Despite the surge in Covid-19 cases outside of China, specifically South Korea, Iran, and Italy, safe-haven assets are in the midst of a corrective phase. New Zealand downgraded its GDP forecast for 2020, but the NZD/CHF found stability inside of its support zone in extreme oversold conditions. Consumer spending in January was off to a solid start, buffering negative impacts related to the virus. A breakout materialized, anticipated to lead this currency pair into a short-term reversal. You can read more about a support zone here.

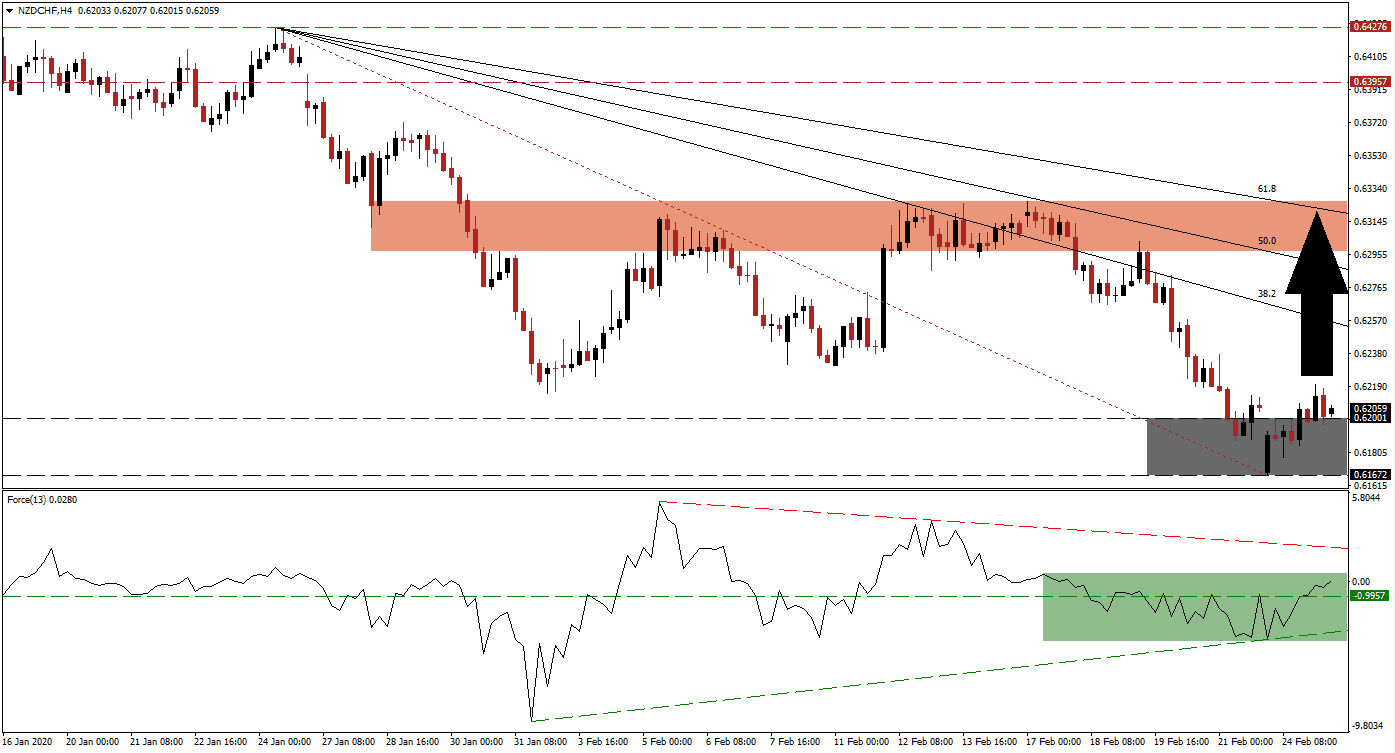

The Force Index, a next-generation technical indicator, confirms the breakout in the NZD/CHF with a bounce off of its ascending support level. It led to a push above its horizontal resistance level, converting it into support, as marked by the green rectangle. Adding to bullish developments is the move in the Force Index above its 0 center-line, allowing bulls to take control of price action. This technical indicator is now likely to challenge its descending resistance level.

This currency pair is maintaining the breakout above its horizontal support zone located between 0.61672 and 0.62001, as marked by the grey rectangle. Due to the increase in bullish momentum, a spike into its descending 38.2 Fibonacci Retracement Fan Resistance Level is favored. Forex traders are advised to monitor the intra-day high of 0.62375, the peak before the NZD/CHF descended to a lower low. A breakout is expected to result in the addition of new net buy positions.

With the Reserve Bank of New Zealand upbeat on the economy and the Swiss National Bank reducing its direct market manipulation of the Swiss Franc, the NZD/CHF is cleared to challenge its short-term resistance zone. Price action was rejected three times by this zone, located between 0.62973 and 0.63264, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is passing through this zone, enforcing the bearish chart pattern. A breakout extension will require a fresh fundamental catalyst.

NZD/CHF Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.62050

Take Profit @ 0.63250

Stop Loss @ 0.61650

Upside Potential: 120 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 3.00

Should the Force Index correct below its ascending support level, the NZD/CHF is anticipated to attempt a breakdown. This will provide Forex traders with an excellent long-term buying opportunity, due to the bullish outlook on this currency pair. The next support zone is located between 0.60570 and 0.60820, dating back to June 2015. Short-term volatility may increase in response to Covid-19 developments, in conjunction with central bank actions.

NZD/CHF Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.61250

Take Profit @ 0.60600

Stop Loss @ 0.61550

Downside Potential: 65 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.17