With traders already discounting the negative impact of the spreading coronavirus, the Japanese Yen is losing support. The deadly virus has now spread to all of China’s thirty-one provinces, with confirmed cases in at least twenty-two countries. Wuhan, the epicenter of the coronavirus where some estimations call for the infection of over 75,000, has additionally reported an outbreak of the H5N1 bird-flu virus. Forex traders appear to ignore the severity of the issues, positioning the NZD/JPY for a short-covering rally.

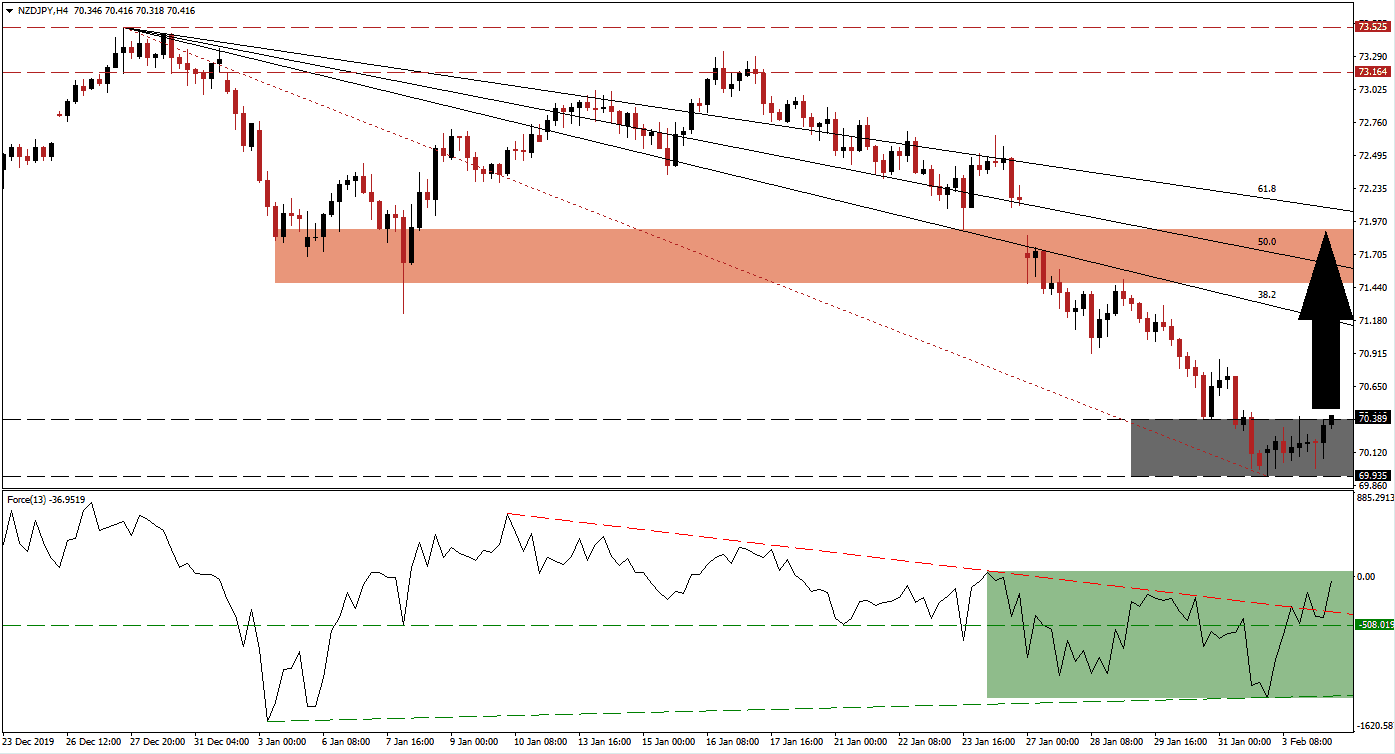

The Force Index, a next-generation technical indicator, points towards a strong momentum recovery after recording a higher low. While this currency pair reached its support zone, an ascending support level materialized, and the Force Index quickly accelerated. It led to a conversion of its horizontal resistance level into support, followed by a breakout above its descending resistance level, as marked by the green rectangle. This technical indicator is now favored to push into positive territory, placing bulls in control of the NZD/JPY. You can learn more about the Force Index here.

Price action is now pushing above its support zone located between 69.935 and 70.389, as marked by the grey rectangle. A short-covering rally is anticipated to close the gap between the NZD/JPY and its descending 38.2 Fibonacci Retracement Fan Resistance Level. Forex traders are recommended to monitor the intra-day high of 70.867, the peak of a failed breakout, which led to a lower low. A breakout is likely to invite the next wave of net buy positions into this currency pair. You can learn more about a breakout here.

Adding to bullish developments is the move in the NZD/JPY above its Fibonacci Retracement Fan trendline, inside of its support zone. Global manufacturing PMI data surprised to the upside for January, easing fears of virus-related economic damages. Safe-haven demand for the Japanese Yen is easing, clearing the path for an advance in this currency pair into its short-term resistance zone. This zone awaits price action between 71.746 and 71.906, as marked by the red rectangle. It will also close a previous price gap to the downside.

NZD/JPY Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 70.400

Take Profit @ 71.900

Stop Loss @ 69.900

Upside Potential: 150 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 3.00

A breakdown in the Force Index below its ascending support level is favored to result in more downside in the NZD/JPY. With the daily worsening coronavirus situation, on the verge of being classified as a pandemic, downside risks to price action cannot be ignored. The next support zone awaits this currency pair between 68.497 and 68.988, from where an extension of the breakdown will depend on the fundamental situation.

NZD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 69.750

Take Profit @ 68.500

Stop Loss @ 70.200

Downside Potential: 125 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 2.78