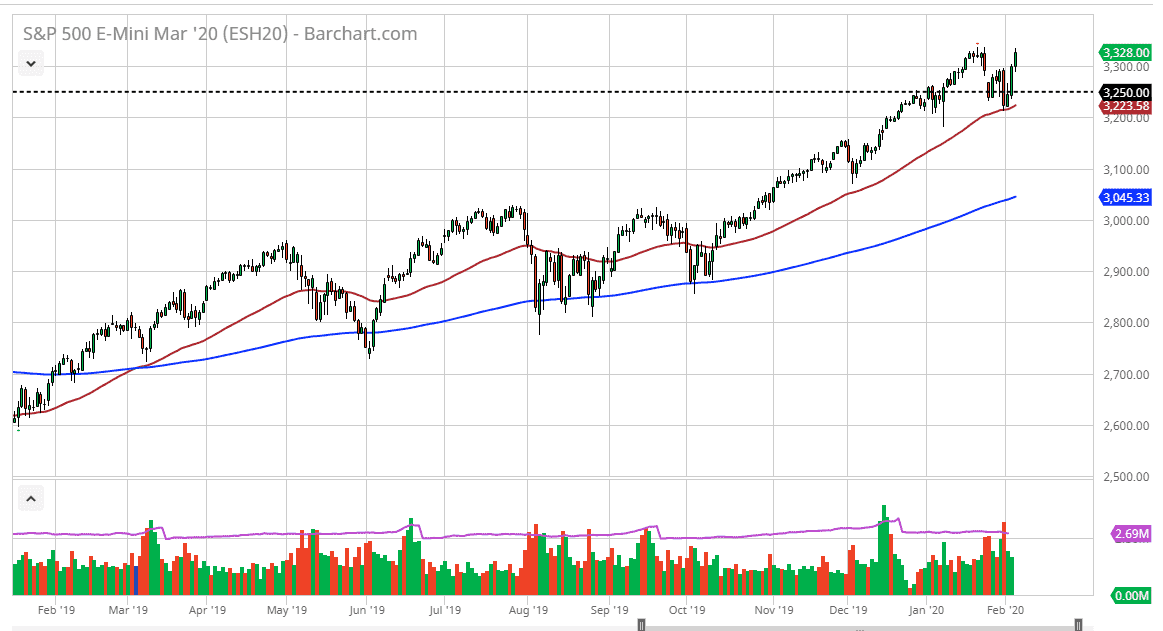

The S&P 500 has rallied significantly during the trading session on Thursday again, as central banks around the world continue to keep monetary policy loose, thereby lifting the market. Furthermore, there is talk of some advances made against the coronavirus, and therefore it was probably the excuse to continue buying stocks that Wall Street needed. In fact, all of the losses since the coronavirus care have been recovered, and now we are at all-time highs, or at least essentially so.

Dips at this point should be buying opportunities as we are very strong in this market to say the least, and the 3350 level will be, yet a formality given enough time. Pullbacks at this point should be supported down to at least the 50 day EMA in the short term. The jobs number comes out on Friday so therefore you should keep that in mind, and it is likely that the markets will be very choppy between now and then, but obviously there is more of an upward proclivity than anything else. Furthermore, earnings season has been fairly strong in that certainly doesn’t hurt the case either.

At this point, I do believe that 3500 will be targeted sometime this year, and I have to be the first to admit that I am a bit surprised at how quick we continue to go looking for that level. Pullbacks will not only be supported by the 50 day EMA though, but also the 3200 level and then the 200 day EMA now level that is now above the 3000 handle quite handily. The slope in the uptrend is relatively strong, so it certainly looks as if we aren’t quite overdone and the most recent selloff has actually been a very good thing for the market.

Look for short-term dips for buying opportunities and forget about shorting this market anytime soon. Quite frankly, we could get a good 5% selloff and I still wouldn’t be looking to short this market, because it is far too strong at this point in of course the Federal Reserve will do whatever it takes to keep the markets higher, we have already seen that more than once. I like the idea of buying little bits and pieces and forming a larger core position, and that is in fact what I have been going on in our for the last several years.