Variation in official reports from China regarding its losses due to the outbreak of the Corona epidemic lead to fluctuation in the performance of safe haven assets. Accordingly, we have noticed a fluctuation in the USD/JPY pair during last week's trading, between the 110.13 resistance and the 109.61 support, before closing the week's trading around the 109.77 level. On Sunday, China reported a decrease in cases of coronavirus for the third day in a row, as it became clear that officials were aware of the potential seriousness of the situation before the crisis escalated.

In the early days of the epidemic, which was one of the greatest political challenges of Chinese President Xi Jinping's tenure, Xi played a minor role. But Saturday night, official media published a letter Shi gave on February 3 in which he said he had given instructions on combating the virus on January 7. The disclosure indicates that senior leaders were aware of possible death weeks before such risks appeared to the public. It was not until late January that officials said the virus could spread between people and the public alert began to rise.

There are 2009 new cases in China, bringing the total number of confirmed cases to 68,500, according to the country's National Health Committee. The commission said the death rate remained stable with 142 new deaths. The death toll in China stands at 1,666 in total, and in return 9,419 people have recovered and been discharged from hospital.

On the economic side. US retail sales rose in line with economists' estimates in January, and the US Department of Commerce announced that retail sales rose by 0.3 percent in January after rising by a revised 0.2 percent in December. Economists had expected retail sales to rise by 0.3 percent, in line with the increase originally announced in the previous month. The report said that the closely watched core retail sales, which excludes cars, gasoline, building materials and food services, did not change in January after rising 0.2 percent.

On the other hand. An official report showed a steady decline in US industrial production in January. The Federal Reserve said that industrial production fell by -0.3 percent in January, after a revised 0.4 percent decline in December. Economists had expected industrial production to drop by 0.2 percent, compared to a decline of -0.3 percent in the previous month.

The decline was slightly larger than expected in production, as utility production fell 4.0 percent in January, after falling by 6.2 percent in December. In the same context, a note from economists at the University of Oxford of Economics said: “Looking at the future, the challenges of supply chains due to the Coronavirus and deadly stoppage of production Boeing plane, will merge with the steady headwinds of weak global growth and protectionist trade policies to prevent a revival of industrial activity.” They added, "Energy activity will remain weak because oil prices are not likely to hold together amid a quiet global growth environment." and: "Therefore, we expect industrial production growth to stagnate this year."

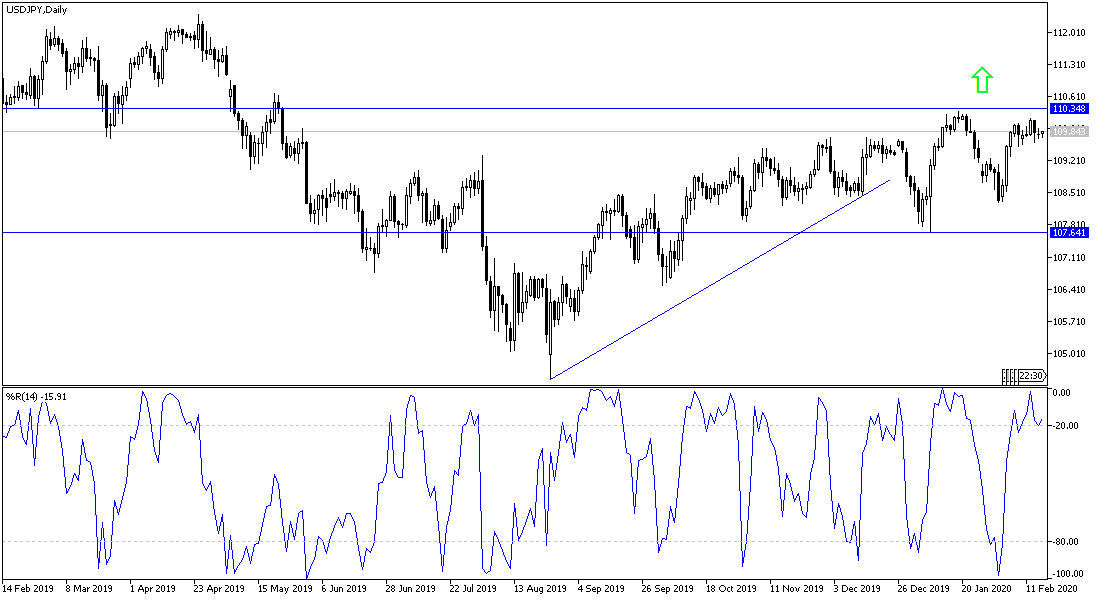

According to the technical analysis of the pair: On the daily chart, the USD/JPY pair is still inside a bullish channel, and spent the recent trading sessions in a limited range foreshadowing a future movement in either direction. Increasing global losses due to the Coronavirus will pave the gains for the Yen. The closest support levels for the pair are now at 109.55, 108.80 and 108.00, respectively. On the upside, stability above the 110.00 psychological resistance is a catalyst for bulls to take the pair to stronger bullish levels.

As for the economic calendar data today: From Japan, the GDP growth rate and the industrial production rate will be announced. On the other hand, there is an American holiday for the Presidents' Day.