The US dollar has done very little during the trading session on Friday, at least against the Japanese yen. The market is currently sitting at the ¥109.75 level, just below the psychologically big figure of ¥110. That’s an area that should continue to offer selling pressure, so I think any rally towards that area will be looked at with suspicion. After all, it has repelled price more than once and it should be noted that the weekly candlestick that formed is a shooting star which attracts a lot of attention in and of itself.

The US dollar has been resilient against most currencies, and as a result we have seen the Euro meltdown, the British pound drift a bit, and a whole host of other currencies get hit. However, the Japanese yen is a little bit different in the sense that it is considered to be a “safety currency”, so there is a natural drive towards Japan during the mass of headlines that we have seen recently. However, when looking at the economy of Japan it’s a different animal at the moment, as we have seen negative growth last quarter and could very easily see that at the next print as well. In other words, we could inner a technical recession in Japan, and that is part of what has been keeping the Japanese yen a little less strong than one would anticipate given the headlines.

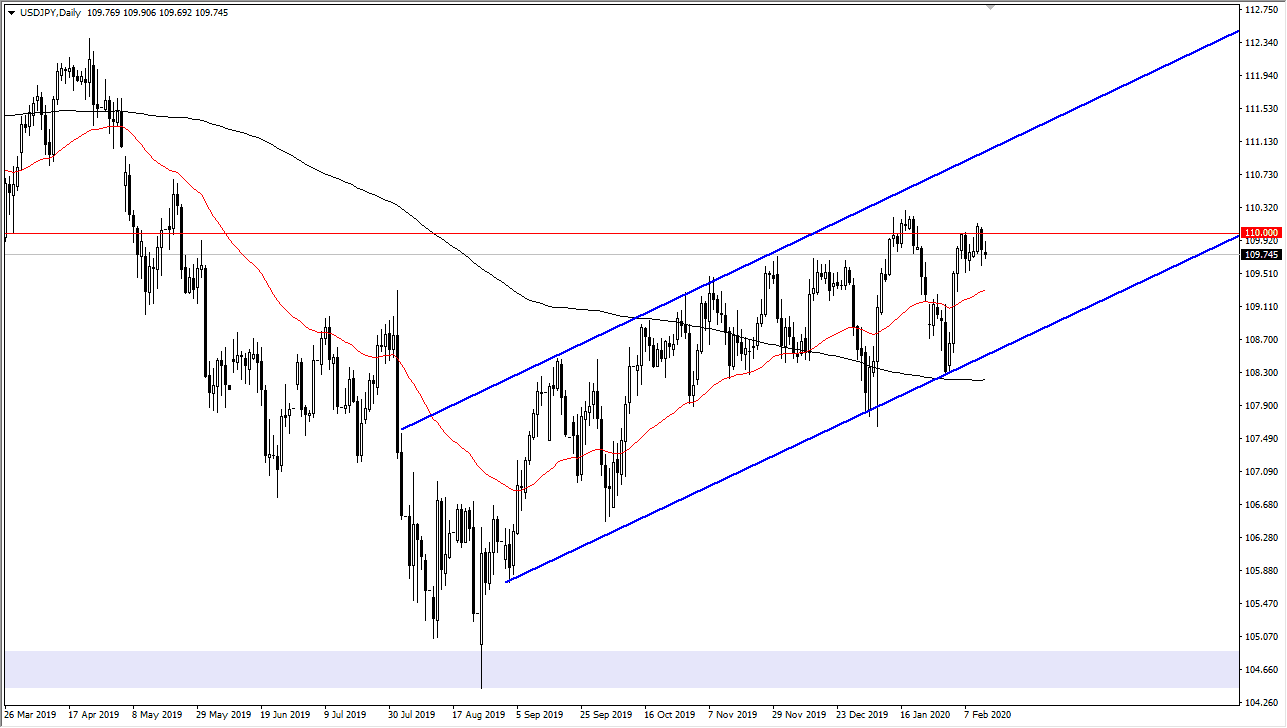

Having said that, if the sentiment of risk appetite deteriorates further, I feel that the pair will probably give way to a sell off towards the bottom of the uptrend and channel that we are currently in. The first support level would be the 50 day EMA between here and there, but I believe that the ¥108.50 level will be crucial. If it gets broken, ostensibly break in the uptrend line, then this market more than likely will go looking towards the ¥105 level on the longer-term charts. However, to the upside I think that the market could go looking towards the ¥111 level, and then possibly even the ¥112.30 level based upon my analysis previously. The fresh, new high would have more traders coming in to take advantage of that. In the short term though, it certainly looks as if the market is trying to rollover a bit, but I expect buyers underneath. That being said though, headlines can come out over the weekend to change everything in have people running towards the yen.