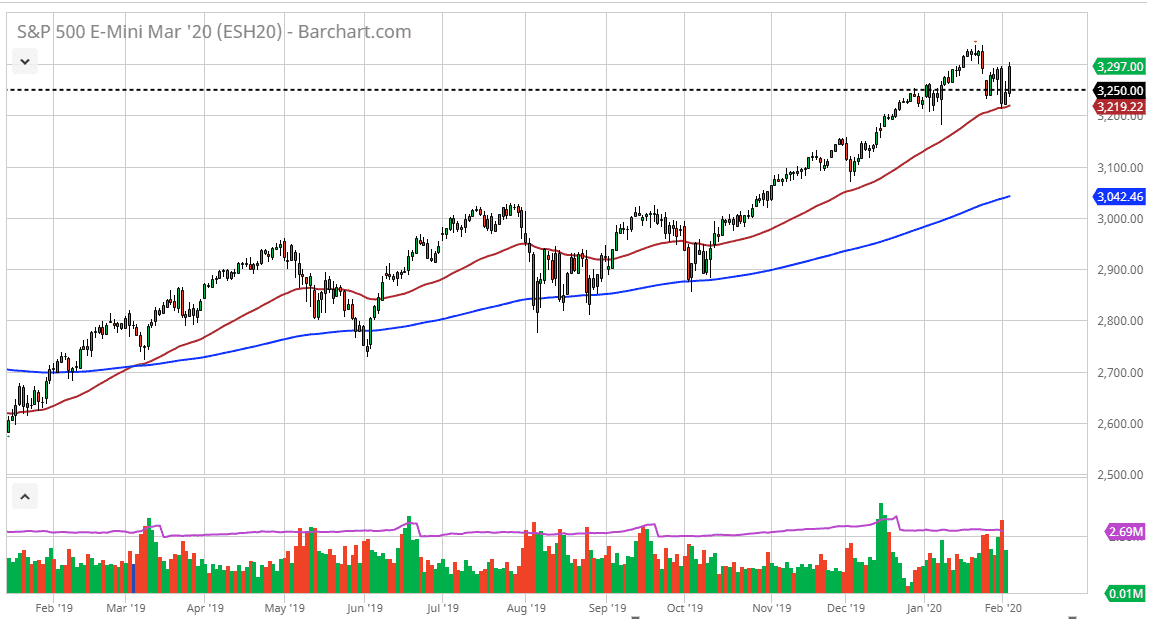

The S&P 500 has rallied significantly during the trading session on Tuesday, reaching towards the 3300 level. This is an area that is psychologically important due to the fact that it is a large, round, psychologically significant figure. Furthermore, it’s essentially where the market gapped down from at the beginning of last week, and now that it’s been recovered it’s very likely that the buyers will continue to push this market as high as they can. The 3350 level is probably the next target, but I have a longer-term target of 3500 given enough time.

I recognize the 50 day EMA underneath as being supportive, so I do think that it’s only a matter of time before buyers would come in if we pull back towards that area, as it is not only technically important, but it has offered significant support recently. Because of this, there should be buyers on dips near the 3220 level, and most certainly at the 3200 level as it had been supportive previously.

I like the idea of aiming for short-term pullbacks as potential buying opportunities and I also like the idea of building up a larger core position. Right now, my plan is to exploit value as it occurs, but this is a marketplace that is obviously going to be moving on the latest news, and therefore you have to be cautious about the coronavirus and the light coming into the news flow and causing chaos. I still believe that a certain amount of money is flowing into the United States to avoid places like Asia, as the S&P 500 has been a bit of a safety trade as of late.

With the Federal Reserve being very loose with its monetary policy, it does suggest that perhaps stock markets can count on some type of support from the Fed as well. Because of this, I feel that it is only a matter of time before rallies get snapped up and therefore you cannot be a short seller anytime soon as that has led to nothing but trouble as of late. With the destruction that this market has seen recently, we still find plenty of buyers to pick up the slack anytime that does in fact happen. With that, I believe that the market continues to be one that traders will look to buy, and therefore selling is going to be basically impossible at this juncture.