With the coronavirus claiming more deaths, Reserve Bank of New Zealand Governor Orr hinted that another interest rate cut is on the table to cushion the economic fallout. Despite his commentary, the NZD/CHF managed a breakout above its support zone. The Swiss National Bank has been more active in manipulating its currency to support its export-dependent economy. Bullish momentum is on the rise, anticipated to ignite a recovery in this currency pair.

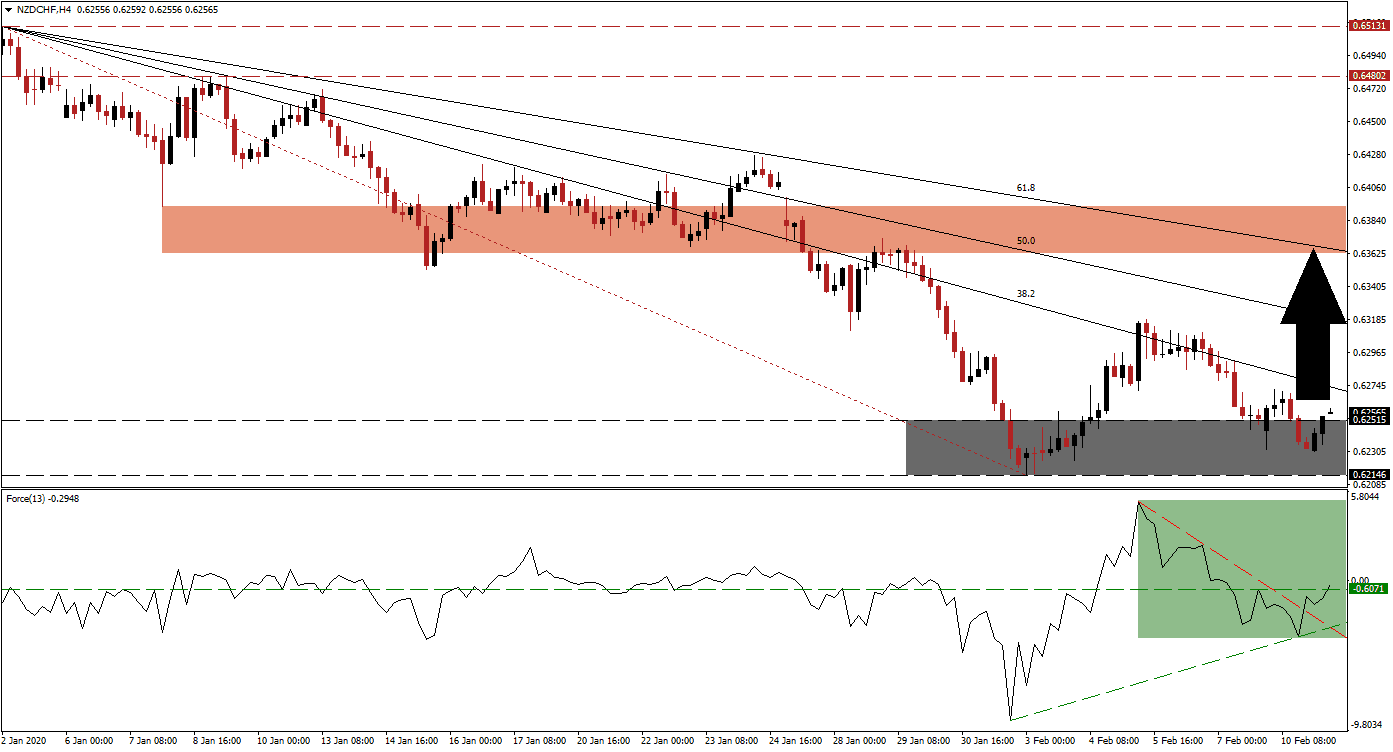

The Force Index, a next-generation technical indicator, indicates the momentum recovery after a higher low led to the formation of an ascending support level. The Force Index followed through with a push above its descending resistance level, which now acts as a temporary support. Adding to bullish developments in the NZD/CHF is the conversion of its horizontal resistance level into support, as marked by the green rectangle. Bulls are expected to take control of price action after this technical indicator moves above the 0 center-line. You can learn more about the Force Index here.

This currency pair is now faced with its descending 38.2 Fibonacci Retracement Fan Resistance Level, which is approaching the top range of its support zone. This zone is located between 0.62146 and 0.62515, as marked by the grey rectangle. A breakout is favored to spark a short-covering rally in the NZD/CHF. The long-term economic outlook for New Zealand remains bullish, adding a fundamental driver to this currency pair, while the SNB is likely to continue its direct market interference.

Forex traders are advised to monitor the intra-day high of 0.63186, the peak of the initial breakout above its support zone, which was reversed into a higher low. A sustained advance above this mark will result in the addition of new net buy positions, providing the fuel to extend the breakout in the NZD/CHF. The next short-term resistance zone awaits price action between 0.63622 and 0.63934, as marked by the red rectangle, with the 61.8 Fibonacci Retracement Fan Resistance Level marking the potential end of the recovery.

NZD/CHF Technical Trading Set-Up - Short-covering Scenario

Long Entry @ 0.62550

Take Profit @ 0.63600

Stop Loss @ 0.62250

Upside Potential: 105 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 3.50

A reversal in the Force Index below its ascending support level is expected to pressure the NZD/CHF into a breakdown attempt. Given the fundamental outlook, supported by developing technical conditions, the downside potential is limited to its next support zone located between 0.61120 and 0.61410. This will present Forex traders with a great buying opportunity.

NZD/CHF Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.61900

Take Profit @ 0.61150

Stop Loss @ 0.62250

Downside Potential: 75 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 2.14