Despite a series of economic disappointments, the Singapore Dollar managed to recover off of depressed levels. The city-state continues to feel the negative impact of the deadly coronavirus. Retail sales posted an unexpected contraction in December, with other indicators suggesting short-term disruptions. While companies predict that 10% of its foreign labor force will be impacted by the virus, the long-term economic outlook remains bright. Government agency Enterprise Singapore continues to drive the economy forward, positioning the SGD/JPY for a new breakout sequence.

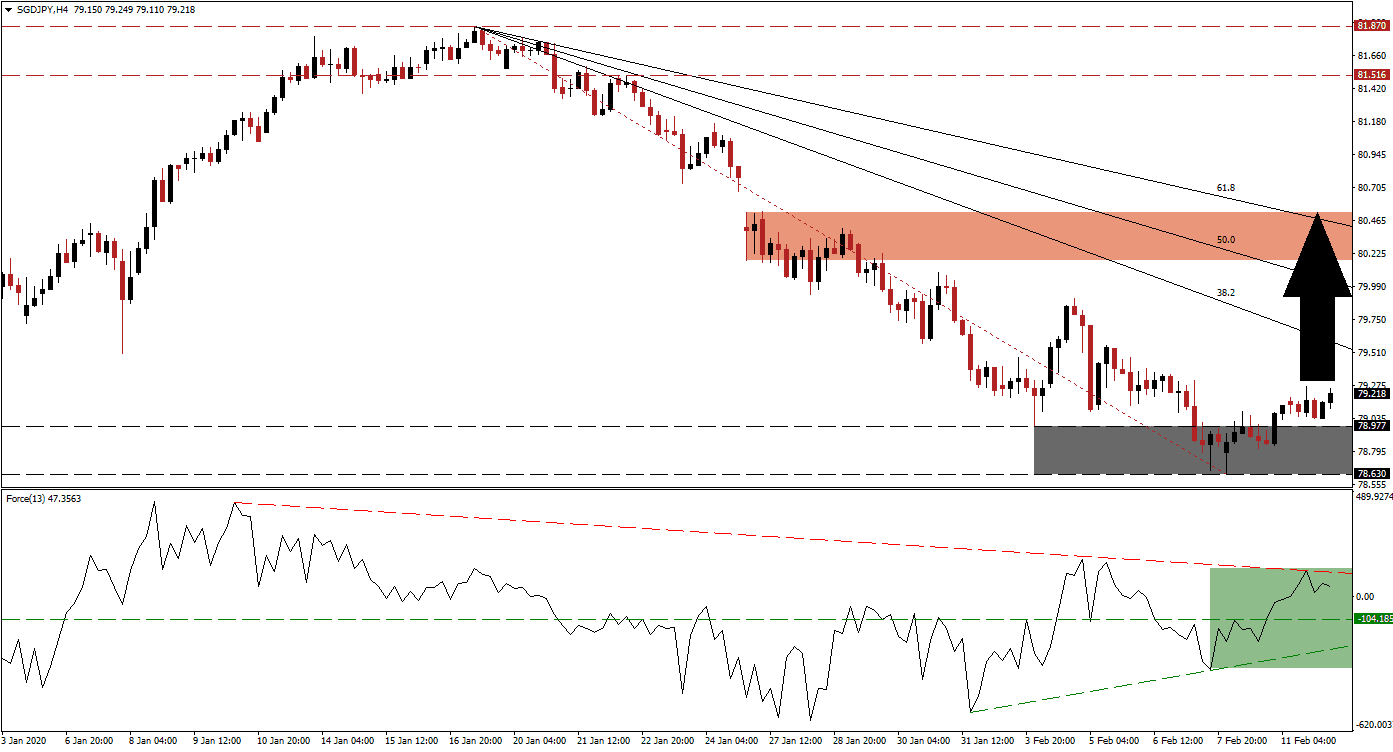

The Force Index, a next-generation technical indicator, offered the first sign that this currency is approaching the end of its corrective phase. As the SGD/JPY moved into its support zone, bullish momentum started to recover. A positive divergence formed, and the Force Index accelerated off of its ascending support level, leading to a conversion of its horizontal resistance level into support. This technical indicator is now being pressured by its descending resistance level in positive conditions, as marked by the green rectangle. A breakout is expected to lead price action higher.

Following the move above its Fibonacci Retracement Fan trendline, price action completed a breakout above its support zone located between 78.630 and 78.977, as marked by the grey rectangle. The SGD/JPY is now anticipated to close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. With financial markets dismissing the global economic impact of the coronavirus, safe-haven demand for the Japanese Yen is easing, adding to the increase in bullish momentum in this currency pair. You can learn more about the Fibonacci Retracement Fan here.

One key level to monitor is the intra-day high of 79.475, the peak of a minor pause in the sell-off, which was rejected, and led the SGD/JPY into a lower low. A breakout is favored to initiate the next wave of net buy positions into this currency pair. It will additionally clear the path into its short-term resistance zone located between 80.181 and 80.526, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is enforcing this zone. A breakout is likely to extend the pending breakout sequence farther to the upside.

SGD/JPY Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 79.200

Take Profit @ 80.500

Stop Loss @ 78.800

Upside Potential: 130 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 3.25

In case of a reversal in the Force Index leading to a breakdown below its ascending support level, the SGD/JPY is anticipated to attempt a push to the downside. Given the long-term bullish outlook for the Singapore economy, the downside potential remains limited to its next support zone located between 77.152 and 77.625. Forex traders are advised to consider this an excellent buying opportunity.

SGD/JPY Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 78.400

Take Profit @ 77.400

Stop Loss @ 78.800

Downside Potential: 100 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.50