Fourth-quarter retail sales in New Zealand contracted more than predicted, but January credit card spending showed resilience. This allowed the NZD/CAD to find stability inside of its support zone. The government lowered its 2020 GDP forecast to between 2.0% and 2.5%, with the sectors noted to feel the most severe impact from Covid-19 noted as tourism, forestry, and education. Canada’s economy appears to be in worse shape, following the unexpected contraction in December manufacturing sales. You can read more about a support zone here.

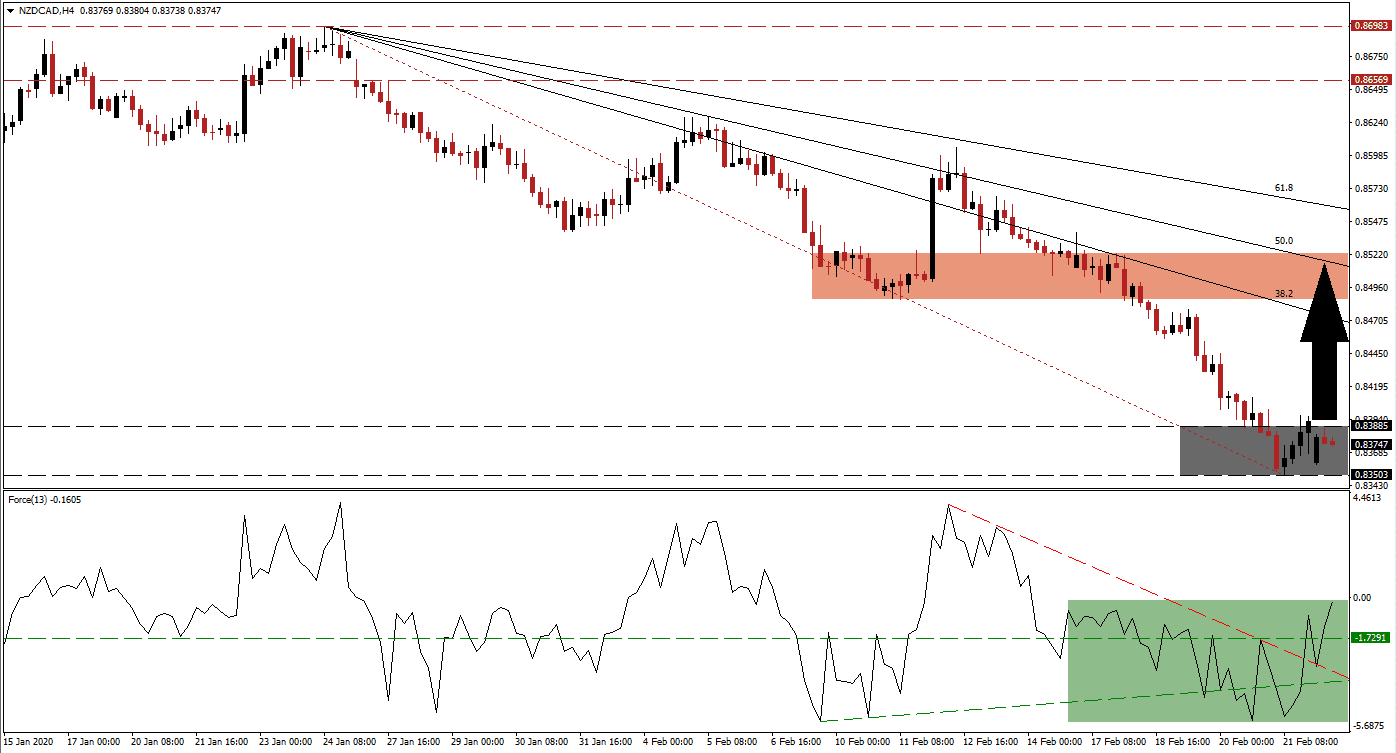

The Force Index, a next-generation technical indicator, points towards a bullish momentum recovery. Following a temporary dip below its ascending support level, the Force Index pushed above its descending resistance level. A breakout above its horizontal resistance level converted it into support, as marked by the green rectangle. This technical indicator is now on the verge of crossing into positive conditions, which will place bulls in charge of the NZD/CAD, positioning it for a price action reversal.

Economic data out of Canada suggests a weaker-than-priced impact from Covid-19. This is anticipated to have a significant impact in the first half of 2020. Technical developments in this currency pair favor a breakout above its support zone located between 0.83503 and 0.83885, as marked by the grey rectangle. A short-covering rally will likely close the gap between the NZD/CAD and its descending 38.2 Fibonacci Retracement Fan Resistance Level. You can learn more about a short-covering rally here.

This currency pair is well-positioned to advance into its next short-term resistance zone located between 0.84869 and 0.85228, as marked by the red rectangle. The 50.0 Fibonacci Retracement Fan Resistance Level is crossing through this zone and may halt the pending recovery in the NZD/CAD. It has previously enforced the long-term bearish trend in price action. While a breakout remains an option, a fresh fundamental catalyst will be required.

NZD/CAD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.83750

Take Profit @ 0.85100

Stop Loss @ 0.83350

Upside Potential: 135 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 3.38

A push in the Force Index below its ascending support level is favored to pressure the NZD/CAD into a breakdown attempt. The next support zone awaits this currency pair between 0.82451 and 0.82712, which will create a great long-term buying opportunity for Forex traders to consider. More downside is highly unlikely, given the economic headwinds facing Canada and its commodity sector.

NZD/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.83100

Take Profit @ 0.82600

Stop Loss @ 0.83350

Downside Potential: 50 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.00