As Covid-19 continues to spread globally, panic selling has impacted commodity currencies like the New Zealand Dollar. The attention is now on the spread outside of China, failing to acknowledge that the impact where the virus originated is fading. It remains premature to consider China past the peak-infection period, but it is paramount to consider the situation in its entirety, rather than focusing on certain aspects of it. The NZD/USD experienced a strong push into its support zone to a fresh 2020 low, from where signs of a rebound started to emerge. You can learn more about a support zone here.

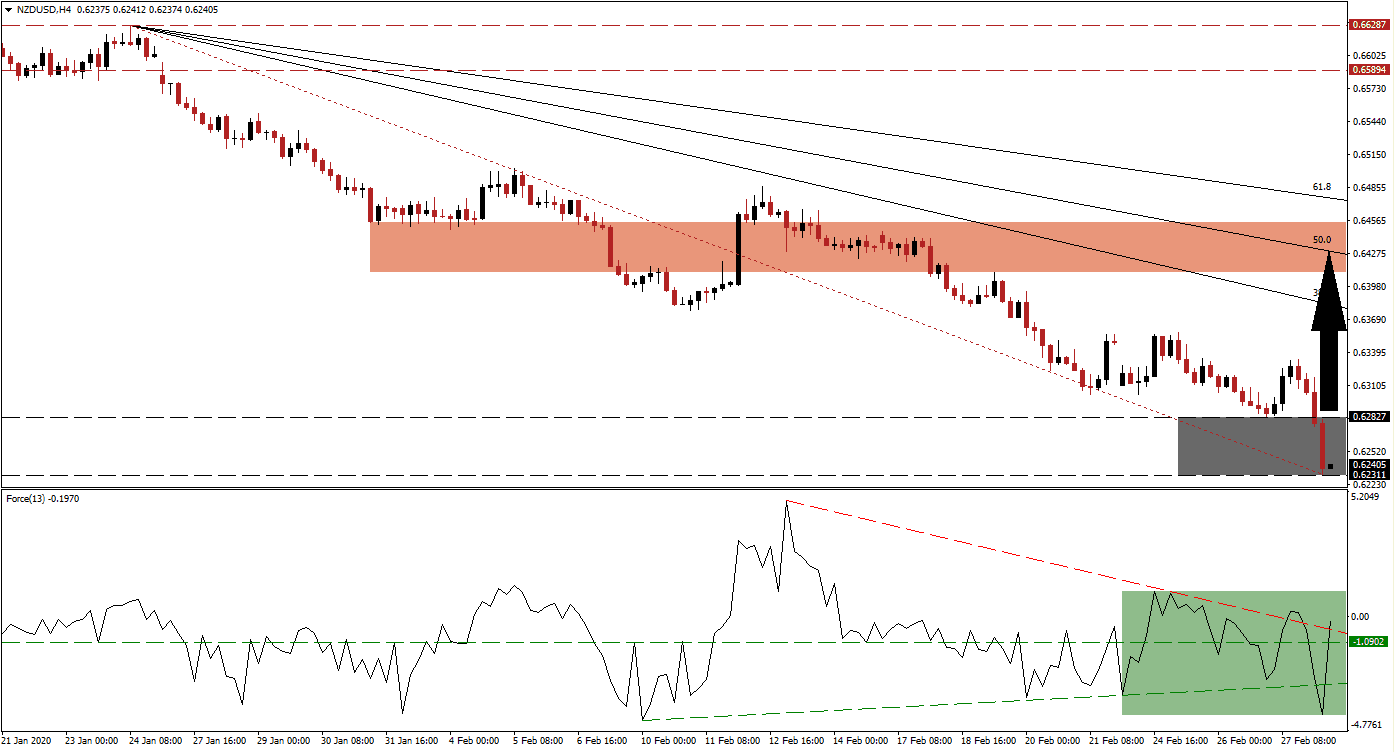

The Force Index, a next-generation technical indicator, failed to confirm the current 2020 intra-day low. It did correct after being ejected by its descending resistance level but quickly recovered above it, following a brief dip below its ascending support level. The Force Index converted its horizontal resistance level back into support, as marked by the green rectangle. Bulls are anticipated to regain control of the NZD/USD once this technical indicator crosses into positive territory.

This currency pair has now reached a support zone dating back to May 2004 from where it reversed a volatile trading period to a new all-time high. The last time this support zone located between 0.62311 and 0.62827, as marked by the grey rectangle, had a significant impact on the NZD/USD was August 2015. One bullish fundamental factor to highlight is the New Zealand economy, which entered the Covid-19 crisis on a strong foundation. The finance ministry confirmed the country is prepared to respond to a range of scenarios. Aspects for a short-covering rally started to materialize.

With the descending Fibonacci Retracement Fan sequence enforcing the long-term bearish chart pattern, a breakout from current levels is favored to close the gap between the NZD/USD and its 38.2 Fibonacci Retracement Fan Resistance Level. New Zealand has no Covid-19 cases as of yet but prepared for its arrival. The US reported its first community infected patient. This situation warrants a price spike into its short-term resistance zone located between 0.64103 and 0.64546, as marked by the red rectangle. The 50.0 Fibonacci Retracement Fan Resistance Level may end any advance unless a new catalyst emerges.

NZD/USD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.62400

Take Profit @ 0.64200

Stop Loss @ 0.61900

Upside Potential: 180 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 3.60

In case of a sustained reversal in the Force Index below its ascending support level, the NZD/USD is expected to attempt an extension of its corrective phase. With the long-term outlook for this currency pair bullish, the downside potential remains limited to its next support zone, located between 0.60330 and 0.60812, dating back to December 2008. Forex traders should view this as a good buying opportunity.

NZD/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.61600

Take Profit @ 0.60800

Stop Loss @ 0.61900

Downside Potential: 80 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.67