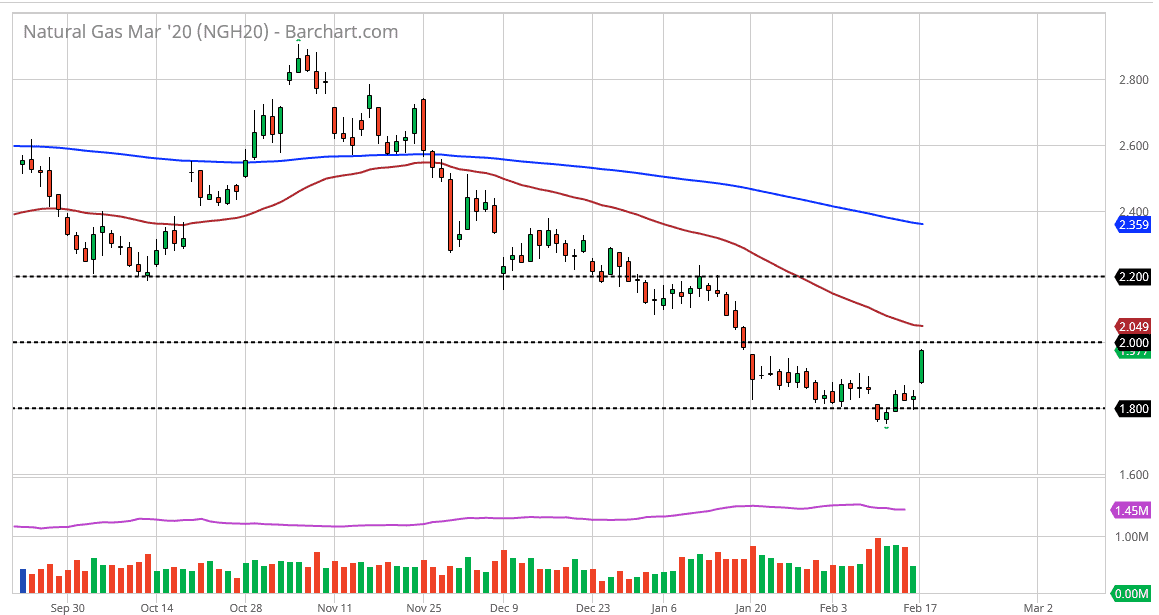

Natural gas markets exploded to the upside during the trading session on Tuesday as traders came back to work. The market looks as if it is trying to reach towards the 50 day EMA which is currently sitting at roughly $2.05. The market should find some type of resistance in this area, because the natural gas markets are absolutely saturated as you probably know by now. The oversupply of natural gas has been a structural problem for the last couple of years, and I suspect that later this year we will see a whole slew of bankruptcies in the United States when it comes to producers and drillers. That being said, the bankruptcies are a longer-term situation and not something that’s going to affect the market right away.

Color temperatures heading towards United States of course help natural gas markets, but this will be a short-term phenomenon at best. I like the idea of fading the market after it shows signs of exhaustion, but I would use the daily close in order to do so. This is a market that will eventually run into trouble, but we may have a couple of days’ worth of strength. I think that the $2.20 level is far too expensive for this market, so somewhere between here and there I’m looking for an opportunity to start shorting.

At the $1.75 level, we have recently seen a bit of a bounce, but I think the market will try to get back down towards that area. What will be truly interesting is once we get into the warmer months, the reaction of the natural gas markets and then. I think we could see a bit of a year, with natural gas rallying every time a major producer goes under. That being said, it is still a “sell the rallies” type of situation going forward, and I don’t necessarily see it changing anytime soon. I have been saying for a while you simply need to fade rallies as they occur, and it should continue to be the case. I do think that the downside is somewhat limited though, because we are so oversold. $1.60 would probably be the floor based upon historical trading, but this market and its weakness never ceases to amaze me. I’m simply waiting for an opportunity to sell yet again, but currently don’t have the set up. Buying down here is something that day trading firms are doing right now, but you will probably not have the computer power to do that type of algorithmic trading.