Although the price of the USD/JPY pair fell during the Friday session to the 109.53 support 109.53 before closing the week's trading around 109.77 level, the general trend of the pair is still upward. The pair did not take good advantage of the announcement of US job numbers, as fears of increased losses from the Coronavirus supported more gains for the Japanese yen as a safe haven. The US dollar will react this week to the reaction from the content of Fed Governor Jerome Powell's testimony for two days in a row. He is expected to touch on the latest US jobs and inflation figures to confirm the bank’s position by sticking to its monetary policy unchanged.

Last Friday, the details of the Labor Department report on US job numbers for January 2020 were announced. We noticed a variation in the results of the reports, as the US economy succeeded in adding stronger than expected jobs in the non-agricultural sector by adding 225,000 new jobs, and expectations were for 160,000 jobs from 145,000 in December 2019. Hourly wages increased by 0.2%, and expectations were for a 0.3% increase from 0.1% previously. As for the unemployment rate in the country, it rose from its lowest levels in 50 years, around 3.5% to 3.6%, contrary to expectations that the rate would remain unchanged.

The Japanese yen is one of the most important safe havens for investors since the outbreak of the Coronavirus in China, amid fears that it could cause a recession in the global economy. The number of deaths, according to Chinese figures, has risen to more than 800, and there are global doubts about the numbers announced by the government, given that the population of China is the largest in the world. According to health experts, the virus is rapidly spreading in several ways. There are cases of infection in more than 20 countries around the world besides China, the source of the coronavirus. The continuation of global losses from the virus means more gains for the Japanese yen.

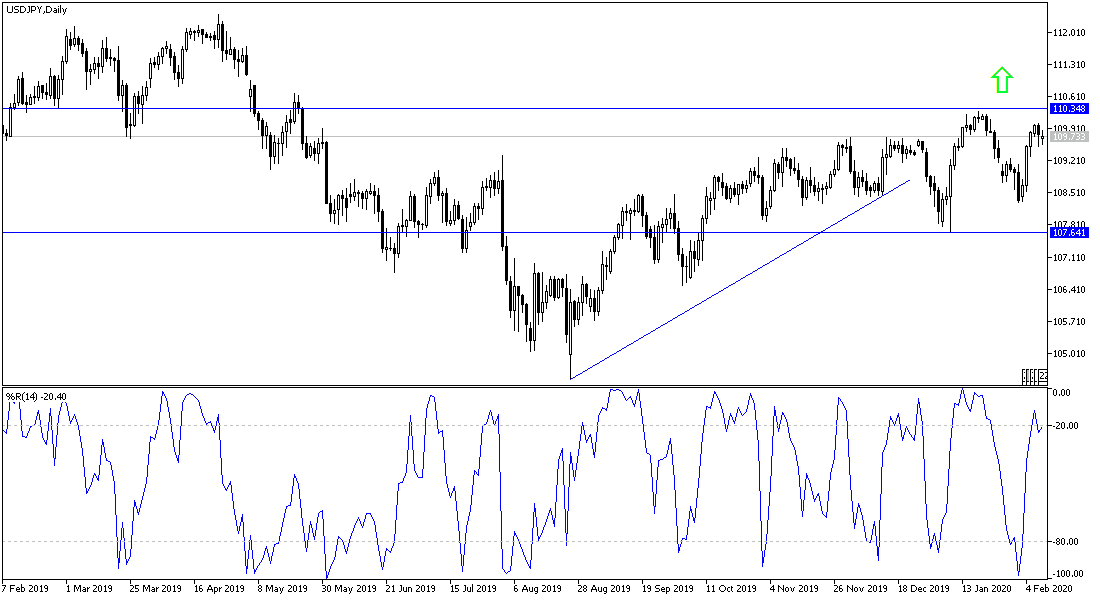

According to the technical analysis of the pair: Despite the recent bounce in the USD/JPY, it is still moving inside a bullish channel. Therefore, bulls will target long-term profits at around 110.36 or higher at 111.24. On the other hand, bear will look to make profits when the pair retracts to around 109.32 or 108.43 or less at 107.51. I still prefer buying the pair from every downtrend. Today's economic calendar lacks important economic data, whether from Japan or the United States of America.