New Zealand Prime Minister Ardern confirmed that the economy is facing disruptions due to the deadly coronavirus, but noted they are manageable. China already canceled export orders for meat, dairy, timber, and seafood. The tourism sector has been severely impacted, with over 87% of it related to China, the biggest trading partner of New Zealand. Price action in the NZD/CAD stabilized inside of its support zone, and a short-covering rally is now pending.

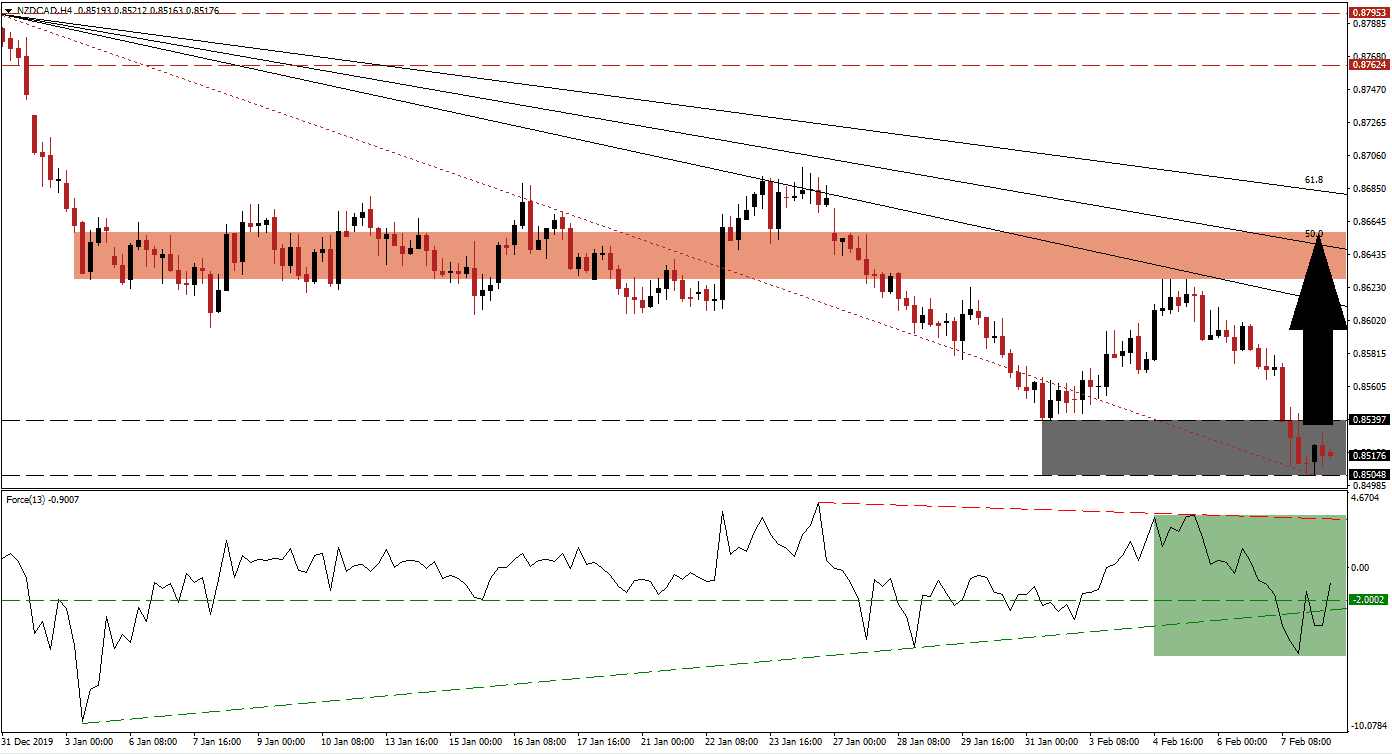

The Force Index, a next-generation technical indicator, recorded a lower low as this currency pair moved into its support zone. Momentum started to recover quickly, following a breakdown below its ascending support level. It resulted in a conversion of its horizontal resistance level into support, as marked by the green rectangle. The Force Index is now favored to accelerate above the 0 center-line and into its descending resistance level, placing bulls in charge of the NZD/CAD.

A breakout in this currency pair above its support zone located between 0.85048 and 0.85397, as marked by the grey rectangle, is expected to spark a short-covering rally. This should close the gap between the NZD/CAD and its descending 38.2 Fibonacci Retracement Fan Resistance Level. Forex traders are advised to monitor the intra-day low of 0.85691, the low of a previous pause from where price action advanced further to the upside. A move above this level is anticipated to result in the addition of new net buy orders. You can learn more about the Fibonacci Retracement Fan here.

Adding a bullish fundamental catalyst to the NZD/CAD is the depressed oil price, directly impacting the Canadian Dollar. Last Friday’s strong employment report and upside surprise in the Ivey PMI failed to significantly lift the currency. This currency pair is likely to challenge its short-term resistance zone located between 0.86262 and 0.86577, as marked by the red rectangle, enforced by its 50.0 Fibonacci Retracement Fan Resistance Level. It will result in a higher high, enabling an extension of the breakout sequence in this currency pair.

NZD/CAD Technical Trading Set-Up - Short-covering Scenario

Long Entry @ 0.85150

Take Profit @ 0.86550

Stop Loss @ 0.84750

Upside Potential: 140 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 3.50

In the event of a reversal in the Force Index below its ascending support level, the NZD/CAD is expected to attempt a breakdown. The downside potential remains limited to its next support zone located between 0.83478 and 0.83804. With the long-term fundamental outlook for this currency pair bullish, Forex traders should consider this an excellent buying opportunity.

NZD/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.84500

Take Profit @ 0.83650

Stop Loss @ 0.84850

Downside Potential: 85 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 2.43