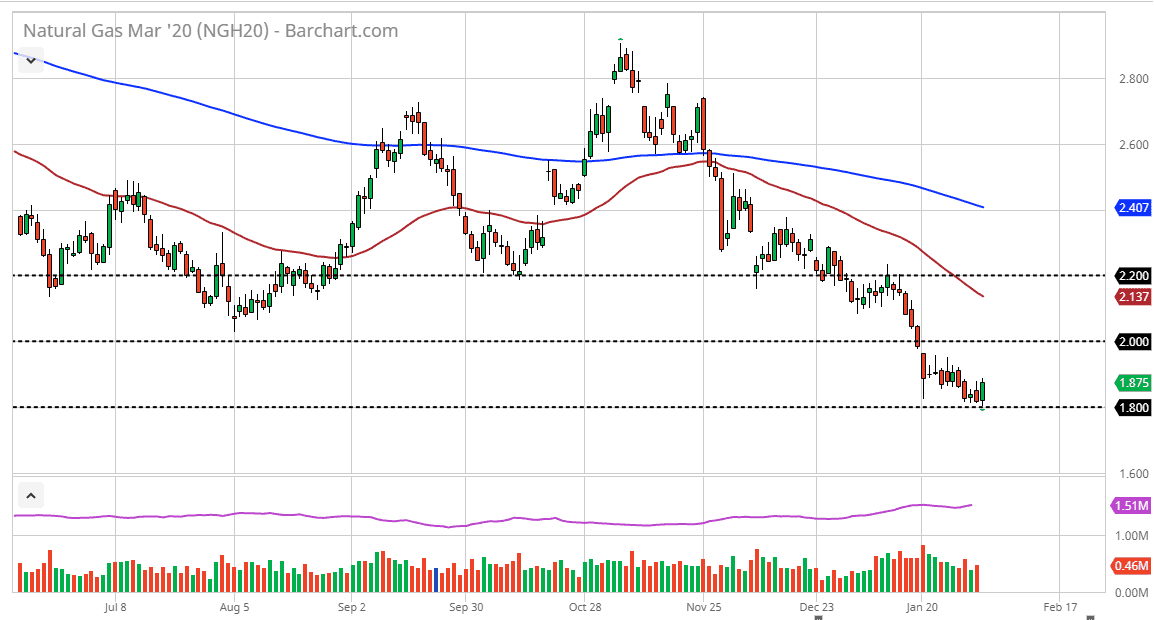

Natural gas markets have initially fallen during the trading session on Tuesday but found support at the $1.80 level yet again. This is an area that has been resilient as of late, but I would not be surprised at all to see market participants look at any rally is a nice selling opportunity. After all, that’s the way this has gone all winter, and now that the market is starting to get close to relatively warm temperatures, one would have to think that natural gas demand will continue to be a major problem for this market. Furthermore, the oversupply situation has not gotten any better.

The candlestick for the trading session on Tuesday was somewhat impressive, but at this point it is far too late in the season to think that the cold temperatures are going to suddenly cause massive amounts of price appreciation when it comes to this commodity. However, there is hope in the future as bankruptcies of American drillers and suppliers will perhaps take a bit of supply off-line. That is a process though, and that something that will happen overnight. Because of this, I believe that we are still in a process of selling the rallies, and now that we have formed this bullish candlestick, we could go looking towards the $2.00 area to start selling again. A break above that level opens up the door to the two point to zero dollars level, via the 50 day EMA which could also cause selling pressure.

I have no interest in buying this market, it has proven itself as being incapable of sustaining rallies in the meantime. That being said, I do believe that eventually this thing turns around, but we are months away from doing so, if not even a few years. As things stand right now, it should be in the back of your mind that this market does tend to react to $0.20 increments, so therefore those are the places that I am looking for selling opportunities. However, if we were to break down below the $1.80 level, then it’s likely we go looking towards the $1.60 level underneath which was a historically significant low several years ago. When you see a candlestick like the one that had formed during the Tuesday session, you should be looking at any move above there as an opportunity to start looking for selling positions based upon exhaustion.