is the closest to it currently. On the downside, there will be no downward correction and trend reversal without the pair moving towards the support levels of 108.85 and 108.00, respectively. Otherwise, the bulls will remain in control.

As for the economic calendar data: From Japan, the trade balance will be announced. From the United States of America, building permits, the producer price index, and the minutes of the last US Federal Reserve meeting will be announced