With fears over the economic damages from the coronavirus easing prematurely, safe-haven demand for the Swiss Franc diminished as the risk-on mood took a dominant role. The Swiss National Bank is known for direct market interference to keep its currency weak, in support of its crucial export sector. US economic data has been mixed, mirroring other developed markets. The USD/CHF advanced into its resistance zone, which rejected price action on three previous occasions.

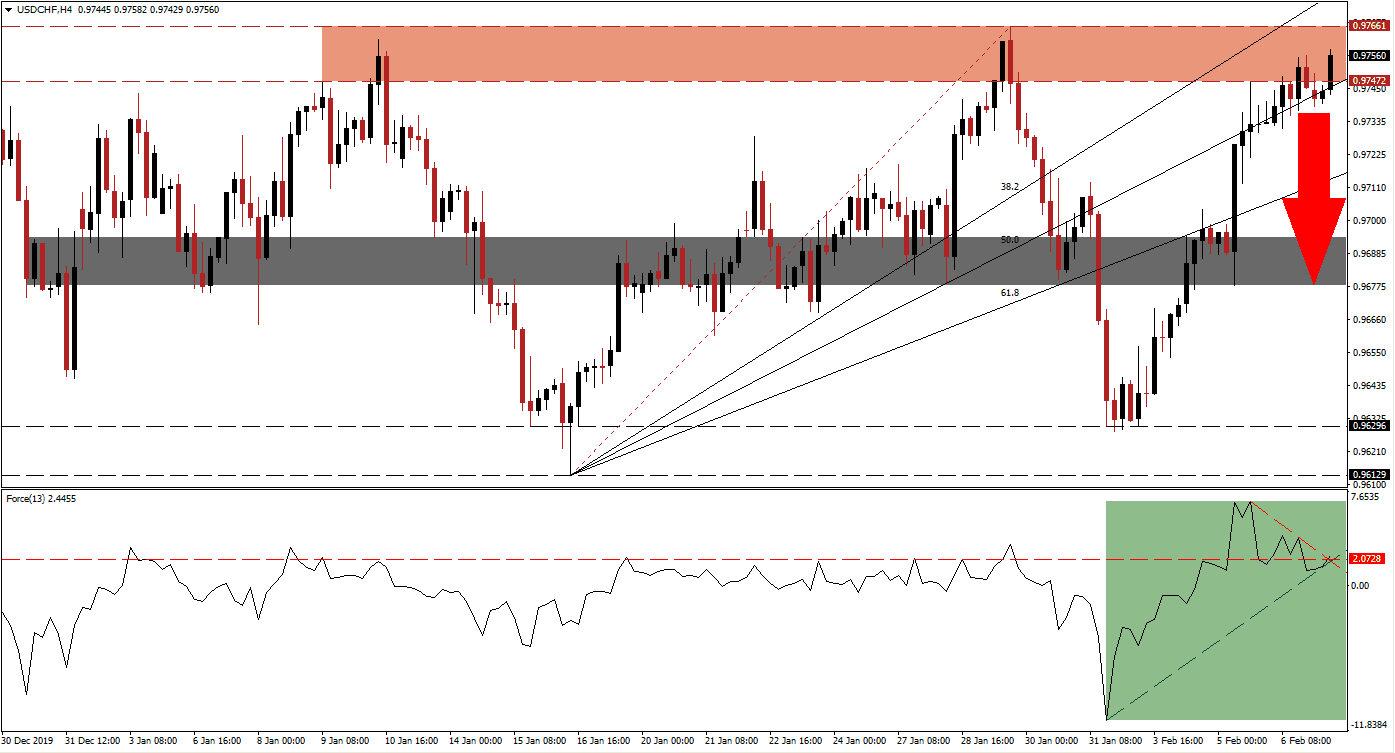

The Force Index, a next-generation technical indicator, points towards the formation of a negative divergence. After the USD/CHF reached the bottom range of its resistance zone, it extended its advance. The Force Index started to retreat from a higher high, moving temporarily below its horizontal resistance level. Its ascending support level reversed the slide, allowing this technical indicator to eclipse its descending resistance level, as marked by the green rectangle. A renewed contraction is favored to pressure the Force Index below the 0 center-line, initiating a more massive corrective phase in this currency pair.

This currency pair is under rising breakdown pressures from its Fibonacci Retracement Fan sequence, which is crossing above its resistance zone located between 0.97472 and 0.97661, as marked by the red rectangle. A breakdown is anticipated to ignite a profit-taking sell-off, wit today’s NFP report out of the US a potential catalyst. It will additionally convert the ascending 50.0 Fibonacci Retracement Fan Support Level into resistance, increasing selling pressure in the USD/CHF. You can learn more about a profit-taking sell-off here.

Global growth concerns will remain in place, with mixed data adding to the ongoing slowdown. China announced the partial removal of retaliatory tariffs, matching the move by the US. It provided a boost to sentiment but fails to address the issues driving the most critical issues. The USD/CHF is positioned to correct into its next short-term support zone located between 0.96777 and 0.96940, as marked by the grey rectangle. An extension of the pending breakdown will require a fresh fundamental catalyst.

USD/CHF Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 0.97550

Take Profit @ 0.96800

Stop Loss @ 0.97750

Downside Potential: 75 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 3.75

A sustained breakout in the Force Index above its descending resistance level, leading to a higher high, could encourage the USD/CHF to extend its advance. Due to the long-term fundamental outlook, supported by developing short-term technical conditions, the upside potential appears limited to its next resistance zone. Price action will challenge this zone between 0.98551 and 0.98751. Forex traders should view this as an excellent short-selling opportunity.

USD/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.98000

Take Profit @ 0.98600

Stop Loss @ 0.97750

Upside Potential: 60 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.40