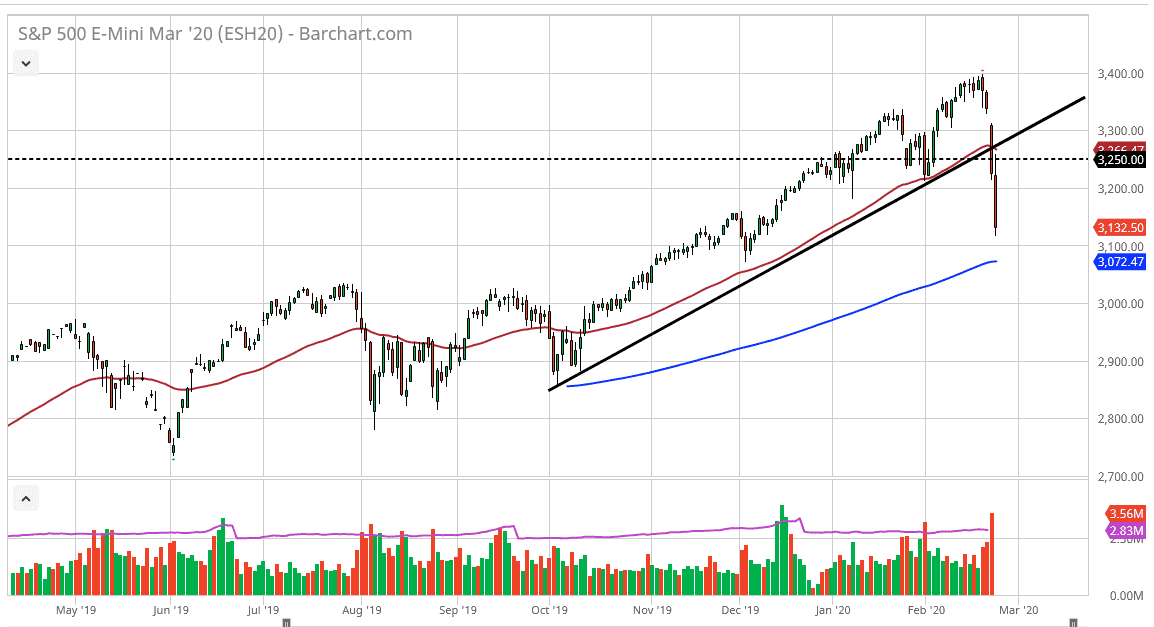

The S&P 500 initially tried to rally during the trading session on Tuesday but gave back the gains as the 50 day EMA continues to offer resistance, not only due to the technical indicator, but the fact that the indicator sits right at the previous uptrend line. The previous uptrend line has now offered selling pressure, and at this point the market pulling back from there is technically expected. Having said that though, the 3100 level is starting to come into the picture and of course the 200 day EMA is sitting just below there. I think that the Wednesday candlestick is going to be important, and if the market ends up forming some type of support of candle, especially a hammer, then we could see value hunters coming back in.

Looking at the markets, I believe that we are closer to the 50% Fibonacci retracement level than anything else and that could attract a certain amount of attention as well. Ultimately, the market is one that is extraordinarily sensitive at the moment, but I do think that it’s only a matter of time before we turn things around again as the longer term uptrend continues. However, if the market does break down below the 3000 level, then it’s likely that the market will fall apart.

This is all about global fear at this point, and very little to do with economic earnings. With that being the case, coronavirus has been the keyword for anything involving weakness. I think that continues to be the case, so if we can sit on the sidelines and simply wait for some type of support of candle, we could get an opportunity to go long. It is a longer-term investors type of market, and not much has changed other than this recent illness. The longer-term outlook for the market is still the same as it always has been, and the damage done by the coronavirus is probably going to be short-term, perhaps only 3 to 6 months, at least as far as people can tell right now. The last couple of candles have been horrific, and we have suddenly found ourselves in a somewhat oversold condition. At this point, look for signs of life, but I will let you know how we will take a look at the market due to the daily candlestick. I would not jump in the markets right away and feel that it would probably be a scenario that you plenty of time to get involved.