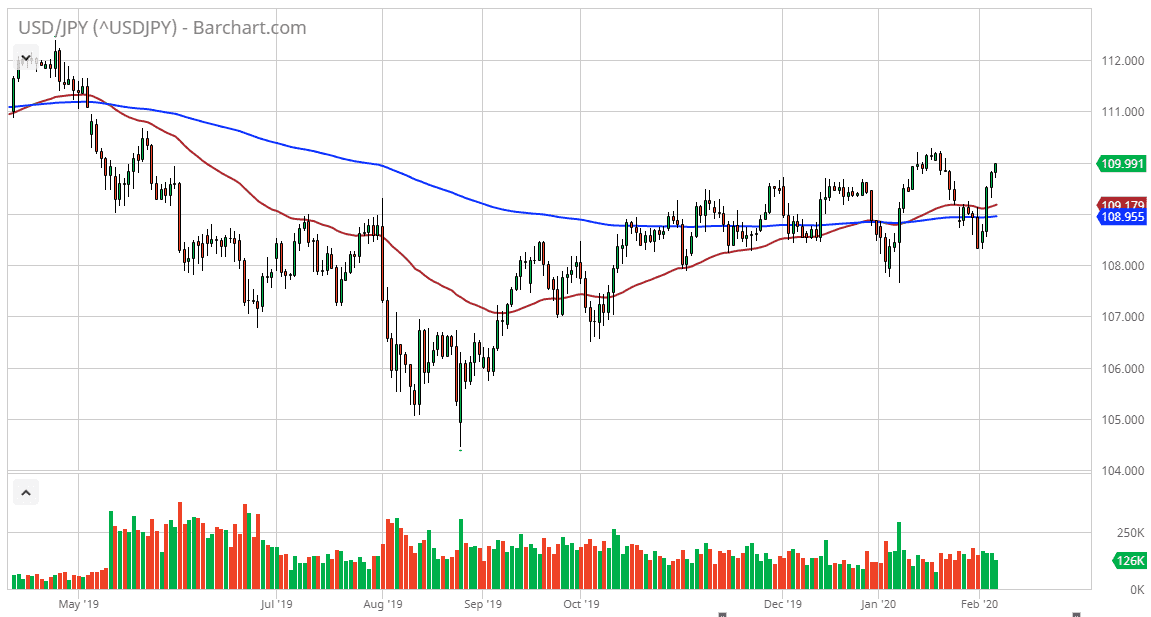

The US dollar has pulled back slightly during the trading session on Thursday but has found enough support to continue going higher. The market is parked just below the ¥110 level, an area that will cause quite a bit of resistance. The market can be broken out above there, then it’s likely that we will continue to go looking towards the ¥111 level. This is a pair that has been very volatile and choppy, but it has been grinding to the upside for some time. Ultimately, I think that the market does break out towards the ¥111 level, and then eventually the ¥112.30 level.

If the market does pull back, it’s very likely that we will find buyers try to pick up bits and pieces of value, as the market has been so relentless in its drive higher. The volatility of course has been all over the place due to the coronavirus causing major issues when it comes to the idea of whether or not there is going to be global growth. Remember, this pair does tend to be somewhat sensitive to risk appetite, but we have seen a general run towards the US dollar during most of the session, and not just in this pair. Because of this, it’s very likely that we are going to continue to see short-term pullbacks offer in buying opportunities in the jobs number of course will have a major influence on the volatility. A pullback at this point would more than likely attract a certain amount of attention, especially near the ¥109 level if we get that far. Alternately, if we shoot straight through the top it’s likely that this pair will continue to go looking much higher. Keep in mind that position sizing will be crucial, because there is going to be a lot of noise and volatility around that announcement at 8:30 AM in New York City, so you will need to step back and look at the bigger picture so that you don’t get shaken out due to that noisy hour or two.