The US dollar fell during a large portion of the trading session on Friday, as the ¥110 level has offered a significant barrier of resistance recently. However, the market recovered towards the end of the day, showing that people were not willing to be short the US dollar heading into the weekend, as we have seen a lot of buying pressure underneath. Keep in mind that this pair is a bit different than many of the other US dollar pairs, as the Japanese yen is considered to be a major safety currency.

That being said, perhaps the Japanese yen is being avoided due to the fact that the coronavirus is showing itself throughout Asia, so therefore it’s probably “safer” to be in the US dollar, as there is more growth in that country anyway. Furthermore, traders are probably more apt to buy the Swiss franc over the Japanese yen at this point due to that situation.

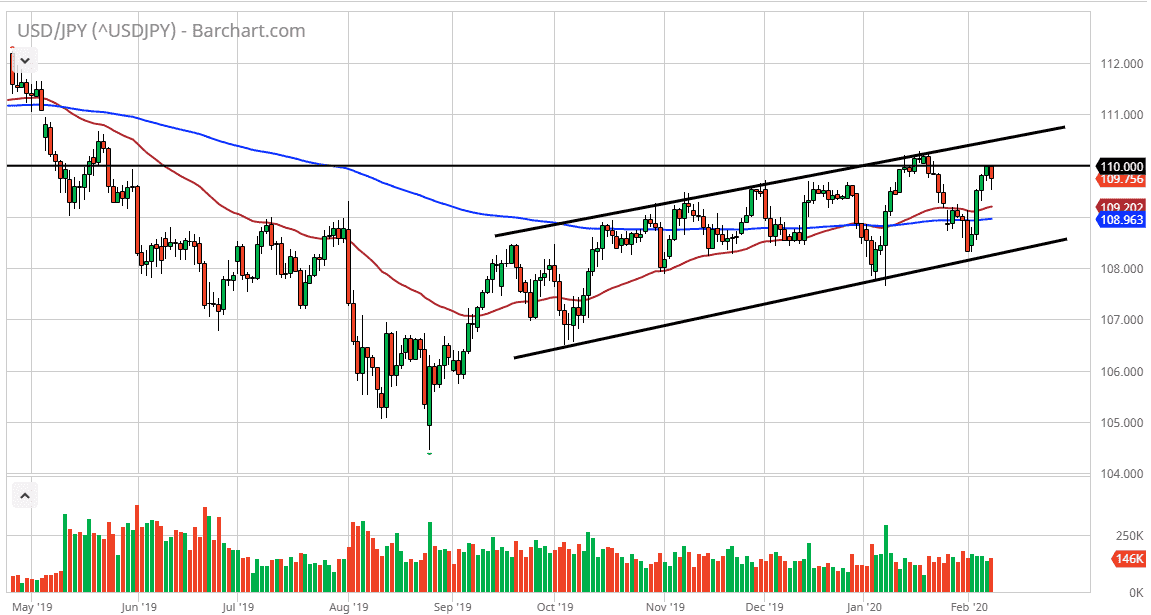

The market has been in a nice up trending channel for a while now, and it looks as if the buyers underneath are willing to pick this market up on pullbacks however, when looked at from an ultra-long timeframe, the market has essentially been bouncing around between the ¥105 level on the bottom and the ¥115 level on the top. That makes the ¥110 level essentially “fair value” as it is balance in the market. That could be one of the main reasons why the ¥110 level has been so difficult to break above. However, there is also the longer-term risk appetite representation that this pair also has, so that could be a bit of a conflict of interest.

If we do break down below the bottom of the candlestick from the Friday session, I anticipate that the ¥109 level should offer plenty of support, and of course the uptrend line that makes up the channel. To the upside, I would anticipate that it’s not until we clear the ¥110.25 level that we have the “all clear” to aim for much higher levels, with the 111 level being the initial target, followed by the ¥112.50 level. Expect a lot of choppy trading regardless of what happens next, as this pair has a lot of conflicting currents. China, slow down globally, and of course strength out the United States have this marketplace going back and forth over the last few days as you can see in the channel.