Bearish momentum is on the rise after the USD/CAD sustained a breakdown below its resistance zone. Last week’s surprise reading on the US service sector, which showed it in recessionary territory, provided an end to the advance in this currency pair. Canadian economic data featured disappointments of its own, and the downside pressure on oil prices will have an impact. Weakness out of Canada is better priced in, where hopes for the US are unjustifiably elevated. This combination positions price action for a new corrective phase. You can learn more about a breakdown here.

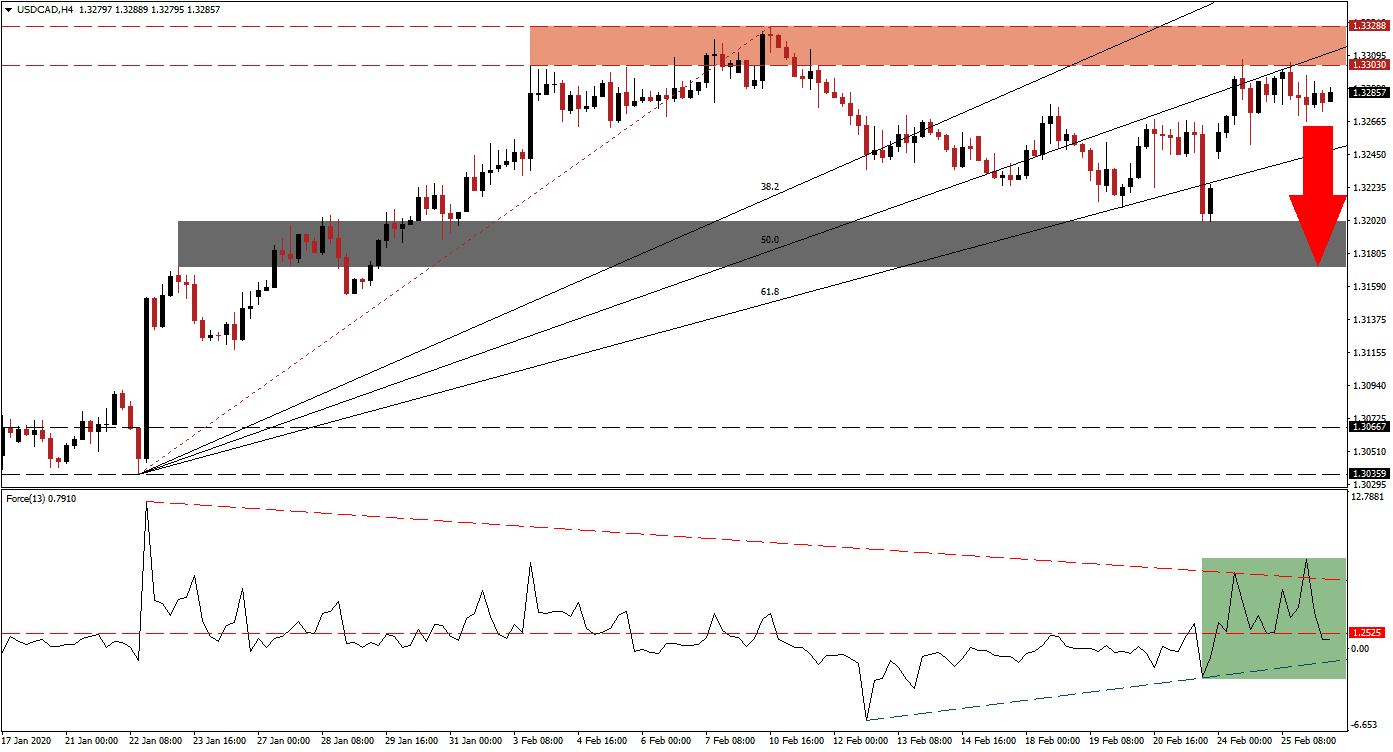

The Force Index, a next-generation technical indicator, briefly peaked above its descending resistance level before entering a reversal. The collapse in bullish momentum resulted in the conversion of its horizontal support level into resistance, as marked by the green rectangle. Bulls remain in control of the USD/CAD but are on the verge of ceding it to bears with a move in the Force Index into negative conditions. It should also lead the technical indicator below its ascending support level, resulting in a rise in downside pressures in price action.

This currency pair reversed its initial breakdown below its resistance zone, which pressured it below its entire Fibonacci Retracement Fan sequence. A quick advance followed but was rejected by the bottom range of its resistance zone located between 1.33030 and 1.33288, as marked by the red rectangle. The ascending 50.0 Fibonacci Retracement Fan Resistance Level rejected an extension of the push higher. Forex traders are advised to monitor the intra-day low of 1.32517, the low of a previous rejection. More net sell orders are favored once the USD/CAD descends below this level.

Price action is well-positioned to move below its 61.8 Fibonacci Retracement Fan Support Level, from where a quick drop into its support zone is anticipated. This zone, located between 1.31711 and 1.32013, as marked by the grey rectangle, represents the support level preventing a more massive corrective phase. Covid-19 related economic disruptions may provide a short-term trigger to violate this support zone to the downside, with the intra-day low of 1.31180 offering a final pivot point for the USD/CAD. You can read more about a support zone here.

USD/CAD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.32850

Take Profit @ 1.31750

Stop Loss @ 1.33150

Downside Potential: 110 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.67

A move in the Force Index above its descending resistance level is likely to inspire a fifth breakout attempt in the USD/CAD. Given the fundamental developments, the outlook remains uncertain with a bearish bias. Any breakout attempt should be viewed as a great short-selling opportunity, especially if US economic data continues to be weak. The next resistance zone awaits price action between 1.34041 and 1.34317.

USD/CAD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.33500

Take Profit @ 1.34200

Stop Loss @ 1.35150

Upside Potential: 70 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.00