Singapore announced a massive S$6.4 billion financial aid package in response to Covid-19, placing the country on track to record the biggest budget deficit since 1997. S$800 million will go towards the healthcare sector, S$1.6 billion are destined to assist households, while S$4 billion are earmarked to assist businesses and workers. The NZD/SGD accelerated to the downside until it was able to stabilize at the top range of its support zone. Singapore has the financial buffer to protects its economy, but if Covid-19 persists longer than expected, it will place the country in a challenging position.

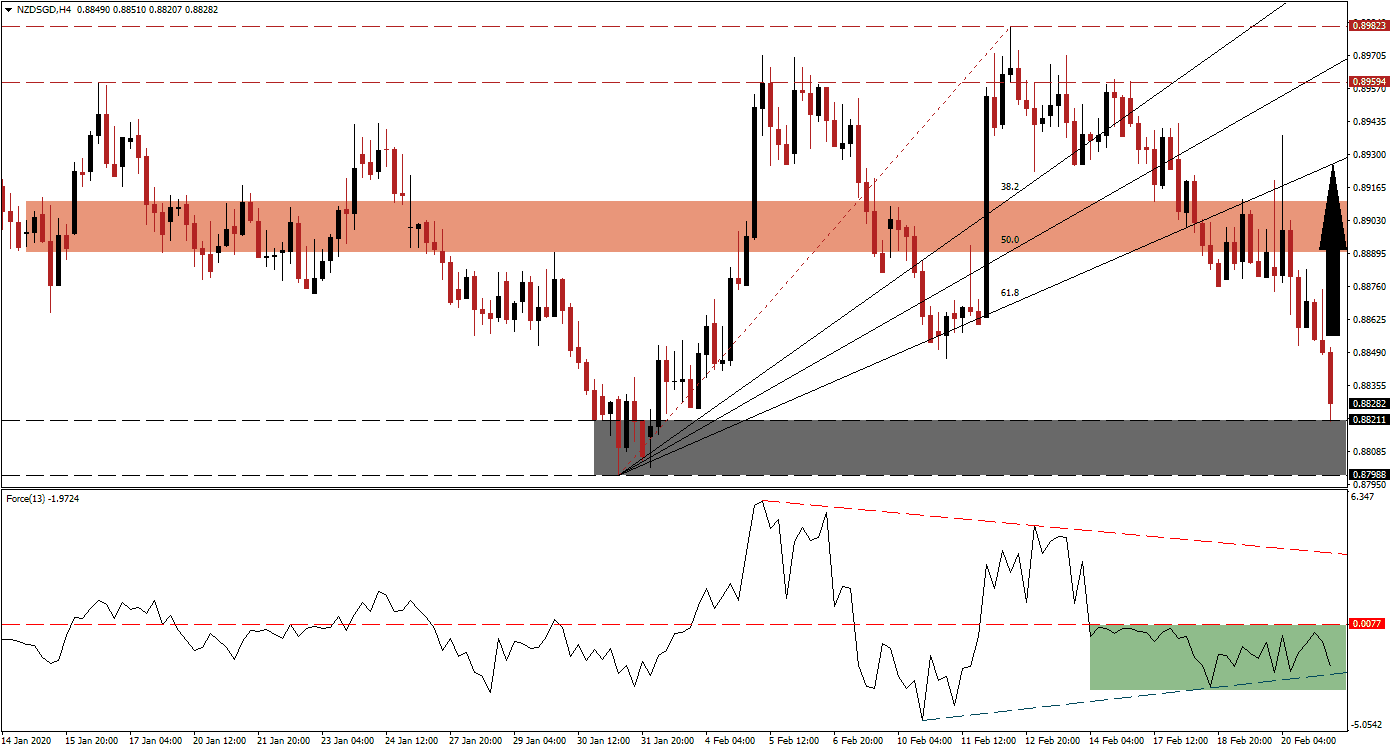

The Force Index, a next-generation technical indicator, indicates the presence of a positive divergence. While price action recorded a lower low, the Force Index recovered from a higher low, as marked by the green rectangle. Bullish momentum is on the rise, with the ascending support level anticipated to pressure this technical indicator above its horizontal resistance level, converting it into support. It will place bulls in control of the NZD/SGD after the push into positive territory, closing the gap to its descending resistance level. You can learn more about the Force Index here.

New Covid-19 cases outside of China remain limited, but the World Health Organization (WHO) warns that this may change. China’s announcement that work resumption is speeding up may provide a short-term fundamental catalyst for the NZD/SGD, sparking a short-covering rally. The support zone located between 0.87988 and 0.88211, as marked by the grey rectangle, previously reversed a corrective phase in this currency pair. Due to the momentum recovery, another price action reversal is pending.

One key level to monitor is the intra-day low of 0.88465, the low of the last instance the ascending 61.8 Fibonacci Retracement Fan Support Level forced a reversal in this currency pair before it was converted into resistance. A breakout is favored to inspire new net buy orders, elevating the NZD/SGD into its short-term resistance zone. This zone is located between 0.88898 and 0.89109, as marked by the red rectangle. A spike into its 61.8 Fibonacci Retracement Fan Resistance Level is likely to materialize. You can learn more about a breakout here.

NZD/SGD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.88300

Take Profit @ 0.89300

Stop Loss @ 0.88000

Upside Potential: 100 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 3.33

In the event of a breakdown in the Force Index below its ascending support level, the NZD/SGD is expected to extend its sell-off. Singapore remains proactive in its response to Covid-19, while New Zealand opted to take a reactive stance. The long-term outlook is uncertain, but this currency pair will challenge its next support zone between 0.87097 and 0.87305. A new fundamental catalyst will be required for price action to get a new direction.

NZD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.87700

Take Profit @ 0.87100

Stop Loss @ 0.88000

Downside Potential: 60 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.00