For the third consecutive day, the price of the pair USD/JPY is moving in a limited range between the 109.65 support and the 109.96 level before settling around the 109.78 level at the time of writing. The pair cautiously awaits developments on the ground in China regarding the outbreak of the deadly Corona epidemic - COVID 19 -. According to the latest official statistics, the epidemic claimed 1868 deaths and infected more than 72 thousand people in China alone. The Chinese government continuously publishes reports confirming a decline in cases and deaths to reassure the world about the situation, but there are usually doubts about the Chinese data, especially since no vaccine has been declared to face this epidemic, which has spread to many countries around the world and has already become a threat to global economic growth.

The Japanese economy contracted by -1.6% in the last quarter of 2019 thanks to the government's decision to raise sales taxes, a drop that was much greater than the decline that markets had expected which was -1.0%. Meanwhile, the fourth-quarter annual decline was steady at -6.3%, which is much deeper than the -3.7% expected. Meanwhile, economists doubt that the Japanese economy will see a sharp recovery in early 2020 due to the threat of the Coronavirus, and the data is likely to put more pressure on the government and monetary authorities to come up with measures to support the economy.

The latest announced mix of the monetary and financial support could also affect the Japanese Yen’s trends during 2020. Any potential support measures announced by the Bank of Japan will likely boost the Yen’s attractiveness as a funding currency, which means that the Japanese currency will likely remain highly exposed to domestic and international investors’ sentiment, who do not favor the Yen at the moment.

The drop in Japanese GDP was driven by a 3% drop in private consumption in the fourth quarter which followed a 0.4% increase in the third quarter. In contrast, consumption decreased after the increase in the country's sales tax rate from 8% to 10% in October 2019.

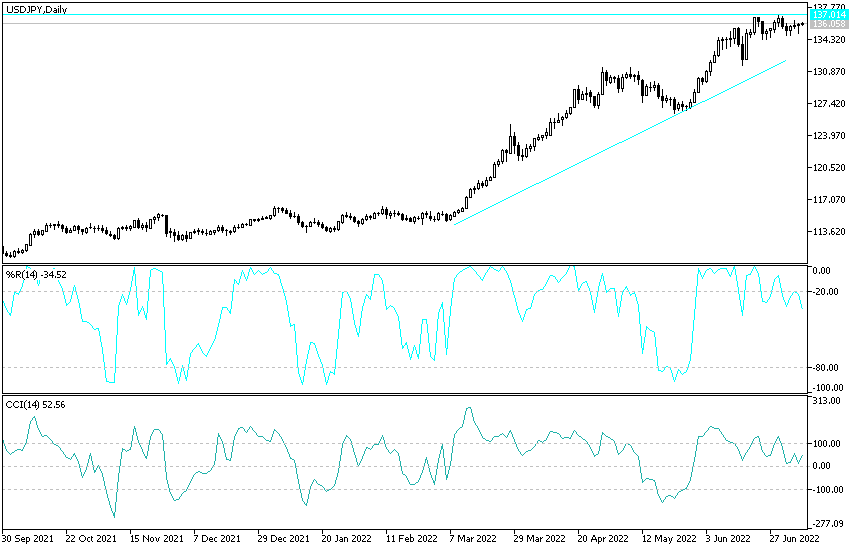

According to the technical analysis of the pair: On the USD/JPY daily chart there is a state of stability in a limited range for several trading sessions, which foreshadows a strong movement coming in one of the two directions depending on investor sentiment and the level of the dollar. So far, the momentum remains bullish as long as it is near the 110.00 psychological resistance, which supports bulls' control of performance. There will be no downward momentum for the pair without moving below the 109.00 support, otherwise the general trend will remain bullish. I still prefer buying the pair from every lower level.

Today's economic calendar has no significant influencing data from Japan or the United States of America.