New Zealand’s service sector had a terrific start to the year, as evident in yesterday’s data, despite Covid-19 having a visible impact on the manufacturing and tourism sectors. While a drop in external migration and visitors was anticipated, the contraction was minimal. The rather upbeat economic assessment by the Reserve Bank of New Zealand surprised market participants, despite the risk of $250 million in potential economic damages as a direct result of the virus. With Japanese fourth-quarter GDP figures dismal yesterday, the NZD/JPY fond stability after reaching its support zone.

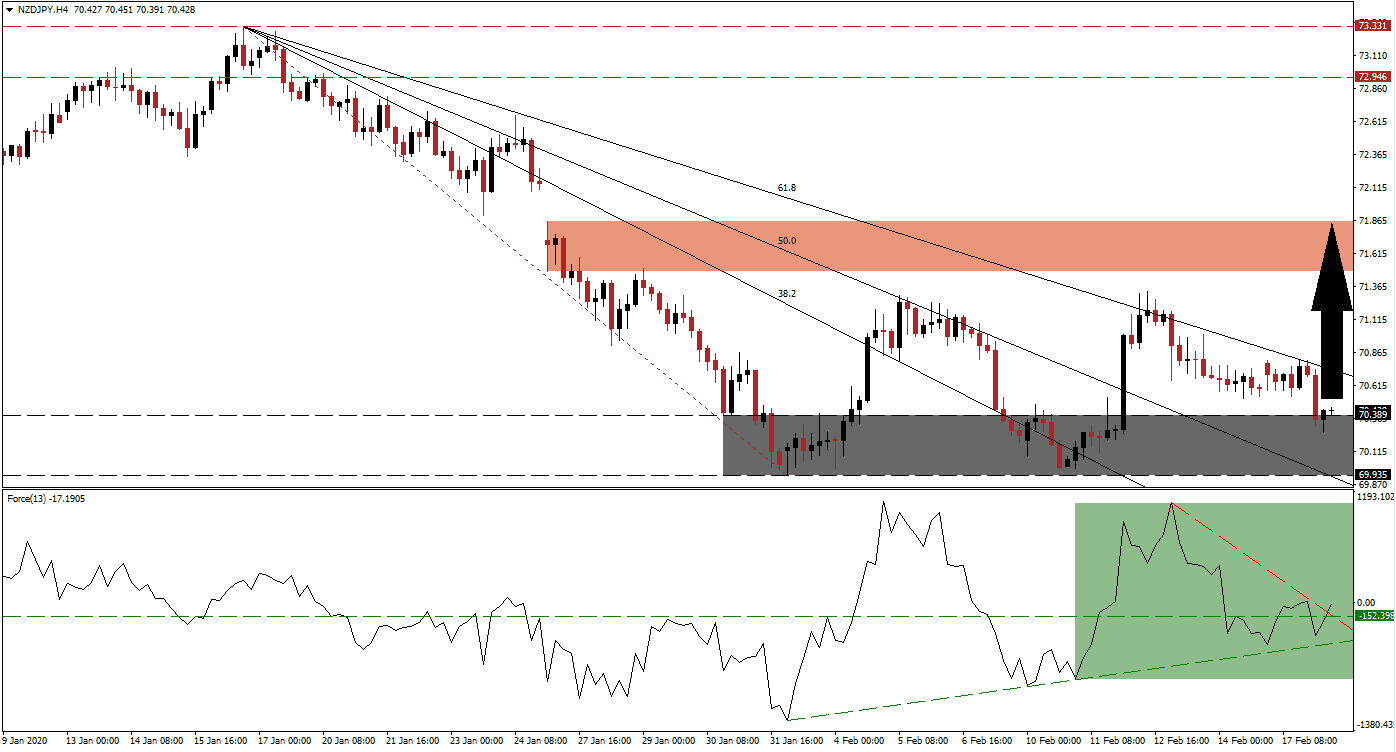

The Force Index, a next-generation technical indicator, indicates underlying bullish momentum as price action reversed its breakout. A series of higher lows allowed an ascending support level to materialize, which is applying upside pressure. The Force Index has now converted its horizontal resistance level into support, as marked by the green rectangle, and pushed above its descending resistance level. This technical indicator is now cleared to place bulls in control of the NZD/JPY with a move above the 0 center-line.

While safe-haven demand for the Japanese Yen remains persistent, economic data continues to disappoint, countering positive drivers for this currency. The NZD/JPY is positioned to take advantage of this condition with a short-covering rally. A breakout above its support zone located between 69.935 and 70.389, as marked by the grey rectangle, followed by one above its descending 61.8 Fibonacci Retracement Fan Resistance Level, is expected to act as the catalyst for it. You can learn more about a short-covering rally here.

A sustained breakout in this currency pair above its 61.8 Fibonacci Retracement Fan Resistance Level will eliminate the final hurdle for price action to accelerate into its next short-term resistance level. The NZD/JPY will reach this zone between 71.476 and 71.855, as marked by the red rectangle, with the top range representing the end-point of a previous price gap to the downside. More upside will be challenging as long as Covid-19 poses an imminent threat to the global economy, an event that may last for months to come.

NZD/JPY Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 70.350

Take Profit @ 71.850

Stop Loss @ 69.900

Upside Potential: 150 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 3.33

Should the Force Index reverse below its ascending support level, the NZD/JPY is likely to attempt a breakdown. The downside potential is limited to its next support zone located between 68.510 and 68.871 unless fundamental conditions are faced with a material change. Volatility is favored to increase if this currency pair contracts into this zone, but as the economic outlook for the New Zealand economy trumps the Japanese one through Covid-19 related disruptions, a cautiously bullish assessment is warranted.

NZD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 69.700

Take Profit @ 68.700

Stop Loss @ 70.100

Downside Potential: 100 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.50