While the Reserve Bank of New Zealand surprised financial markets with an upbeat outlook on the economy, keeping its interest rate unchanged, and downplaying the impact of the Covid-19, the currency is under pressure. Economic data released this morning showed the business PMI below 50.0, indicating a recession in the sector. Food prices rose January, and as the deadly virus is spreading outside China, more disruptions should be expected. The NZD/USD is in a reversal following a breakout above its support zone.

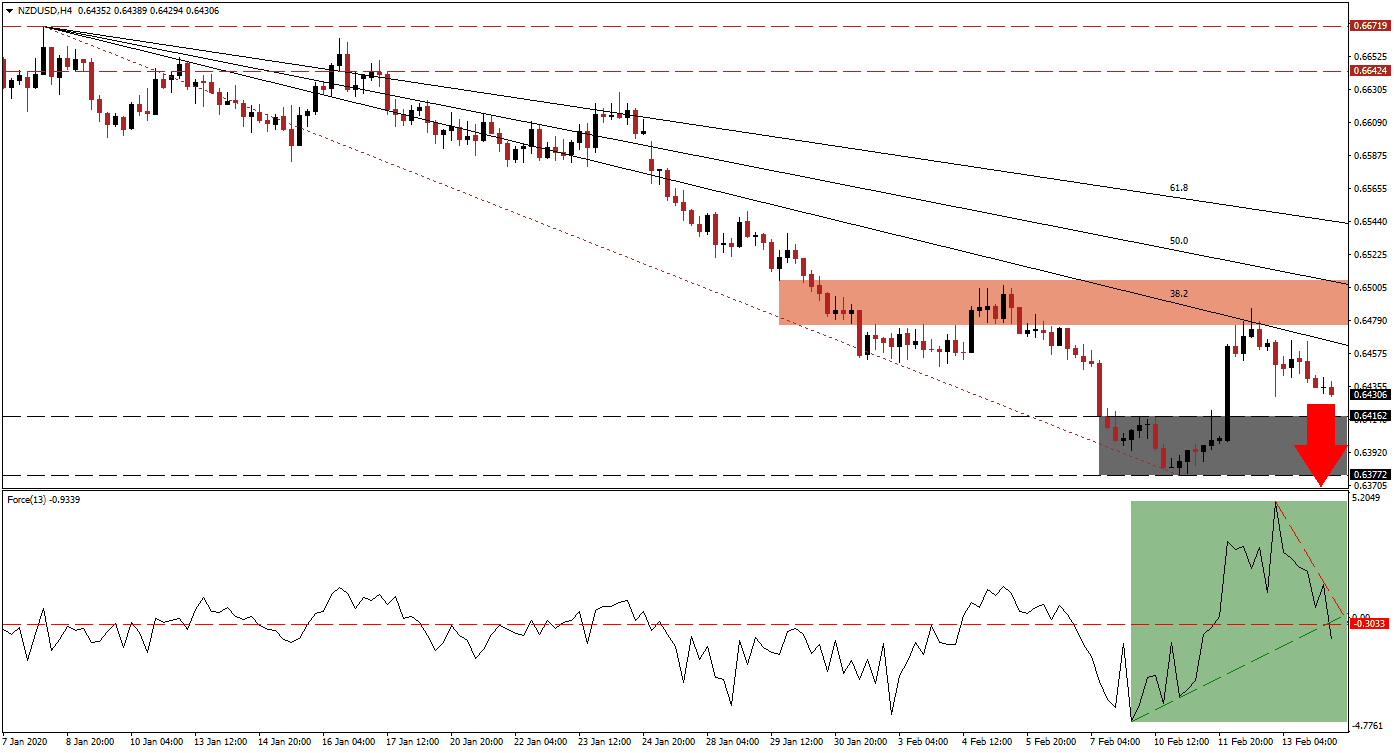

The Force Index, a next-generation technical indicator, initially spiked to a fresh 2020 high before reversing sharply. It led to a conversion of its horizontal support level into resistance, as marked by the green rectangle. A steep descending resistance level materialized, which added to downside pressure, pushing the Force Index below its ascending support level. Bears have taken control of the NZD/USD after this technical indicator moved into negative territory. You can learn more about the Force Index here.

Since January, a strong bearish trend emerged through a series of lower highs and lower lows. The rejection of price action by its descending 38.2 Fibonacci Retracement Fan Resistance Level kept the downtrend intact. It also resulted in another lower high inside of its short-term resistance zone located between 0.64755 and 0.65055, as marked by the red rectangle. More downside in the NZD/USD is anticipated, with the Fibonacci Retracement Fan sequence adding breakdown pressures.

This currency pair is now approaching the top range of its support zone located between 0.63772 and 0.64162, as marked by the grey rectangle. The expansion in bearish momentum is favored to lead to a breakdown, as Covid-19 continues to disrupt the global supply chain. Price action will face its next support zone between 0.62991 and 0.63242, from where more downside in the NZD/USD will require a major fundamental catalyst. You can learn more about a breakdown here.

NZD/USD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.64300

Take Profit @ 0.63000

Stop Loss @ 0.64700

Downside Potential: 130 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 3.25

In the event of a reversal in the Force Index above its descending resistance level, the NZD/USD is expected to launch a second breakout attempt above its short-term resistance zone. The upside potential is limited to its descending 61.8 Fibonacci Retracement Fan Resistance Level, and any advance should be considered an excellent short-selling opportunity for Forex traders to consider.

NZD/USD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.65000

Take Profit @ 0.65400

Stop Loss @ 0.64850

Upside Potential: 40 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 2.67