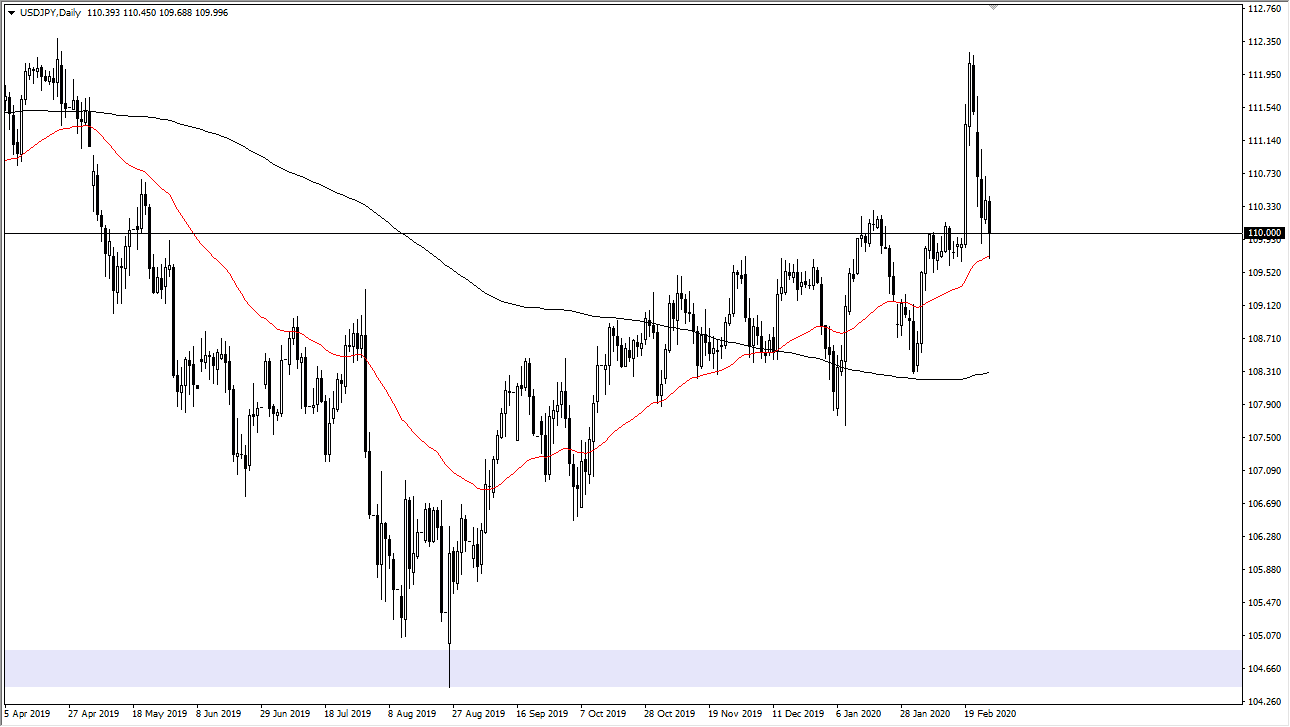

The US dollar has broken down significantly during the trading session on Thursday, slicing through the ¥110 level. However, we are testing the 50 day EMA for support and I think it’s only a matter of time before the market makes a serious attempt to break down through there. If the Friday candlestick closes below that level, it’s very likely that the market will continue to fall hard.

The United States dollar is getting hammered due to the fact that we are starting to see coronavirus cases in the United States, and therefore it looks as if the market has some catching up to do. However, as far as buying is concerned it might be possible, but we need to see a daily candlestick close well above the ¥110 level. If that happens, then it’s likely that the market will then try to recover completely. From a fundamental standpoint, at least in theory the US dollar should rally against the Japanese yen. After all, the Japanese economy is getting ready to go into recession, and the US dollar is still a representative of one of the few economies in the world that shows strength. The question now is whether or not that strength is overhyped.

That being said, it will be interesting to see how the Friday candlestick for this pair reacts to whatever happens in the stock markets. Ultimately, the Japanese yen is starting to operate as a safety currency yet again, and as a result we are starting to see a lot of flow into that currency. The Japanese yen is strengthening against almost everything, not just the US dollar. If this market breaks down significantly below the ¥109.50 level, there may be even more gains to be had in other currencies such as the CAD/JPY pair, or maybe even the AUD/JPY pair. At this point, it’s very difficult to imagine a scenario where you can easily buy this pair unless of course there is some type of massive turnaround on either the daily or perhaps even the weekly candlestick. At this point, it looks as if the US dollar run against the Japanese yen is rapidly coming to an end. Be careful, as we go into the weekend things could get rather volatile and crazy, and if Wall Street behaves like it has over the last couple of days, then it’s likely that this pair will fall apart again.