The US dollar received strong support from Federal Reserve Governor Jerome Powell testifying before the congressional and Senate committees, as he reiterated his confidence in the economic performance of the United States of America, citing the longest economic growth period in the history of the United States, and an unemployment rate down to the lowest level in 50 years, and not affected by external risks, which could be an early indication of the bank's concerns about the continued outbreak of the Coronavirus, as Powell stressed that the bank is monitoring developments and the effect of this virus on the US economy, and that the and its work team are ready to do what is necessary if the economy is negatively affected. This confidence pushed the USD/JPY towards the 110.13 resistance before settling around 109.80 at the time of writing, and before the announcement of an important US inflation figures.

The rosy view of the US dollar is increasingly at risk of political discomfort with the start of Democratic primary elections. Investors were clearly in an upbeat mood on Wednesday as many stock markets around the world gained nearly a full percentage point while the price of oil rose nearly 3%, as concerns about the global economic impact of the Coronavirus receded, after the number of new confirmed cases in China dropped again. This resulted in the dollar appreciating against the Japanese yen and the Swiss franc as a safe havens, while ceding most of its gains against other currencies, including the Pound, Australian and New Zealand dollars.

Economists at Goldman Sachs estimate that the coronavirus, as well as Boeing shutting down its MAX737 troubled plane, could weaken economic growth by three quarters of a percentage point in the first three months of this year. But growth is likely to rebound and offset some slowdown by the second half of 2020.

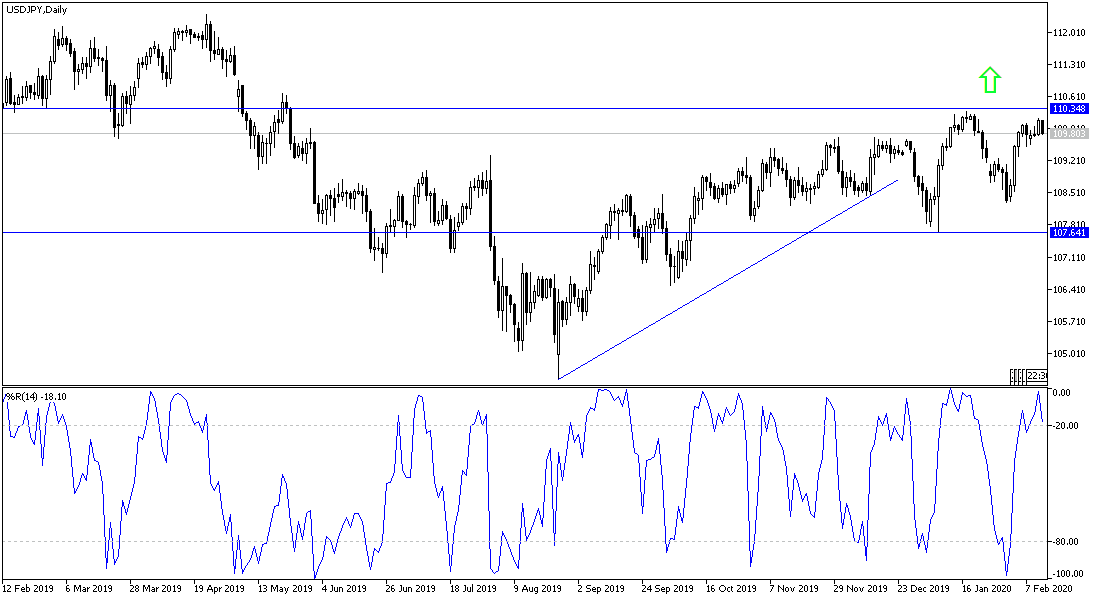

According to the technical analysis of the pair: the USD/JPY remains in the range of a bullish channel, and the 110.00 resistance supports strength. The US inflation and retail figures today and tomorrow will have a strong impact on gains of this pair, in addition to developments on the ground regarding the Corona virus, which is still disturbing the world economy despite China's recent reassurances to markets and the world that the situation is under control. The closest support levels for the pair are currently 109.65, 109.00 and 108.55, respectively. I still prefer buying the pair from every downward level.

As for the economic calendar data: Today, the pair’s focus will be on the announcement of the US CPI, along with the claims of the unemployed.