The US dollar went back and forth during trading on Monday as we continue to see a lot of indecision’s when it comes to the USD/JPY pair.

USD/JPY

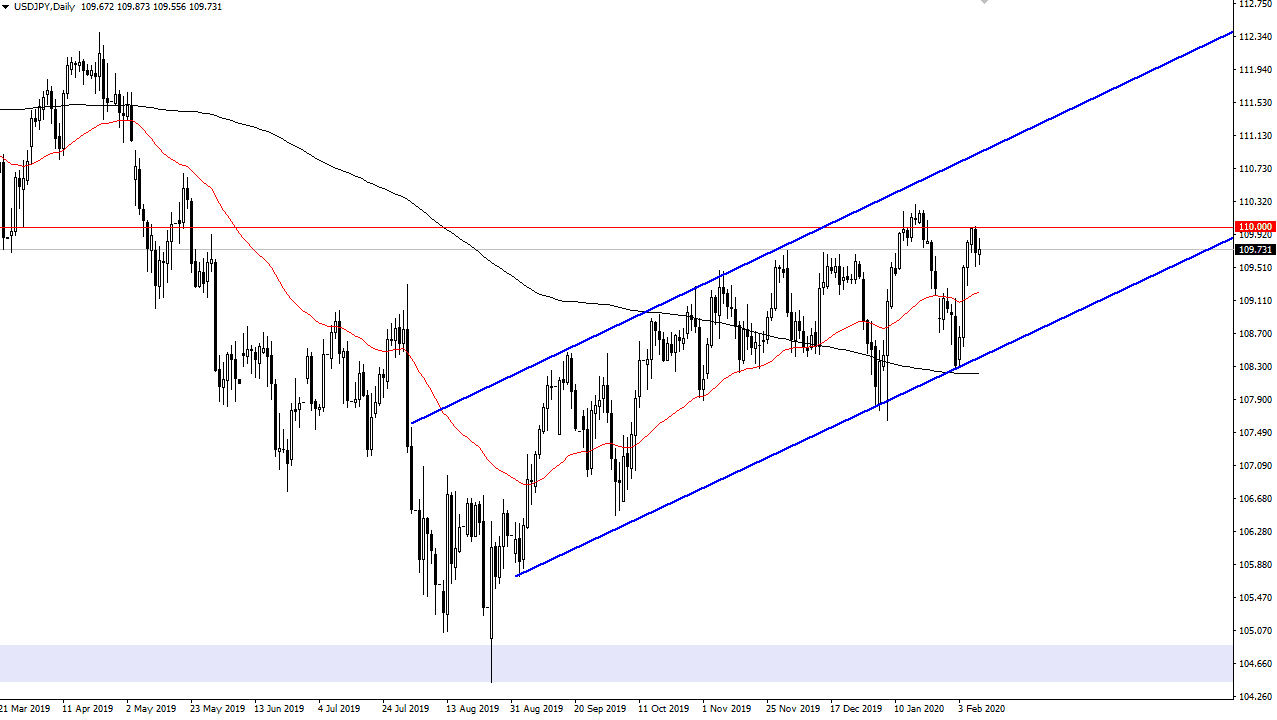

The US dollar went back and forth during the trading session on Monday to kick off the week, showing quite a bit of confusion and disarray as traders bounce between the idea of owning US dollars, and of course the idea of this safety trade when it comes to buying the Japanese yen. There is a significant amount of resistance at the ¥110 level just above, and therefore it’s not a huge surprise to think that this market may have pulled back just a bit. By pulling back the way it has, it’s very likely that we will continue to find selling pressure, and therefore it’s possible that we reach towards the 50 day EMA underneath, and possibly even the uptrend line of the up trending channel.

Keep in mind that this pair is highly sensitive to risk appetite in general, so pay attention to the S&P 500. If it starts to sell off or pull back, that will more than likely put downward pressure on this pair as well. Alternately, if the S&P 500 takes out to the upside and breaks out for a big move above the recent highs, then it’s likely that this pair will probably reach towards the recent highs again. At this point, the market breaking below the bottom of the candlestick for the Monday session would of course be a negative sign as it could confirm a “lower high.” However, I don’t think that necessarily means that we melt down, rather that we go looking for value at lower levels.

If we do break down below the up trending line which is the bottom of the channel, then it’s possible we may go looking towards the ¥105 level longer-term. That would coincide with pretty ugly risk sentiment, so keep in mind that you would need to pay attention to multiple markets. If you start to see red everywhere though, it’s very likely that this pair will continue to break down at that point. To the upside, I see the ¥111 level as a target and then eventually the ¥112.33 level. One thing I think you can count on is a lot of choppiness and volatility, regardless of which direction we go.