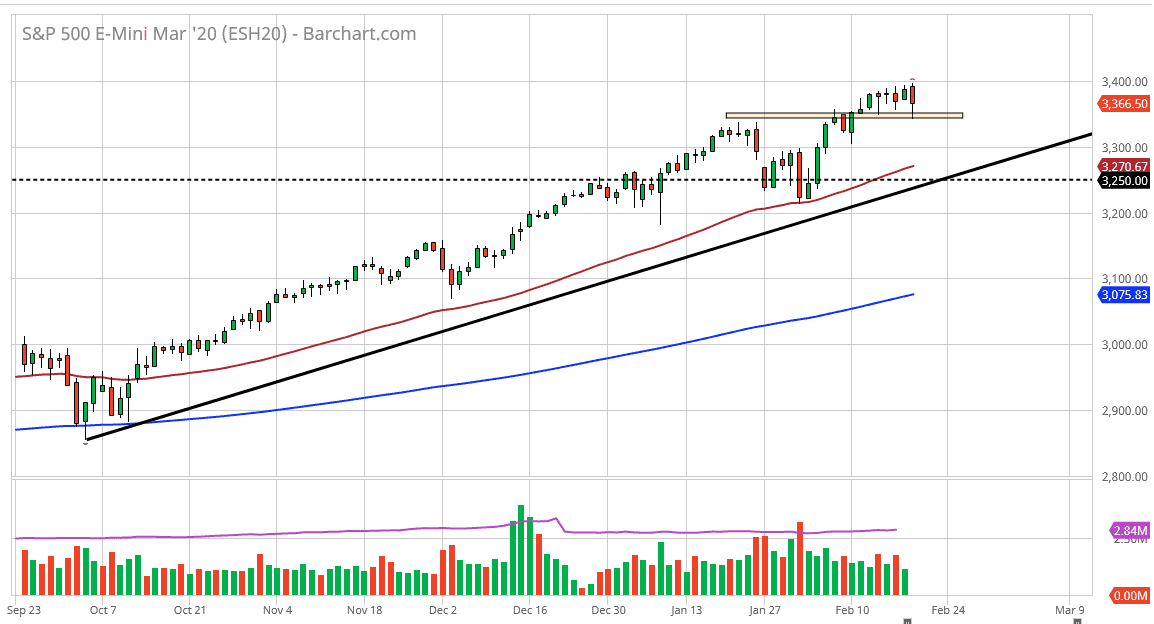

The S&P 500 fell during the trading session on Thursday, showing signs of weakness yet again, but at the same region we continue to see buyers come back in and lift this market. The 3350 level is an area that has been important more than once, so having said that I think it’s likely that the market will continue to find plenty of buyers there but even if we were to break down below that level, it doesn’t necessarily mean that the trend is over, quite the contrary. I believe that there are supportive levels in the form of the 3300 level, the 50 day EMA after that, and of course the uptrend line that I have marked on the chart. I don’t have any interest in trying to fade this market, because quite frankly the S&P 500 is one of the favored destinations of foreign investors to put money to work as the United States continues to grow much stronger than other economies.

If we were to break to the upside, we could clear the 3400 level and that opens up the idea of a move to the 3500 level. That is my longer-term target but I thought it would take longer to get to that level then it appears we are going to. We are in an uptrend, so no matter what happens in the next couple of days, you should keep that in mind. After all, trends don’t change on a dime, and the same fundamental reasons are still affecting the market that have been for some time. After all, the Federal Reserve continues to support the markets and it certainly seems as if Wall Street believes that will be the case going forward.

Looking at the chart, the one thing that stands out to me is the fact that there has been extraordinarily stubborn buying pressure underneath, and therefore I think we are trying to build up enough pressure to break out. Whether or not we can do it on a Friday is a completely different question, because there is a certain amount of concern about holding risk assets going into the weekend considering how the world has behaved as of late, but that doesn’t mean that you can’t find value at lower levels. That being said though, it might be a trade for Monday and not necessarily Friday. Regardless, there is no opportunity to short this market in the short term.