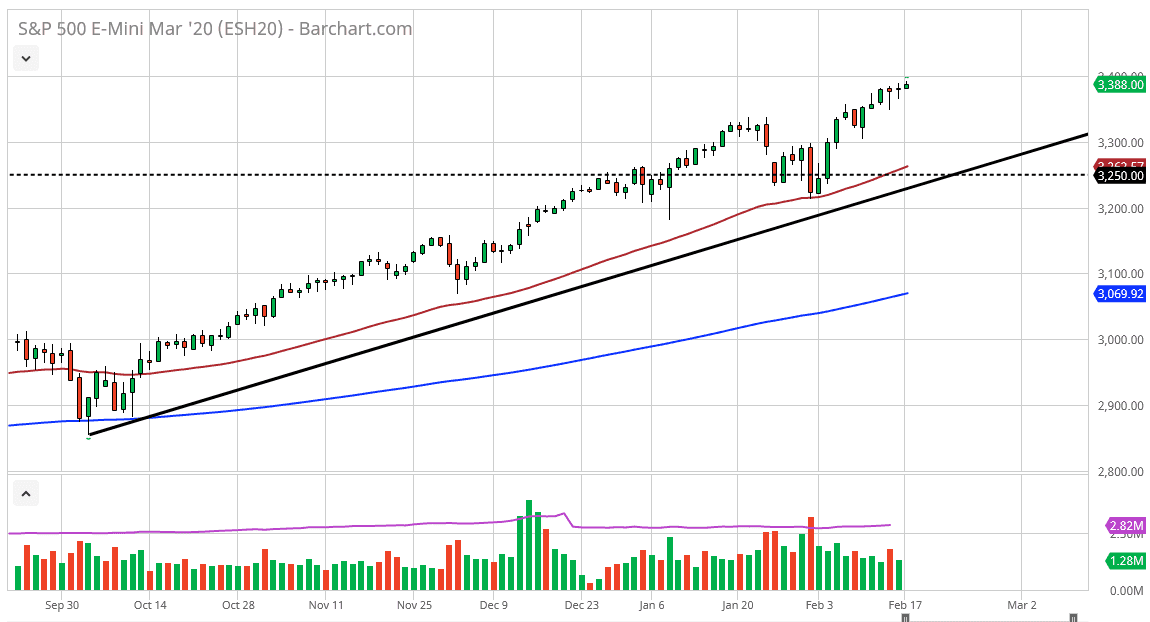

The S&P 500 was closed during the Monday session, but there was some Globex trading of the E-mini contract. Nonetheless, there is still a proclivity to go higher and that’s essentially what we should be paying attention to. Ultimately, this is a market that is in an uptrend and as money flows into the S&P 500 away from foreign markets, we should continue to see plenty of buyers.

To the downside I see the 3300 level as massive support, just as the 50 day EMA is as well. Underneath there, we have the uptrend line so therefore I have no interest in shorting this market, it is far too well supported underneath. Central banks around the world continue to liquefy markets, and therefore drive down interest rates, forcing money into the stock markets. The S&P 500 of course represents United States growth, which is currently outpacing the rest of the world. Ultimately, this is considered to be a bit of a safe haven, so I think at this point it makes sense that the S&P 500 continues to go higher.

This is despite the fact that we have seen the US dollar rally. All things being equal it’s very likely that this market continues to see inflows when it comes to foreign investments, so because of this it’s going to be important to pay attention to these pullbacks that are coming as potential buying opportunities. I think the market will continue to favor buying the dips as the value that comes into these dips and people who have missed the trade will continue to push to the upside. If we were to break down below the 3200 level, then I think at that point we probably need to go looking towards the 200 day EMA. Having said that, earnings season has been reasonable, and therefore I think it makes quite a bit of sense that we continue to jump higher every time we pull back. There’s nowhere else to put your money because bond traders are being squeezed into smaller and smaller interest rates. The Federal Reserve also looks likely to liquefy markets further down the road this year, and that will drive stocks to the upside as well. The S&P 500 should continue to reach towards the 3500 level, which was my yearly target but at this point I may have to revise that target a bit higher.