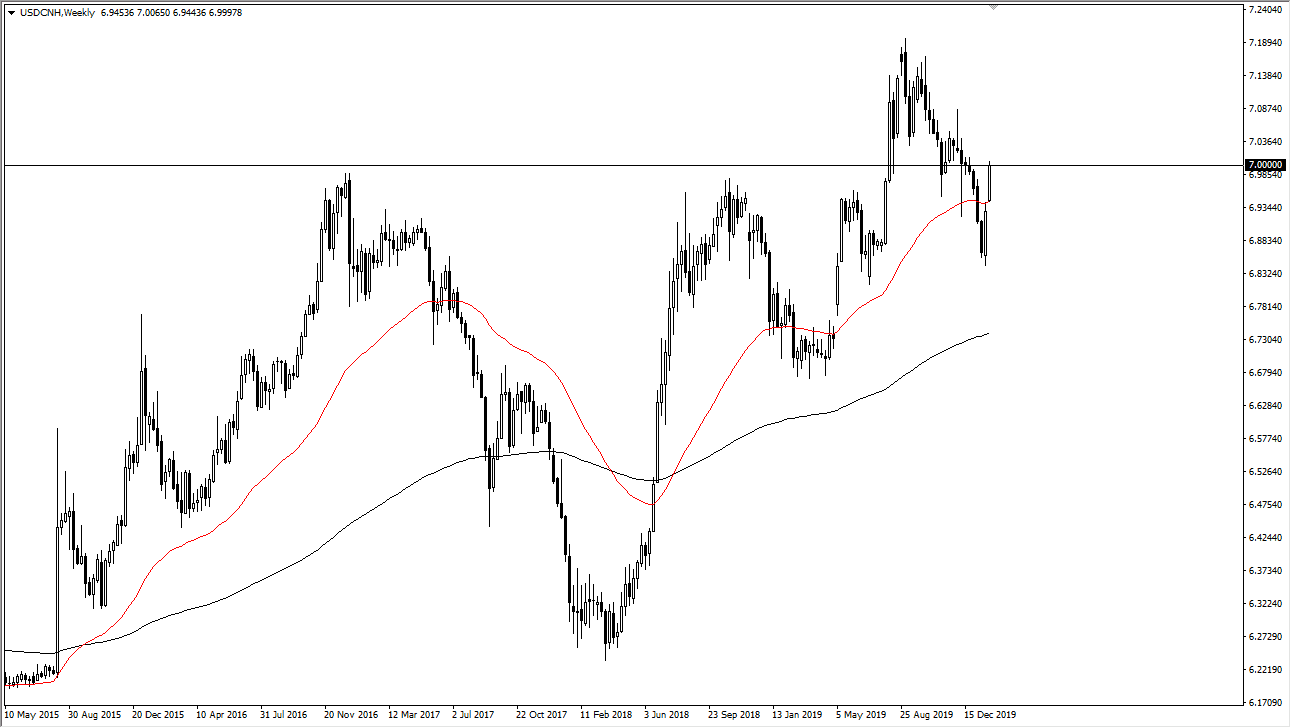

The United States dollar has had a complete turnaround during the month of January against the Chinese Yuan, as the market initially broke down, only to turn around and reach towards the 7.0000 level. This is a large, round, psychologically significant figure that of course will continue to attract a lot of attention. That being said, I do believe that we eventually break above this large, round, psychologically significant figure, mainly because the final week of the month has closed that the very top of its range sitting right at that level. That being said, you should also keep in mind that the coronavirus situation and China seem to be getting worse, and that of course will send the value of the Chinese Yuan lower.

Beyond all of that, we are in an uptrend to begin with. The trade war has wreaked havoc on the Chinese economy, and it should be noted that the Americans haven’t lifted the tariffs yet. That being said, the coronavirus was probably then used as the reason to start buying this pair again. There are a whole host of issues involving China shadow banking system and debt as well, so there’s no reason to think that this pair should suddenly fall apart. Risk is certainly in the “risk off” mode, and as the coronavirus gets worse, it’s very likely that this pair will continue to go higher. However, if sometime during the month we start to see signs of the coronavirus abating, that will send this market lower.

Don’t get me wrong, I don’t think that we shoot straight up in the air, but I recognize that the trend is still very much intact. I think there will be the occasional pullback but look at that as a buying opportunity as the market will continue to favor the greenback, as it is a much safer place to put your money than China right now. This is especially true considering that the US Treasury market will continue to attract a lot of attention as well. It’s not until we break down below the 6.80 level that I would consider the uptrend over, and that something that will take quite a bit of good news to make traders go out and looking for some type of major yield. I suspect that this month will be positive for this pair yet again after forming a hammer for the month of January.