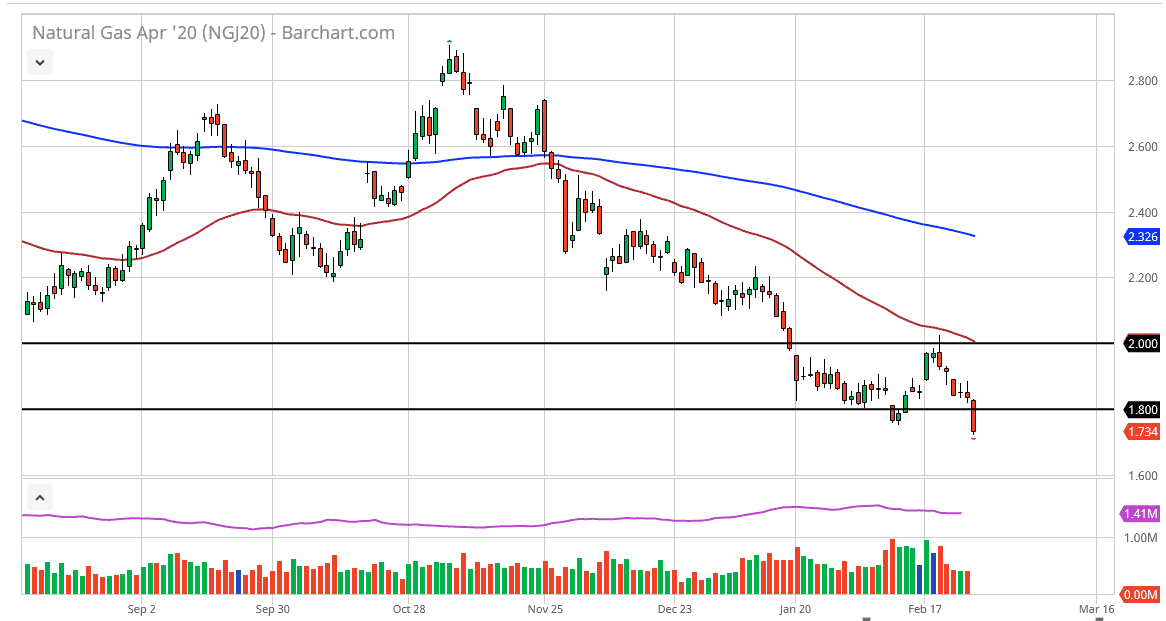

The natural gas markets have broken down significantly during the trading session on Thursday, slicing through the $1.80 level. Beyond that, it now looks as if we are going to settle on a fresh, new low on the daily chart, but at this point it’s likely that we have further to go due to the fact that we had an extreme miss when it comes to the inventory figures during the day. Originally thought to be a -158 billion, the Natural Gas Storage figures in the United States came out at -143 billion, showing less demand than anticipated. The last thing that the natural gas markets needed was to see less demand coming out of the US.

At this point, the market is completely broken, and buying is all but impossible. Yes, we could get some type of rally from here but at this point it should only invite more selling. There is a huge area of resistance between $1.80 and $2.00 that will eventually form a negative candle more likely than not, and it will also be more likely than not that the sellers will come back in and push this market much lower. Furthermore, the 50 day EMA is at the $2.00 level, and should show plenty of resistance.

Looking at the candlestick, we are closing at the very bottom of the range and that of course is a very negative sign in and of itself, typically showing a bit of continuation going forward. Unfortunately for anybody who is trying to buy this market, it is far oversupplied, and we are now seeing multiple reasons for demand to go lower. The initial reason of course is that the temperatures are going to rise over the next couple of months, and that should break demand. The other things to consider is that perhaps the coronavirus will drive down demand for energy when it comes to industry, as we are seeing the crude oil market get punished as well. Furthermore, the US dollar has been relatively strong so that should drive down the value of commodities in general as well. At this point I am much more interested in fading rallies when they occur, instead of trying to sell at these extreme lows. I certainly have no interest in buying until something changes significantly with the markets overall. Until there is a significant wave of bankruptcies, I don’t think it’s very likely that the markets will be able to recover.