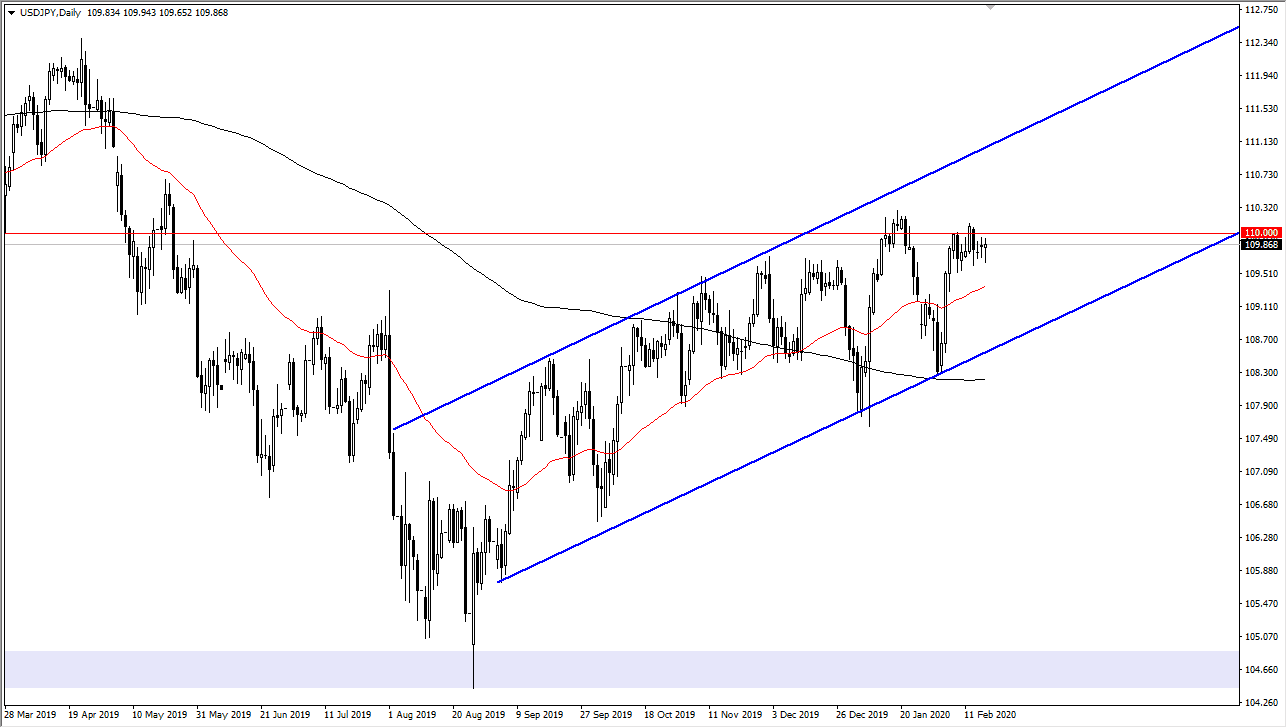

The US dollar initially fell during the trading session on Tuesday but turned around to show signs of life again as the Americans came on board. The ¥110 level above is an area that is massive resistance, so you can see that we have failed to break above there significantly for quite some time. The ¥110 level is essentially what I consider to be “fair value” when it comes to this pair as it has been bouncing around between the ¥105 level on the bottom and the ¥115 level on the top. With that being the case, it makes sense that the US dollar has trouble breaking through there but is still attracted to that level.

When you look at the longer-term chart, you can see that we have been rallying in an uptrend and channel, so I do think that there are buyers underneath looking to pick up this market. The bottom of the uptrend channel is massive support, so if it were to be broken to the downside it’s likely that the market will then go looking towards the ¥105 level underneath. In fact, if we do break through the bottom of the channel, closer to the ¥108 level, then the market will probably accelerate to the downside. However, if we were to break above the most recent high, I think the move higher from there would probably be more of a grind than anything else, reaching towards the ¥111 level, possibly even the ¥112.30 level after that. Ultimately, this is a market that does tend to move with risk appetite as well, so pay attention to the stock markets in America.

It is worth noting that stock markets initially fell during the trading session on Tuesday, but then turned around to show signs of strength later in the day. This shows the resilience of the US economy, and that a lot of larger funds continue to throw money into the marketplace. If that’s going to be the case, it’s very likely that this market is going to continue to rally given enough time. However, it’s going to take a significant amount of work to do so. Expect a lot of choppiness so it’s going to be a market that is probably better off traded in small bits and pieces, as the volatility could get quite dangerous once we finally make a significant move. The nice thing about that of course is that once we get some type of impulsive candlestick, it will probably be a larger move.