After financial markets absorbed what was mentioned in the content of the testimony of Jerome Powell, the US Federal Reserve Governor, focus will be placed on developments in the fight against the deadly Coronavirus, especially after Powell expressed his concern that the continued outbreak of the coronavirus will threaten US and global economic growth. Powell's statements contributed to a downward correction of the USD/JPY pair towards the 109.72 support, after stabilizing around the 110.00 psychological resistance. Other global central banks are also expected to express their concerns about the consequences of the Coronavirus, especially with the failure to reach a vaccine that stops the losses resulted from it, which contributed to the death of more than 1,000 people in China, and infected more than 40,000 confirmed cases, and a global spread to more than 20 countries besides China.

Because of coronavirus, China has remained closed to business, with about 60 million people under quarantine in the country. The embargo has raised concerns about the extent of damage to production chains in China, the world's second largest economy, by global supply chains. China accounts for more than 80% of global smartphone and laptop production, and more than half of the global production of television and servers, according to recent estimates.

As for US interest rates, which the U.S president called on several occasions to reduce to zero, amid a fierce attack on Powell's policy that he choose for this important position, Powell said that the Federal Reserve "believes that the current position of monetary policy will support continued economic growth and a strong job market", and returns the annual inflation to the bank's target level of 2%. Powell was also asked about negative interest rates, a policy Trump has always endorsed in his tweets as a way to further boost the economy; "This is not a tool to look forward to," Powell said, noting that some research indicates that negative interest rates may harm bank profitability.

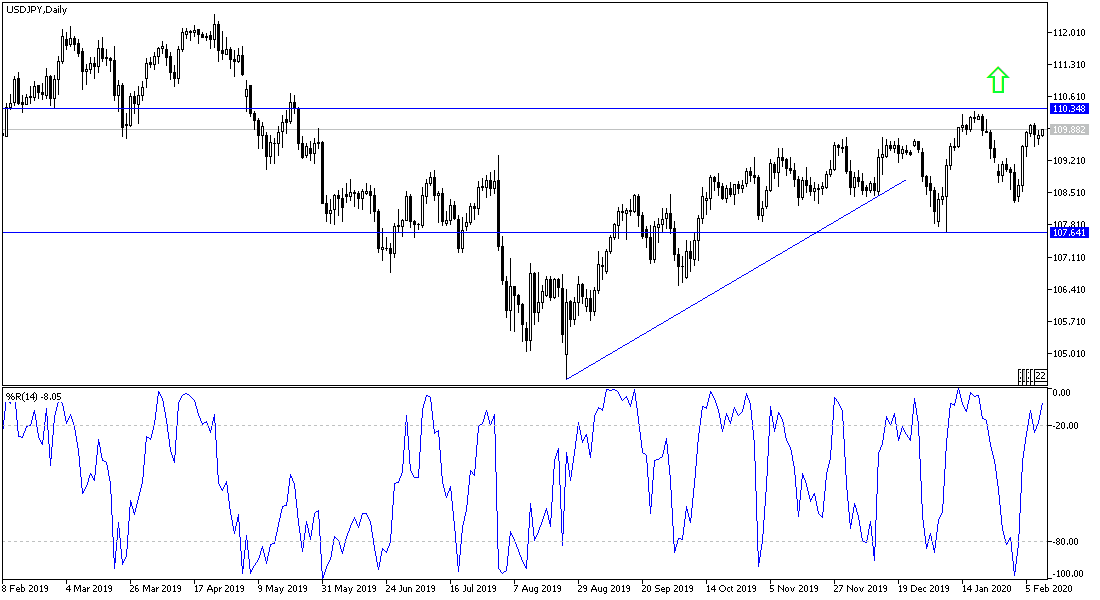

According to the technical analysis of the pair: the limited correction did not have much effect on the general bullish trend of the USD/JPY pair, as it is currently closest to the 110.00 psychological resistance, and there will not be a true reversal of the trend without the pair moving below the 108.80 support. Bulls still have control, as gains were only halted amid continued losses and growing fears of the Coronavirus. The Japanese yen is a safe haven, which is very popular in times of uncertainty.

As for today's economic calendar data: There are no significant economic releases from Japan today. The focus will be only on the content of the second testimony of Federal Reserve Governor Jerome Powell.