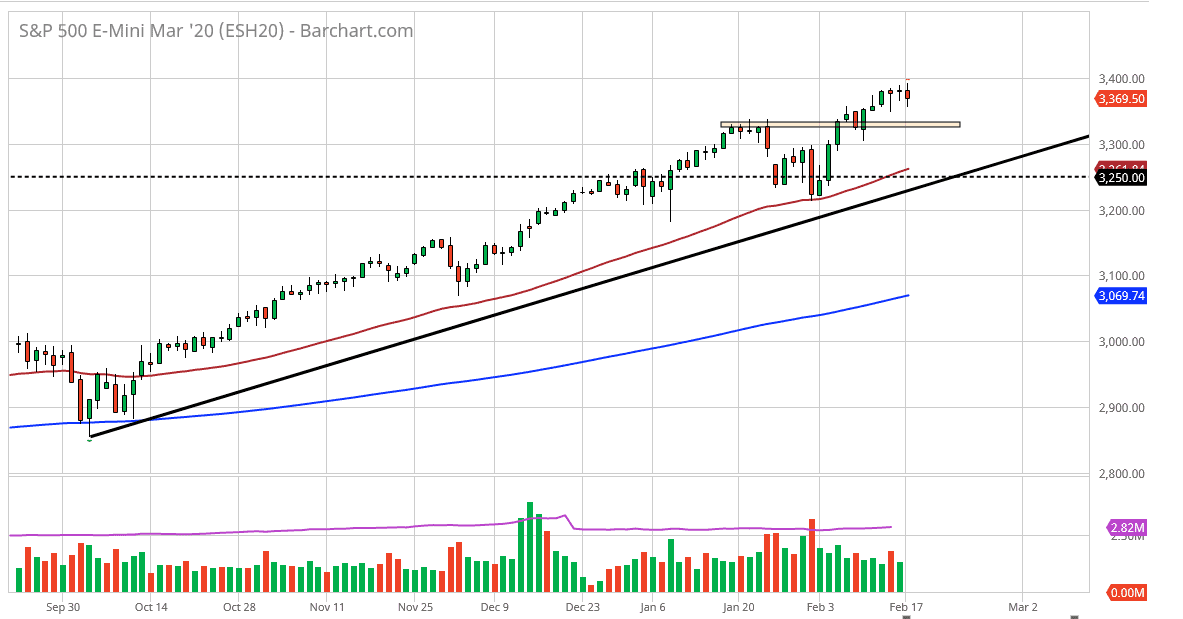

The S&P 500 has pulled back a bit during the trading session on Thursday but did see some buyers come back in later in the day. That is a good sign as a lot of institutional players will place their positions late in the session. As money floods in, it’s a sign that the market will continue to go higher given enough time. The 3350 level is your short-term support, followed by the 50 day EMA which is racing towards the 3300 level. Below there, the uptrend line also comes into play so there are plenty of reasons to think that this market will find value hunters.

The Federal Reserve is fully committed to propping up the stock markets, despite what they may say. You that’s what they have done for the last decade or so and have even recently reversed interest rate hikes in order to prop things up again. With that, it’s very likely that the market will continue to trade based upon the Federal Reserve balance sheet rallying. This doesn’t mean that is going to be easy, but clearly can’t be shorting this market anytime soon, as the uptrend line is so stringent. Quite frankly, it’s not until we break down below the blue 200 day EMA that I would be willing to short.

To the upside I think that the 3400 level is the initial target, but I also believe that we go higher, perhaps reaching towards 3500 level given enough time. That’s my longer-term target but it’s obvious to me that the market may get there much quicker than I had anticipated. In fact, it’s not overly surprising to me if the market breaks above that level now. I had anticipated that we would get to the 3500 level sometime in the fall, but the way the market has started out this year has been so bullish that I think it’s only a matter of time before the buyers overwhelm any supply. Having said that, there are a lot of fears coming out of China and the coronavirus, but you can see how the market has reacted, as the US markets continue to attract a lot of money from overseas. In other words, if the coronavirus can’t bring the market lower, that it’s obvious that not much can at the moment. There are always black swan events, but the latest one seems to have fallen on deaf ears.