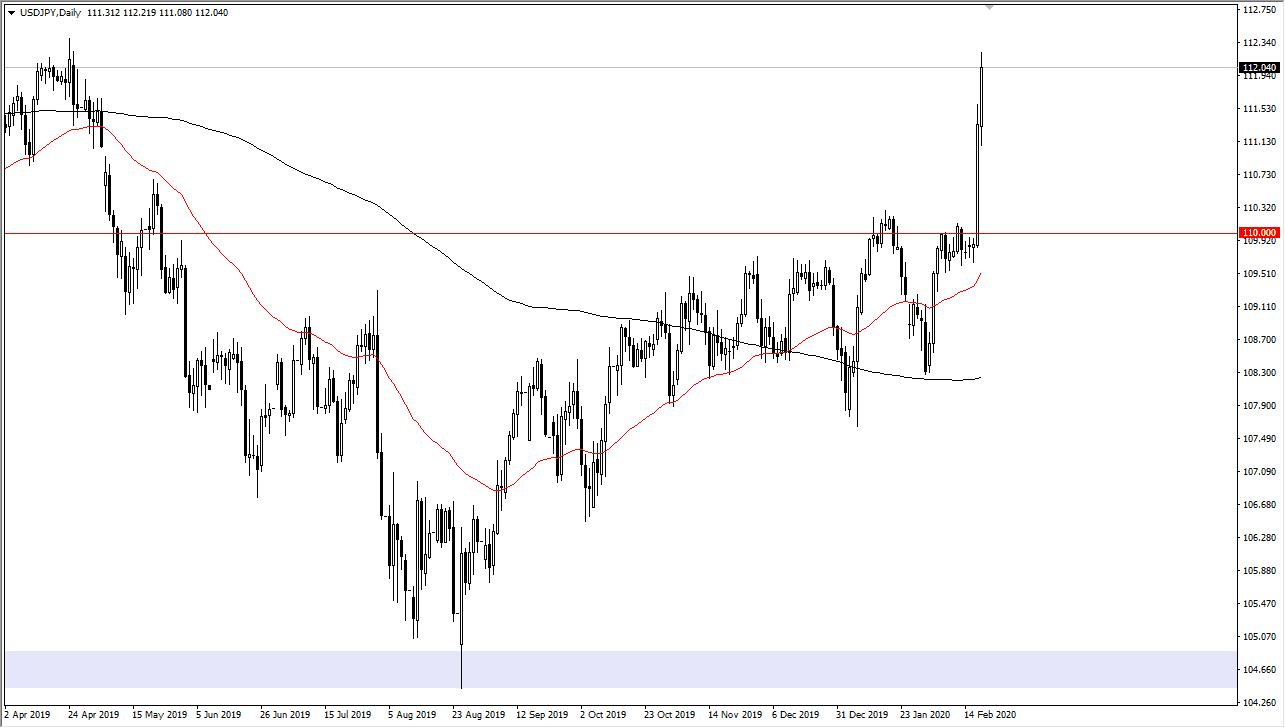

The US dollar has rallied a bit during the trading session yet again on Thursday against the Japanese yen. We had broken above the ¥112 level, which is a very bullish sign but quite frankly I think this market is a bit overdone. Part of the push higher would have been due to the Japanese economic numbers being so poor of the last couple of days, as GDP is dropping. There is the possibility that Japan enters a technical recession, but at the end of the day I think the most likely situation will be that heading into the weekend we will probably get some profit-taking.

To the downside, I see the ¥110 level as offering a bit of a floor in the short term, but I think between here and there we would see buyers eventually anyway. I like the idea of buying pullbacks and as we go into the weekend, it’s very likely that people will try to take some type of profits as they are already a couple of handles higher. Remember, the Japanese yen is considered to be a safety currency, so there does come a time where people will jump into the Japanese yen, despite the fact that the Japanese growth is under pressure.

Part of what has made this market so bullish is the fact that it involves the US dollar, and then of course is the most favored currency in the world right now. The greenback offer safety as well, but as money flows into the US stock markets, it makes quite a bit of sense that the US dollar has to strengthen. This could be thought of as a sign of money flowing out of Asia and into New York, as fears of the coronavirus continue to cause major issues for the idea of Asian growth in general. All of that being equal, I still believe that a pullback makes quite a bit of sense because people won’t want to be short of the Japanese yen going into the weekend. To the upside, I see the ¥114 level as a major target, followed by the ¥115 level, which is the top of the longer-term consolidation. In fact, I have been waiting for some type of impulsive candlestick at what I thought was “fair value” in the larger consolidation, the ¥110 level. Now that we have got an impulsive break out to the upside it tells me there is plenty of momentum.