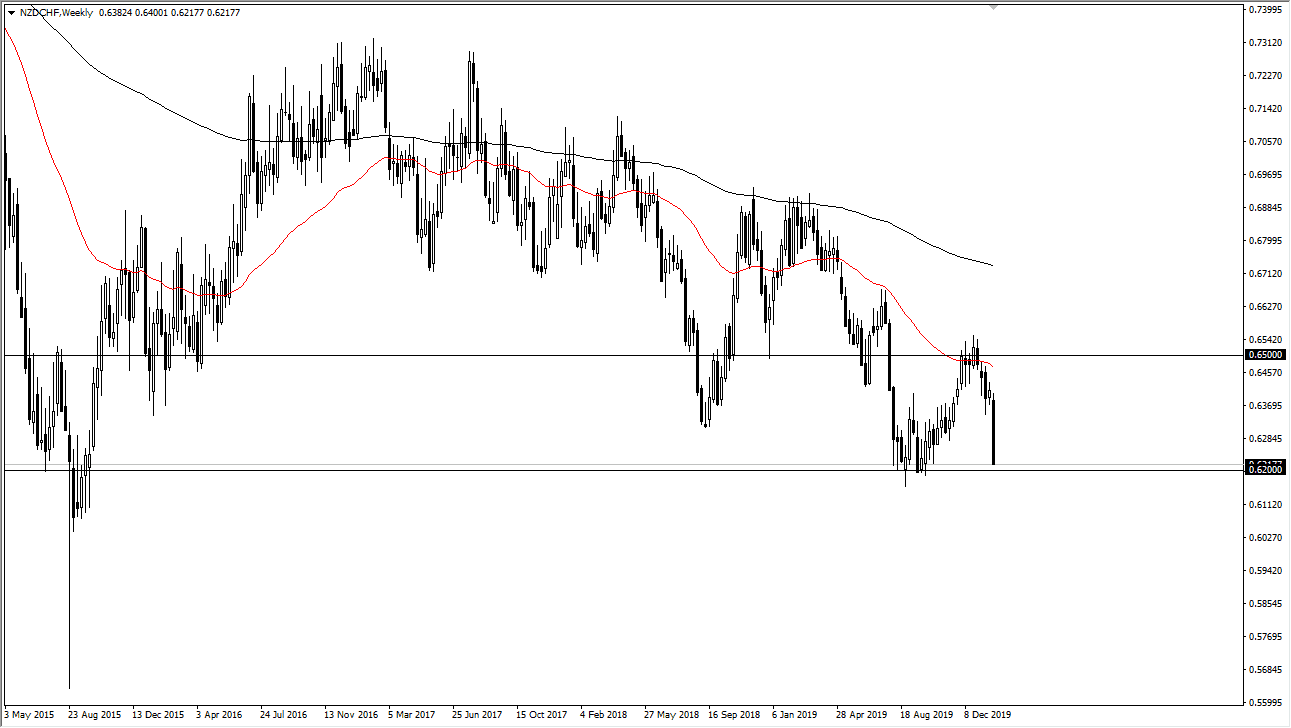

The New Zealand dollar has gotten absolutely crushed against most currencies around the world. The last week of January was particularly bad as the coronavirus continues to cause a lot of issues. That being said, we are now at an area that has caused significant support. If we were to break down below the 0.62 level on a daily close, it’s likely that the NZD/CHF pair will then go looking towards the 0.60 level. That is a large, round, psychologically significant number, and a play on safety as the Swiss franc is one of the “safest currencies” out there.

Furthermore, keep in mind that the New Zealand dollar is highly levered to the Asian economies out there, so as we continue to see concerns about Asian growth and economic activity, with the most obvious place being China, it dries down demand for a lot of New Zealand’s products. Furthermore, traders are looking for safety in general, so the Swiss franc has continued to be one of the stronger currencies in the world. I believe this continues to be the case, and February should see a break down in this pair even further. I don’t know that we can get below the 0.60 level, but if we do it will be more or less a “flush” or possibly a “capitulation move”, where longer-term buyers will come back into play.

When trading a chart like this you have a couple of possibilities. The first one of course is that the coronavirus gets worse and continues to drive the price lower. Ultimately, the market is likely to see a flush lower regardless. However, if we get some type of massive break down below the 0.60 level, then it’s very likely it will end up being capitulation, and longer-term traders will come into pick this market up. After all, we are talking about very historic lows here, as you can see on the longer-term weekly chart. Ultimately, the market looks as if closing at the very bottom of the weekly candlestick suggests that there is more pain to come. I have no scenario in the short term where I would be a buyer of this market, as a recovery would probably be a multiyear story. We need good news involving the coronavirus and global growth in order for this pair to get much of a bounce. That is, unless of course the Swiss National Bank gets involved again.