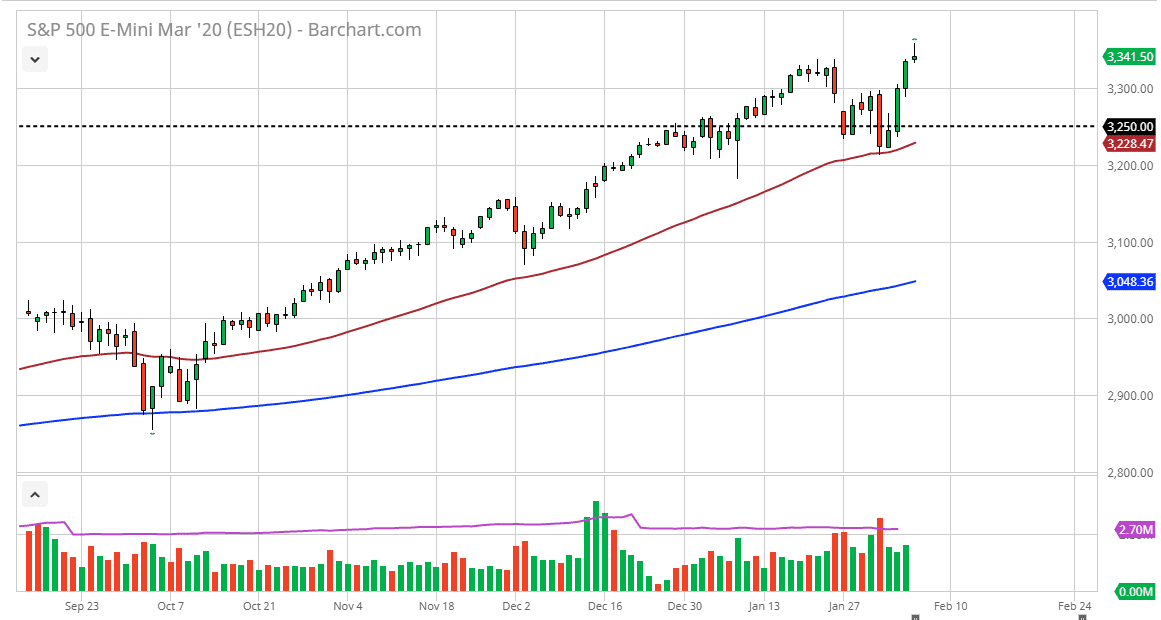

The S&P 500 has initially tried to rally during the trading session on Thursday but gave back the gains to turn around and form a shooting star. The shooting star of course is a negative sign and it’s likely what we are going to see here is more or less the market taking a bit of a breather heading into the jobs figure. Obviously, the jobs figure can have a massive effect on the markets going forward, but as things stand right now the S&P 500 is still the place to be. At this point, pullbacks should offer plenty of support all the way down to at least the 50 day EMA at the 3225 area.

If the market breaks above the shooting star, then the market is ready to continue going much higher, reaching towards the 3500 level above. The 3500 level of course is a major level that I am aiming for, but I think we need a bit of a pullback from time to time in order to build up enough momentum to go higher. Ultimately, I like the idea of buying value as it occurs. That being said, if the market was to break down below the 3200 level, then the market could go down to the 3100 level where we should see a bit of a convergence between that large figure and the 200 day EMA which is racing towards that level. Longer-term, I think it’s only a matter of time before value hunters will push this market based upon the stronger US economy and of course the Federal Reserve out there looking to add liquidity to the markets. The loose monetary policy should continue to push money into the stock markets as there are no returns to be had as far as interest is concerned, so it keeps up that “there is no alternative” field to stock markets. Furthermore, foreigners are buying US stocks as a bit of a safe haven traders well, as the GDP in the United States is far superior to most other industrialized countries right now, so if you’re looking for growth or at least ability it’s probably going to be found in America.